Page 30: of Maritime Logistics Professional Magazine (May/Jun 2018)

Container Ports

Read this page in Pdf, Flash or Html5 edition of May/Jun 2018 Maritime Logistics Professional Magazine

Global Container Shipping he report season for 2018 Q1 corporate results saw an

OVERSUPPLY “earnings miss” (reported earnings below consensus Fleet supply continues to be a vexing problem. A February

T forecasts of analysts) for the bellwether of listed contain- 2018 analysis by Baltic and International Maritime Council er equities, A.P. Moller (APM), with its largest portfolio hold- (BIMCO) offered, “The containership feet has already ex- ing being Maersk Line. In a media telephone interview, APM panded by 1.2% in the frst month of 2018 – equal to the en-

CEO Soren Skou, said, “…in our main business, the ocean tire feet expansion of 2016 … A furry of new ships has been segment, we are not making money.” Indeed, fgures accom- delivered in January. Not since July 2010 has such a massive panying APM’s Q1 report showed a slight decline in average infow of capacity taken place in one month – 254,173 TEU. laden $/FFE (40’ equivalent) on East / West routes, calculating This includes plenty of feeder ships, but also fve ultra-large back to $1,796, compared to the year earlier fgure of $1,813. 20,000+ TEU ships.” And, the strategies for dealing with over-

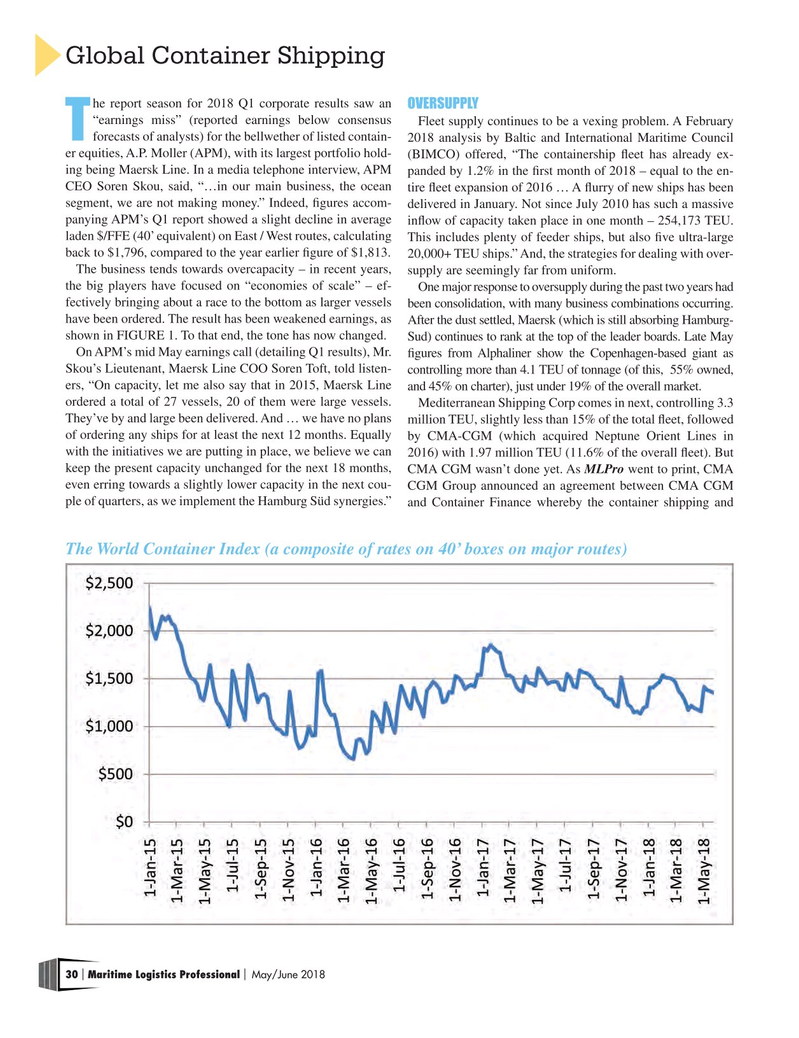

The business tends towards overcapacity – in recent years, supply are seemingly far from uniform. the big players have focused on “economies of scale” – ef- One major response to oversupply during the past two years had fectively bringing about a race to the bottom as larger vessels been consolidation, with many business combinations occurring. have been ordered. The result has been weakened earnings, as After the dust settled, Maersk (which is still absorbing Hamburg- shown in FIGURE 1. To that end, the tone has now changed. Sud) continues to rank at the top of the leader boards. Late May

On APM’s mid May earnings call (detailing Q1 results), Mr. fgures from Alphaliner show the Copenhagen-based giant as

Skou’s Lieutenant, Maersk Line COO Soren Toft, told listen- controlling more than 4.1 TEU of tonnage (of this, 55% owned, ers, “On capacity, let me also say that in 2015, Maersk Line and 45% on charter), just under 19% of the overall market.

ordered a total of 27 vessels, 20 of them were large vessels. Mediterranean Shipping Corp comes in next, controlling 3.3

They’ve by and large been delivered. And … we have no plans million TEU, slightly less than 15% of the total feet, followed of ordering any ships for at least the next 12 months. Equally by CMA-CGM (which acquired Neptune Orient Lines in with the initiatives we are putting in place, we believe we can 2016) with 1.97 million TEU (11.6% of the overall feet). But keep the present capacity unchanged for the next 18 months, CMA CGM wasn’t done yet. As MLPro went to print, CMA even erring towards a slightly lower capacity in the next cou- CGM Group announced an agreement between CMA CGM ple of quarters, as we implement the Hamburg Süd synergies.” and Container Finance whereby the container shipping and

The World Container Index (a composite of rates on 40’ boxes on major routes) 30 Maritime Logistics Professional May/June 2018 | |

29

29

31

31