Page 24: of Maritime Logistics Professional Magazine (Jan/Feb 2017)

CRUISE SHIPPING PORTS

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2017 Maritime Logistics Professional Magazine

Special Report

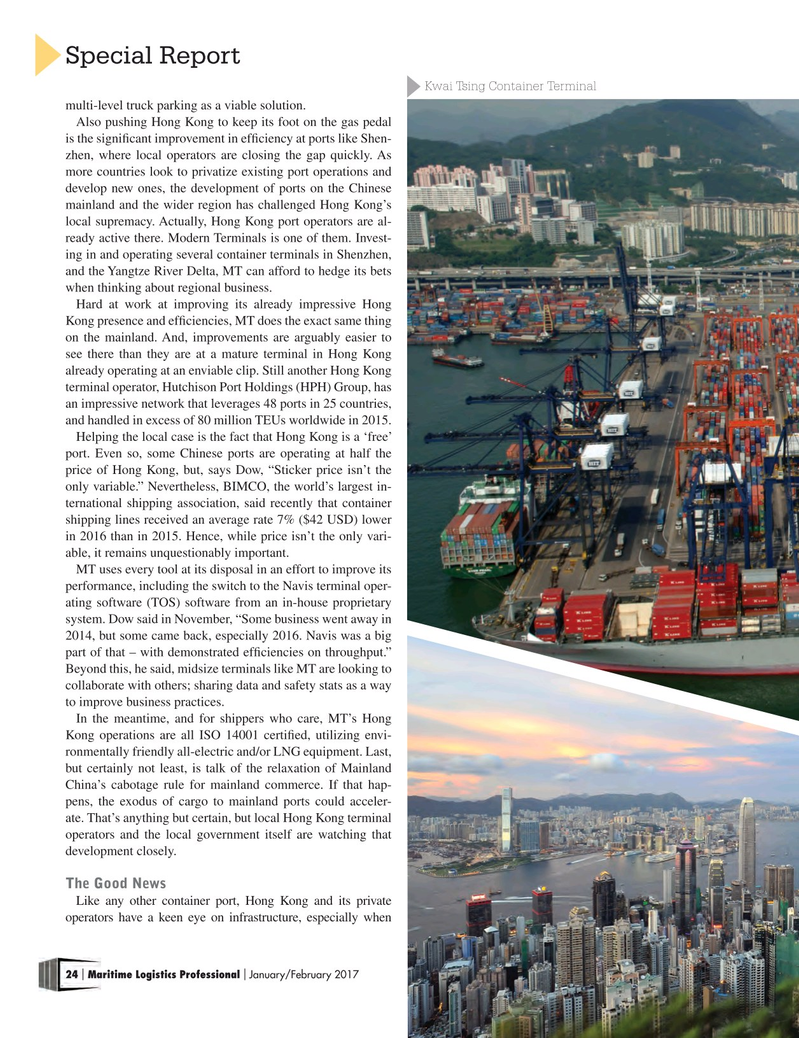

Kwai Tsing Container Terminal multi-level truck parking as a viable solution.

Also pushing Hong Kong to keep its foot on the gas pedal is the signi? cant improvement in ef? ciency at ports like Shen- zhen, where local operators are closing the gap quickly. As more countries look to privatize existing port operations and develop new ones, the development of ports on the Chinese mainland and the wider region has challenged Hong Kong’s local supremacy. Actually, Hong Kong port operators are al- ready active there. Modern Terminals is one of them. Invest- ing in and operating several container terminals in Shenzhen, and the Yangtze River Delta, MT can afford to hedge its bets when thinking about regional business.

Hard at work at improving its already impressive Hong

Kong presence and ef? ciencies, MT does the exact same thing on the mainland. And, improvements are arguably easier to see there than they are at a mature terminal in Hong Kong already operating at an enviable clip. Still another Hong Kong terminal operator, Hutchison Port Holdings (HPH) Group, has an impressive network that leverages 48 ports in 25 countries, and handled in excess of 80 million TEUs worldwide in 2015.

Helping the local case is the fact that Hong Kong is a ‘free’ port. Even so, some Chinese ports are operating at half the price of Hong Kong, but, says Dow, “Sticker price isn’t the only variable.” Nevertheless, BIMCO, the world’s largest in- ternational shipping association, said recently that container shipping lines received an average rate 7% ($42 USD) lower in 2016 than in 2015. Hence, while price isn’t the only vari- able, it remains unquestionably important.

MT uses every tool at its disposal in an effort to improve its performance, including the switch to the Navis terminal oper- ating software (TOS) software from an in-house proprietary system. Dow said in November, “Some business went away in 2014, but some came back, especially 2016. Navis was a big part of that – with demonstrated ef? ciencies on throughput.”

Beyond this, he said, midsize terminals like MT are looking to collaborate with others; sharing data and safety stats as a way to improve business practices.

In the meantime, and for shippers who care, MT’s Hong

Kong operations are all ISO 14001 certi? ed, utilizing envi- ronmentally friendly all-electric and/or LNG equipment. Last, but certainly not least, is talk of the relaxation of Mainland

China’s cabotage rule for mainland commerce. If that hap- pens, the exodus of cargo to mainland ports could acceler- ate. That’s anything but certain, but local Hong Kong terminal operators and the local government itself are watching that development closely.

The Good News

Like any other container port, Hong Kong and its private operators have a keen eye on infrastructure, especially when 24 Maritime Logistics Professional January/February 2017 | |

23

23

25

25