Page 21: of Maritime Logistics Professional Magazine (Q1 2013)

Maritime Risk

Read this page in Pdf, Flash or Html5 edition of Q1 2013 Maritime Logistics Professional Magazine

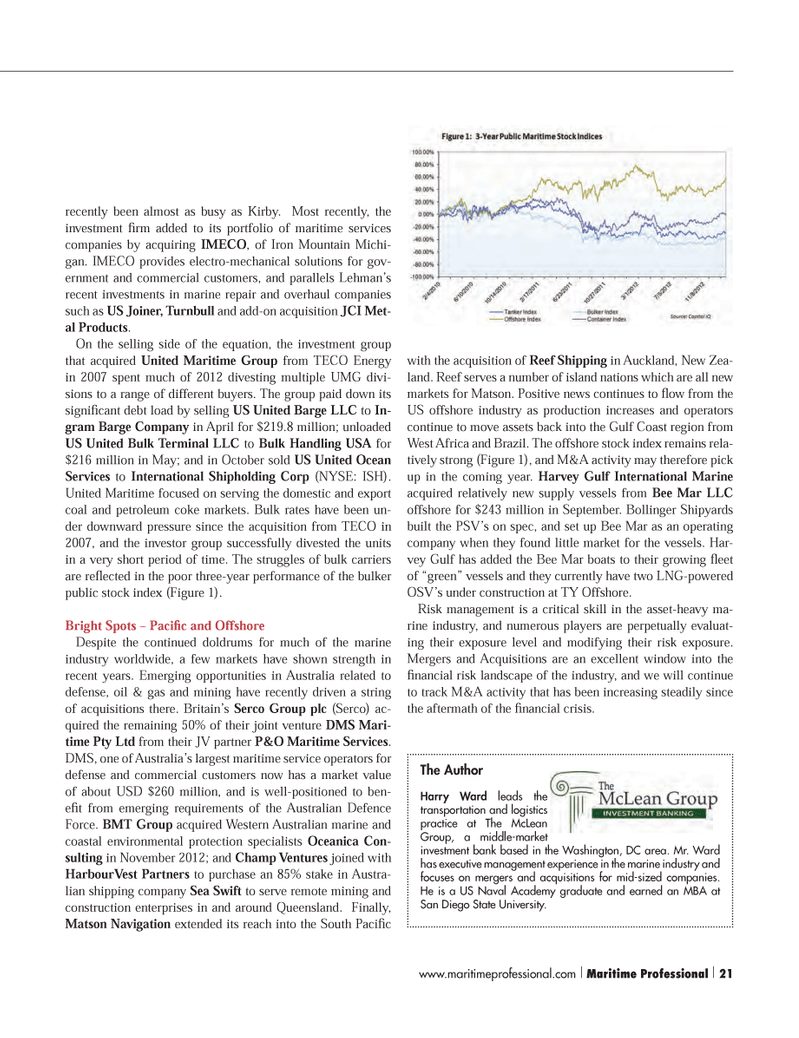

recently been almost as busy as Kirby. Most recently, the investment Þ rm added to its portfolio of maritime services companies by acquiring IMECO, of Iron Mountain Michi-gan. IMECO provides electro-mechanical solutions for gov- ernment and commercial customers, and parallels LehmanÕs recent investments in marine repair and overhaul companies such as US Joiner, Turnbull and add-on acquisition JCI Met-al Products . On the selling side of the equation, the investment group that acquired United Maritime Group from TECO Energy in 2007 spent much of 2012 divesting multiple UMG divi- sions to a range of different buyers. The group paid down its signiÞ cant debt load by selling US United Barge LLC to In-gram Barge Company in April for $219.8 million; unloaded US United Bulk Terminal LLC to Bulk Handling USA for $216 million in May; and in October sold US United Ocean Services to International Shipholding Corp (NYSE: ISH). United Maritime focused on serving the domestic and export coal and petroleum coke markets. Bulk rates have been un- der downward pressure since the acquisition from TECO in 2007, and the investor group successfully divested the units in a very short period of time. The struggles of bulk carriers are reß ected in the poor three-year performance of the bulker public stock index (Figure 1). Bright Spots ? Paci c and Offshore Despite the continued doldrums for much of the marine industry worldwide, a few markets have shown strength in recent years. Emerging opportunities in Australia related to defense, oil & gas and mining have recently driven a string of acquisitions there. BritainÕs Serco Group plc (Serco) ac-quired the remaining 50% of their joint venture DMS Mari-time Pty Ltd from their JV partner P&O Maritime Services . DMS, one of AustraliaÕs largest maritime service operators for defense and commercial customers now has a market value of about USD $260 million, and is well-positioned to ben-eÞ t from emerging requirements of the Australian Defence Force. BMT Group acquired Western Australian marine and coastal environmental protection specialists Oceanica Con-sulting in November 2012; and Champ Ventures joined with HarbourVest Partners to purchase an 85% stake in Austra- lian shipping company Sea Swift to serve remote mining and construction enterprises in and around Queensland. Finally, Matson Navigation extended its reach into the South PaciÞ c with the acquisition of Reef Shipping in Auckland, New Zea- land. Reef serves a number of island nations which are all new markets for Matson. Positive news continues to ß ow from the US offshore industry as production increases and operators continue to move assets back into the Gulf Coast region from West Africa and Brazil. The offshore stock index remains rela- tively strong (Figure 1), and M&A activity may therefore pick up in the coming year. Harvey Gulf International Marine acquired relatively new supply vessels from Bee Mar LLC offshore for $243 million in September. Bollinger Shipyards built the PSVÕs on spec, and set up Bee Mar as an operating company when they found little market for the vessels. Har- vey Gulf has added the Bee Mar boats to their growing ß eet of ÒgreenÓ vessels and they currently have two LNG-powered OSVÕs under construction at TY Offshore. Risk management is a critical skill in the asset-heavy ma- rine industry, and numerous players are perpetually evaluat- ing their exposure level and modifying their risk exposure. Mergers and Acquisitions are an excellent window into the Þ nancial risk landscape of the industry, and we will continue to track M&A activity that has been increasing steadily since the aftermath of the Þ nancial crisis. The Author Harry Ward leads the transportation and logistics practice at The McLean Group, a middle-market investment bank based in the Washington, DC area. Mr. Ward has executive management experience in the marine industry and focuses on mergers and acquisitions for mid-sized companies. He is a US Naval Academy graduate and earned an MBA at San Diego State University. www.maritimeprofessional.com | Maritime Professional | 21MP #1 18-33.indd 21MP #1 18-33.indd 212/22/2013 10:56:16 AM2/22/2013 10:56:16 AM

20

20

22

22