Page 8: of Marine Technology Magazine (January 2022)

Read this page in Pdf, Flash or Html5 edition of January 2022 Marine Technology Magazine

Markets U.S. Offshore Wind

Offshore Wind Development

Gains Speed in the United States

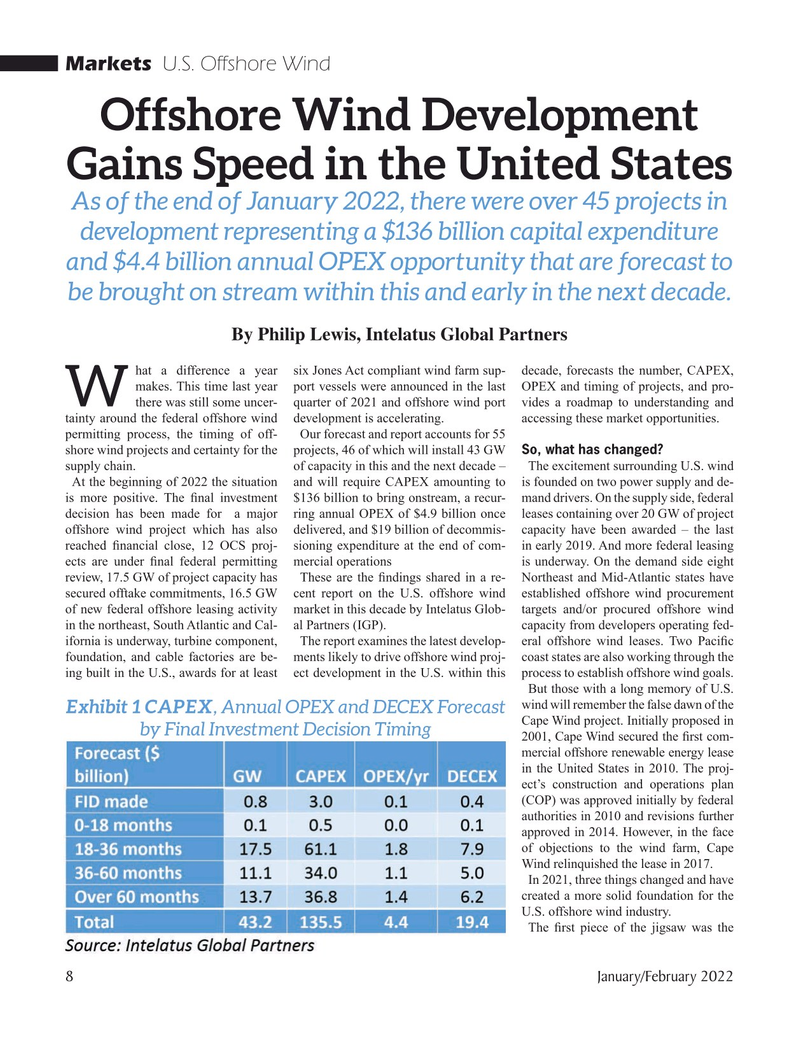

As of the end of January 2022, there were over 45 projects in development representing a $136 billion capital expenditure and $4.4 billion annual OPEX opportunity that are forecast to be brought on stream within this and early in the next decade.

By Philip Lewis, Intelatus Global Partners hat a difference a year six Jones Act compliant wind farm sup- decade, forecasts the number, CAPEX, makes. This time last year port vessels were announced in the last OPEX and timing of projects, and pro-

W there was still some uncer- quarter of 2021 and offshore wind port vides a roadmap to understanding and tainty around the federal offshore wind development is accelerating. accessing these market opportunities. permitting process, the timing of off- Our forecast and report accounts for 55 shore wind projects and certainty for the projects, 46 of which will install 43 GW So, what has changed?

supply chain. of capacity in this and the next decade – The excitement surrounding U.S. wind

At the beginning of 2022 the situation and will require CAPEX amounting to is founded on two power supply and de- is more positive. The ? nal investment $136 billion to bring onstream, a recur- mand drivers. On the supply side, federal decision has been made for a major ring annual OPEX of $4.9 billion once leases containing over 20 GW of project offshore wind project which has also delivered, and $19 billion of decommis- capacity have been awarded – the last reached ? nancial close, 12 OCS proj- sioning expenditure at the end of com- in early 2019. And more federal leasing ects are under ? nal federal permitting mercial operations is underway. On the demand side eight review, 17.5 GW of project capacity has These are the ? ndings shared in a re- Northeast and Mid-Atlantic states have secured offtake commitments, 16.5 GW cent report on the U.S. offshore wind established offshore wind procurement of new federal offshore leasing activity market in this decade by Intelatus Glob- targets and/or procured offshore wind in the northeast, South Atlantic and Cal- al Partners (IGP). capacity from developers operating fed- ifornia is underway, turbine component, The report examines the latest develop- eral offshore wind leases. Two Paci? c foundation, and cable factories are be- ments likely to drive offshore wind proj- coast states are also working through the ing built in the U.S., awards for at least ect development in the U.S. within this process to establish offshore wind goals.

But those with a long memory of U.S. wind will remember the false dawn of the

Exhibit 1 CAPEX, Annual OPEX and DECEX Forecast

Cape Wind project. Initially proposed in by Final Investment Decision Timing 2001, Cape Wind secured the ? rst com- mercial offshore renewable energy lease in the United States in 2010. The proj- ect’s construction and operations plan (COP) was approved initially by federal authorities in 2010 and revisions further approved in 2014. However, in the face of objections to the wind farm, Cape

Wind relinquished the lease in 2017.

In 2021, three things changed and have created a more solid foundation for the

U.S. offshore wind industry.

The ? rst piece of the jigsaw was the 8 January/February 2022

MTR #1 (1-17).indd 8 1/25/2022 10:13:55 AM

7

7

9

9