Page 29: of Marine Technology Magazine (January 2023)

Read this page in Pdf, Flash or Html5 edition of January 2023 Marine Technology Magazine

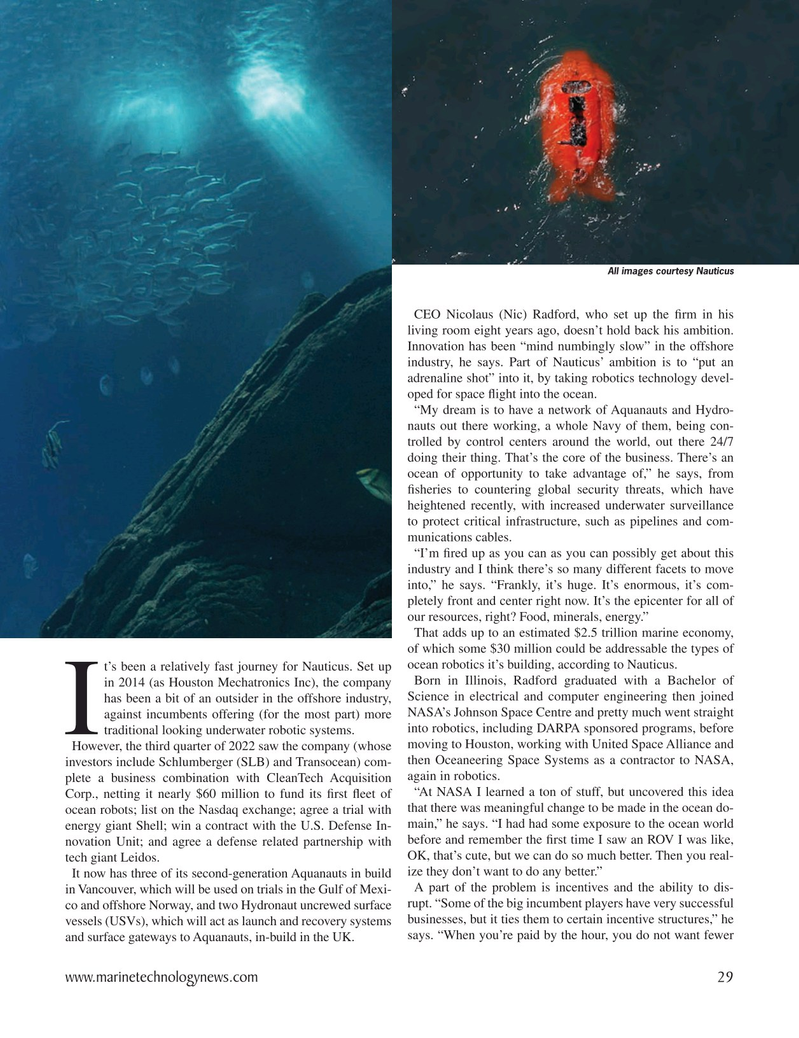

All images courtesy Nauticus

CEO Nicolaus (Nic) Radford, who set up the ? rm in his living room eight years ago, doesn’t hold back his ambition.

Innovation has been “mind numbingly slow” in the offshore industry, he says. Part of Nauticus’ ambition is to “put an adrenaline shot” into it, by taking robotics technology devel- oped for space ? ight into the ocean. “My dream is to have a network of Aquanauts and Hydro- nauts out there working, a whole Navy of them, being con- trolled by control centers around the world, out there 24/7 doing their thing. That’s the core of the business. There’s an ocean of opportunity to take advantage of,” he says, from ? sheries to countering global security threats, which have heightened recently, with increased underwater surveillance to protect critical infrastructure, such as pipelines and com- munications cables. “I’m ? red up as you can as you can possibly get about this industry and I think there’s so many different facets to move into,” he says. “Frankly, it’s huge. It’s enormous, it’s com- pletely front and center right now. It’s the epicenter for all of our resources, right? Food, minerals, energy.”

That adds up to an estimated $2.5 trillion marine economy, of which some $30 million could be addressable the types of t’s been a relatively fast journey for Nauticus. Set up ocean robotics it’s building, according to Nauticus.

Born in Illinois, Radford graduated with a Bachelor of in 2014 (as Houston Mechatronics Inc), the company has been a bit of an outsider in the offshore industry, Science in electrical and computer engineering then joined against incumbents offering (for the most part) more NASA’s Johnson Space Centre and pretty much went straight into robotics, including DARPA sponsored programs, before

I traditional looking underwater robotic systems.

However, the third quarter of 2022 saw the company (whose moving to Houston, working with United Space Alliance and then Oceaneering Space Systems as a contractor to NASA, investors include Schlumberger (SLB) and Transocean) com- plete a business combination with CleanTech Acquisition again in robotics. “At NASA I learned a ton of stuff, but uncovered this idea

Corp., netting it nearly $60 million to fund its ? rst ? eet of ocean robots; list on the Nasdaq exchange; agree a trial with that there was meaningful change to be made in the ocean do- main,” he says. “I had had some exposure to the ocean world energy giant Shell; win a contract with the U.S. Defense In- novation Unit; and agree a defense related partnership with before and remember the ? rst time I saw an ROV I was like,

OK, that’s cute, but we can do so much better. Then you real- tech giant Leidos.

It now has three of its second-generation Aquanauts in build ize they don’t want to do any better.”

A part of the problem is incentives and the ability to dis- in Vancouver, which will be used on trials in the Gulf of Mexi- co and offshore Norway, and two Hydronaut uncrewed surface rupt. “Some of the big incumbent players have very successful vessels (USVs), which will act as launch and recovery systems businesses, but it ties them to certain incentive structures,” he says. “When you’re paid by the hour, you do not want fewer and surface gateways to Aquanauts, in-build in the UK. www.marinetechnologynews.com 29

MTR #1 (18-33).indd 29 1/22/2023 8:10:02 PM

28

28

30

30