Page 14: of Maritime Logistics Professional Magazine (Q1 2013)

Maritime Risk

Read this page in Pdf, Flash or Html5 edition of Q1 2013 Maritime Logistics Professional Magazine

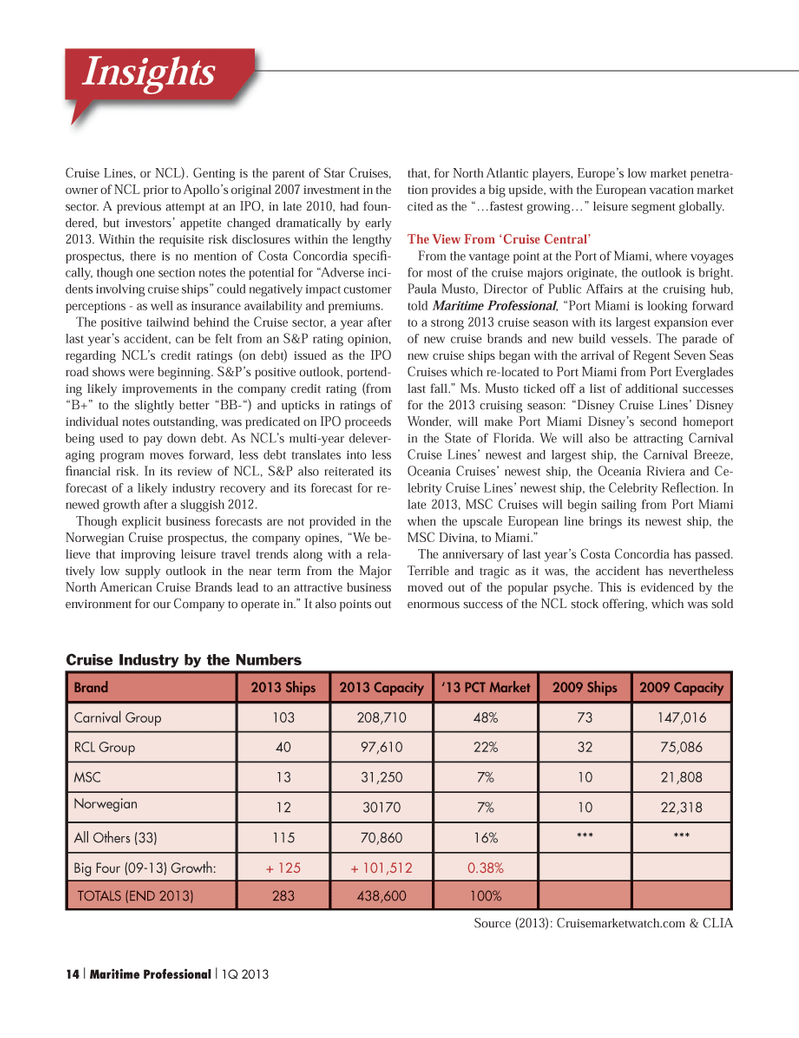

Cruise Lines, or NCL). Genting is the parent of Star Cruises, owner of NCL prior to Apollo?s original 2007 investment in the sector. A previous attempt at an IPO, in late 2010, had foun- dered, but investors? appetite changed dramatically by early 2013. Within the requisite risk disclosures within the lengthy prospectus, there is no mention of Costa Concordia speci -cally, though one section notes the potential for ?Adverse inci- dents involving cruise ships? could negatively impact customer perceptions - as well as insurance availability and premiums. The positive tailwind behind the Cruise sector, a year after last year?s accident, can be felt from an S&P rating opinion, regarding NCL?s credit ratings (on debt) issued as the IPO road shows were beginning. S&P?s positive outlook, portend- ing likely improvements in the company credit rating (from ?B+? to the slightly better ?BB-?) and upticks in ratings of individual notes outstanding, was predicated on IPO proceeds being used to pay down debt. As NCL?s multi-year delever- aging program moves forward, less debt translates into less nancial risk. In its review of NCL, S&P also reiterated its forecast of a likely industry recovery and its forecast for re- newed growth after a sluggish 2012. Though explicit business forecasts are not provided in the Norwegian Cruise prospectus, the company opines, ?We be- lieve that improving leisure travel trends along with a rela- tively low supply outlook in the near term from the Major North American Cruise Brands lead to an attractive business environment for our Company to operate in.? It also points out that, for North Atlantic players, Europe?s low market penetra- tion provides a big upside, with the European vacation market cited as the ??fastest growing?? leisure segment globally. The View From ?Cruise Central? From the vantage point at the Port of Miami, where voyages for most of the cruise majors originate, the outlook is bright. Paula Musto, Director of Public Affairs at the cruising hub, told Maritime Professional , ?Port Miami is looking forward to a strong 2013 cruise season with its largest expansion ever of new cruise brands and new build vessels. The parade of new cruise ships began with the arrival of Regent Seven Seas Cruises which re-located to Port Miami from Port Everglades last fall.? Ms. Musto ticked off a list of additional successes for the 2013 cruising season: ?Disney Cruise Lines? Disney Wonder, will make Port Miami Disney?s second homeport in the State of Florida. We will also be attracting Carnival Cruise Lines? newest and largest ship, the Carnival Breeze, Oceania Cruises? newest ship, the Oceania Riviera and Ce- lebrity Cruise Lines? newest ship, the Celebrity Re ection. In late 2013, MSC Cruises will begin sailing from Port Miami when the upscale European line brings its newest ship, the MSC Divina, to Miami.? The anniversary of last year?s Costa Concordia has passed. Terrible and tragic as it was, the accident has nevertheless moved out of the popular psyche. This is evidenced by the enormous success of the NCL stock offering, which was sold InsightsBrand2013 Ships2013 Capacity?13 PCT Market2009 Ships2009 Capacity Carnival Group 103208,710 48%73147,016 RCL Group4097,61022%3275,086MSC1331,2507%1021,808Norwegian 12301707%1022,318All Others (33)11570,860 16%******Big Four (09-13) Growth:+ 125+ 101,5120.38% TOTALS (END 2013) 283438,600100% Source (2013): Cruisemarketwatch.com & CLIA Cruise Industry by the Numbers14 I Maritime Professional I 1Q 2013MP #1 1-17.indd 14MP #1 1-17.indd 142/25/2013 11:56:21 AM2/25/2013 11:56:21 AM

13

13

15

15