Page 47: of Maritime Logistics Professional Magazine (Q2 2011)

Energy Transportation

Read this page in Pdf, Flash or Html5 edition of Q2 2011 Maritime Logistics Professional Magazine

FFAs as a profit center.

Not surprisingly, many companies have outgrown the spreadsheet method and have turned to a much more sophis- ticated, automated system. To that end, a system that provides a window to its entire portfolio in real time, provides access to analytical tools to make busi- ness decisions and reliably evaluates the company’s risk exposure and profit and loss expectations would include many variables, as shown in Table A (previous page, lower left).

FFA’S TODAY

First and foremost, skillful traders are key to maximizing FFA profitability.

Efstathiou maintains that “there are many ways to enter the market, but you’ll never go wrong starting with shipping experience and then layering on the FFA experience.” That said, any technology solution should not burden the trader – who may be still learning the game – with more keystrokes than necessary. Above all, tools must contin- ue to evolve along with the burgeoning, but still evolving FFA markets.

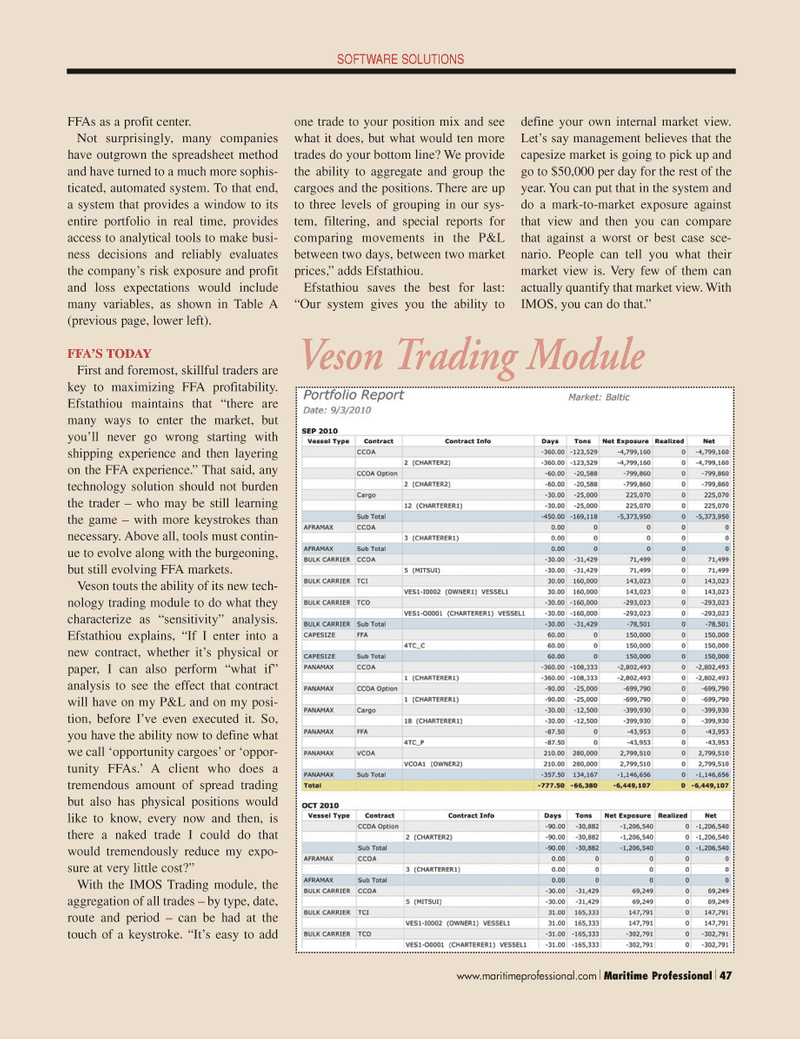

Veson touts the ability of its new tech- nology trading module to do what they characterize as “sensitivity” analysis.

Efstathiou explains, “If I enter into a new contract, whether it’s physical or paper, I can also perform “what if” analysis to see the effect that contract will have on my P&L and on my posi- tion, before I’ve even executed it. So, you have the ability now to define what we call ‘opportunity cargoes’ or ‘oppor- tunity FFAs.’ A client who does a tremendous amount of spread trading but also has physical positions would like to know, every now and then, is there a naked trade I could do that would tremendously reduce my expo- sure at very little cost?”

With the IMOS Trading module, the aggregation of all trades – by type, date, route and period – can be had at the touch of a keystroke. “It’s easy to add one trade to your position mix and see what it does, but what would ten more trades do your bottom line? We provide the ability to aggregate and group the cargoes and the positions. There are up to three levels of grouping in our sys- tem, filtering, and special reports for comparing movements in the P&L between two days, between two market prices,” adds Efstathiou.

Efstathiou saves the best for last: “Our system gives you the ability to define your own internal market view.

Let’s say management believes that the capesize market is going to pick up and go to $50,000 per day for the rest of the year. You can put that in the system and do a mark-to-market exposure against that view and then you can compare that against a worst or best case sce- nario. People can tell you what their market view is. Very few of them can actually quantify that market view. With

IMOS, you can do that.” www.maritimeprofessional.com Maritime Professional 47

SOFTWARE SOLUTIONS

Veson Trading Module

46

46

48

48