Page 50: of Maritime Logistics Professional Magazine (Q3 2016)

Shipbuilding, Repair & Maintenance

Read this page in Pdf, Flash or Html5 edition of Q3 2016 Maritime Logistics Professional Magazine

SHIPBUILDING

U.S. Boatbuilding

Exports Buoy Bottom Lines

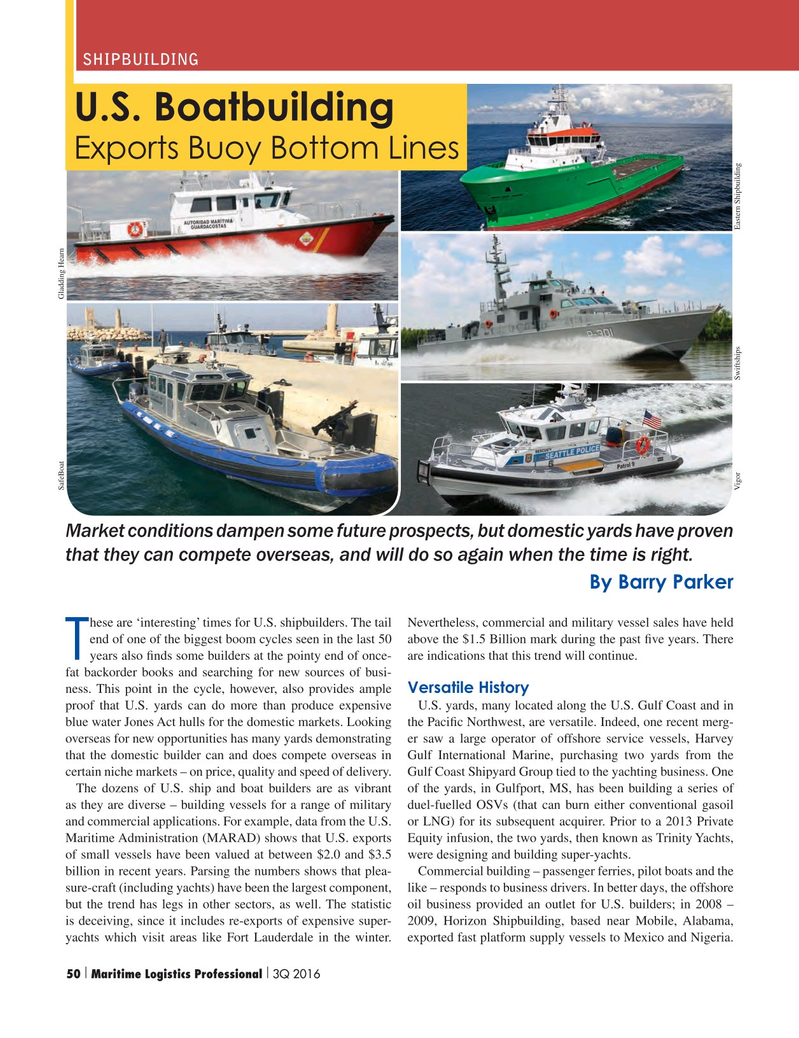

SafeBoat Gladding Hearn

Vigor Swiftships Eastern Shipbuilding

Market conditions dampen some future prospects, but domestic yards have proven that they can compete overseas, and will do so again when the time is right.

By Barry Parker hese are ‘interesting’ times for U.S. shipbuilders. The tail Nevertheless, commercial and military vessel sales have held end of one of the biggest boom cycles seen in the last 50 above the $1.5 Billion mark during the past ? ve years. There

Tyears also ? nds some builders at the pointy end of once- are indications that this trend will continue.

fat backorder books and searching for new sources of busi- ness. This point in the cycle, however, also provides ample Versatile History proof that U.S. yards can do more than produce expensive U.S. yards, many located along the U.S. Gulf Coast and in blue water Jones Act hulls for the domestic markets. Looking the Paci? c Northwest, are versatile. Indeed, one recent merg- overseas for new opportunities has many yards demonstrating er saw a large operator of offshore service vessels, Harvey that the domestic builder can and does compete overseas in Gulf International Marine, purchasing two yards from the certain niche markets – on price, quality and speed of delivery. Gulf Coast Shipyard Group tied to the yachting business. One

The dozens of U.S. ship and boat builders are as vibrant of the yards, in Gulfport, MS, has been building a series of as they are diverse – building vessels for a range of military duel-fuelled OSVs (that can burn either conventional gasoil and commercial applications. For example, data from the U.S. or LNG) for its subsequent acquirer. Prior to a 2013 Private

Maritime Administration (MARAD) shows that U.S. exports Equity infusion, the two yards, then known as Trinity Yachts, of small vessels have been valued at between $2.0 and $3.5 were designing and building super-yachts. billion in recent years. Parsing the numbers shows that plea- Commercial building – passenger ferries, pilot boats and the sure-craft (including yachts) have been the largest component, like – responds to business drivers. In better days, the offshore but the trend has legs in other sectors, as well. The statistic oil business provided an outlet for U.S. builders; in 2008 – is deceiving, since it includes re-exports of expensive super- 2009, Horizon Shipbuilding, based near Mobile, Alabama, yachts which visit areas like Fort Lauderdale in the winter. exported fast platform supply vessels to Mexico and Nigeria. 50 Maritime Logistics Professional 3Q 2016| | 50-63 Q3 MP2016.indd 50 8/17/2016 10:18:28 AM

49

49

51

51