Page 51: of Maritime Logistics Professional Magazine (May/Jun 2017)

BUNKER OPERATIONS & PORTS

Read this page in Pdf, Flash or Html5 edition of May/Jun 2017 Maritime Logistics Professional Magazine

STATISTICS

T e F F M 2017he volving reighT orwarding arkeT control, analysis, development of supply chain solutions. As proof, Logistics Trends & Insights LLC points to DB

Market share shifts were telling over the past 12 months. Schenker’s investment in UShip, DHL’s launch of its online

In terms of revenues by mode of transport – air, ocean, rail freight marketplace CILLOX and even FedEx’s introduction and truck – forwarders’ biggest market share increase was air of FedEx Fulfllment. All of those efforts are all redefning the freight (42.3% of survey responses). The air freight market way items are fulflled, booked and shipped. Niche services has experienced a revival. According to IATA, freight ton ki- is another important differentiator. These services typically lometers increased 3.8% in 2016. This was nearly double the revolve around specialized industry needs such as cold chain. industry’s average growth rate of 2.0% over the last fve years. Panalpina has made recent investments in such niche provid-

On the other hand, the biggest decline in market share, in terms ers as Air Connection and Airfo to expand its perishables of revenue, was not a big surprise – ocean freight. 32.5% of re- solution. Other forwarders including DHL, UPS and FedEx spondents noted a loss in market share in this mode probably due have expanded their track and trace capabilities, specialized to the historic low ocean freight rates hit in 2016. Nevertheless, packaging as well warehousing and distribution networks.

and In terms of market share by volume for the past 12 months, E-commerce is also creating opportunities for forwarders in- all four modes noted increases with air freight noting the highest cluding fulfllment and cross-border services. FedEx and UPS gains at 48.7%, trucking with 48.0%, ocean freight 43.6% and acquired niche providers in this space and DHL introduced rail with 32.5%. That said; turning those volumes into proftable plug & play fulfllment facilities. Amazon, Alibaba, JD.com revenue it seems has been the challenge for many forwarders. and other ecommerce providers are taking heightened roles in logistics. And beyond industry specifc niche services, Chi-

Growth Opportunities: Technology is King na’s One Belt One Road (OBOR) initiative provides another

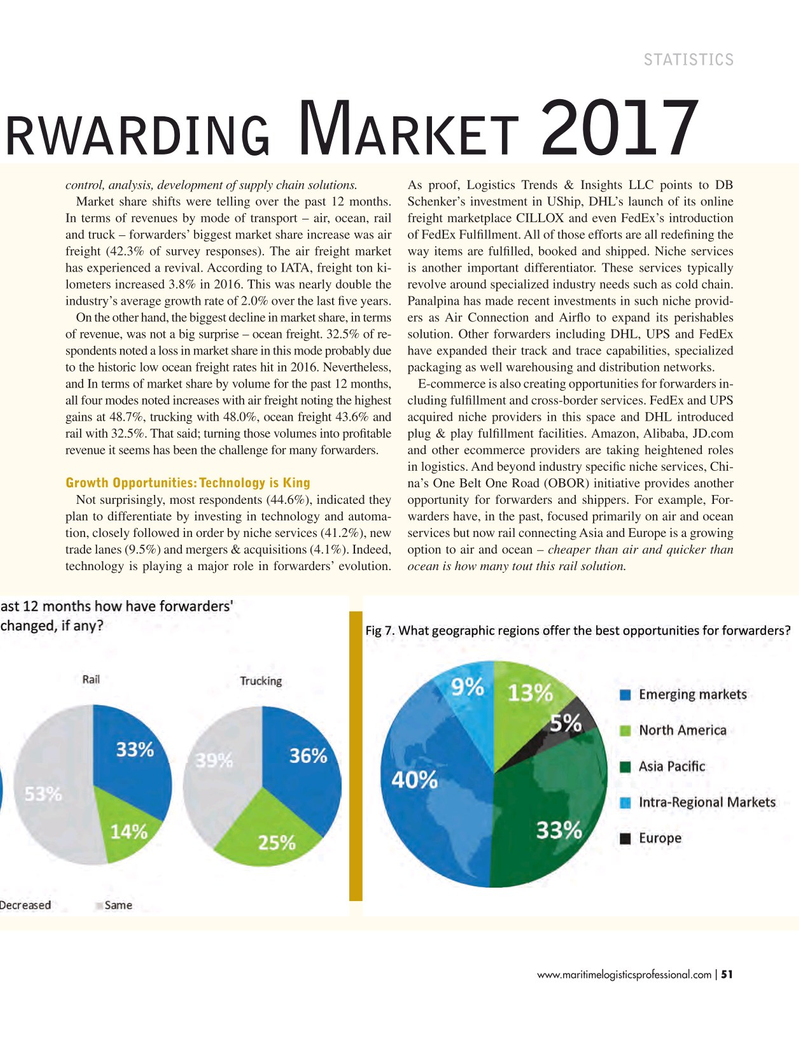

Not surprisingly, most respondents (44.6%), indicated they opportunity for forwarders and shippers. For example, For- plan to differentiate by investing in technology and automa- warders have, in the past, focused primarily on air and ocean tion, closely followed in order by niche services (41.2%), new services but now rail connecting Asia and Europe is a growing trade lanes (9.5%) and mergers & acquisitions (4.1%). Indeed, option to air and ocean – cheaper than air and quicker than technology is playing a major role in forwarders’ evolution. ocean is how many tout this rail solution. www.maritimelogisticsprofessional.com 51

I

50

50

52

52