Page 36: of Maritime Logistics Professional Magazine (May/Jun 2018)

Container Ports

Read this page in Pdf, Flash or Html5 edition of May/Jun 2018 Maritime Logistics Professional Magazine

Containership Valuations

Boxship Bargains:

Where you sit determines where you stand in the market.

Many variables cloud containership vessel valuation calculations today. That said, and according to VesselsValue.com, there are always opportunities at hand for intrepid market participants.

By Court Smith ncertainty has plagued the container markets over being sold at auction or bank sales has also fallen as asset the past several years. German owners have been values, at the same time, have started to climb upwards. This feeing the space during this time as domestic in- indicates that lenders have been less willing to capitulate, and

Uvestors have lost their taste for market exposure true bargains are scarcer. Buyers during the darkest periods of after a dismal decade. Large carriers are clamoring for market the market appear to have gotten the best deals, proving that share and are refusing to exercise order discipline, pushing the strong stomached investors still can return signifcant value in

TEU capacity of the global feet ever higher with larger ships. even the most depressed shipping segments.

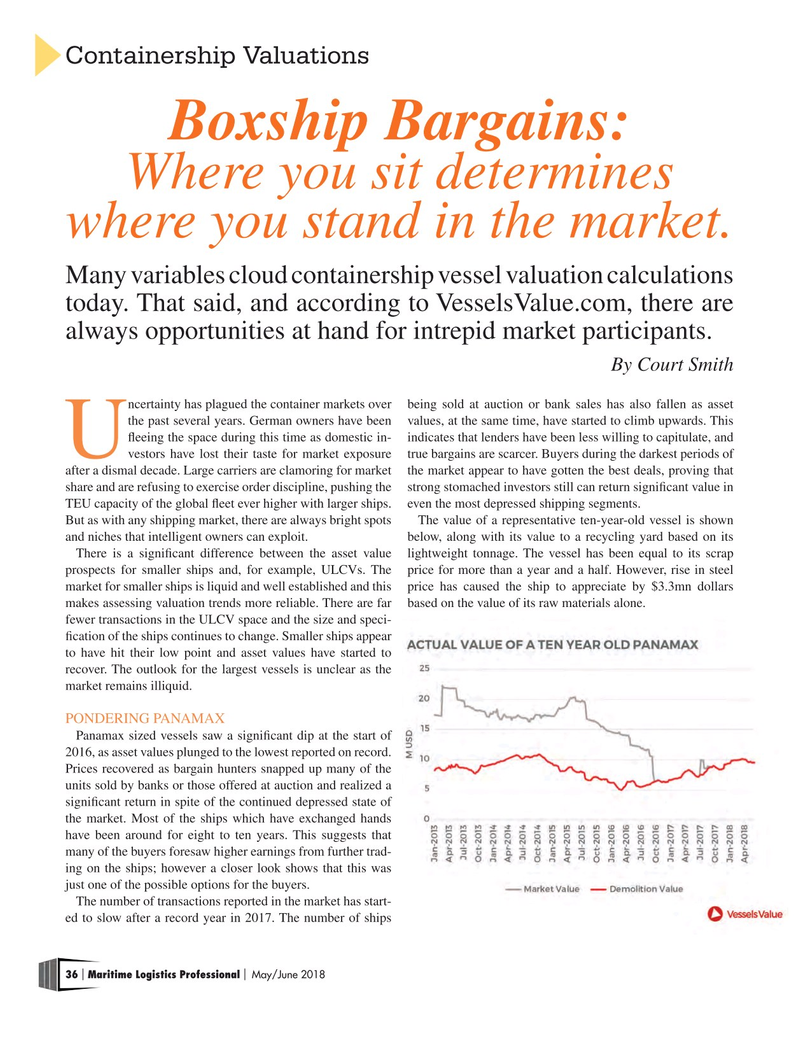

But as with any shipping market, there are always bright spots The value of a representative ten-year-old vessel is shown and niches that intelligent owners can exploit. below, along with its value to a recycling yard based on its

There is a signifcant difference between the asset value lightweight tonnage. The vessel has been equal to its scrap prospects for smaller ships and, for example, ULCVs. The price for more than a year and a half. However, rise in steel market for smaller ships is liquid and well established and this price has caused the ship to appreciate by $3.3mn dollars makes assessing valuation trends more reliable. There are far based on the value of its raw materials alone. fewer transactions in the ULCV space and the size and speci- fcation of the ships continues to change. Smaller ships appear to have hit their low point and asset values have started to recover. The outlook for the largest vessels is unclear as the market remains illiquid.

PONDERING PANAMAX

Panamax sized vessels saw a signifcant dip at the start of 2016, as asset values plunged to the lowest reported on record.

Prices recovered as bargain hunters snapped up many of the units sold by banks or those offered at auction and realized a signifcant return in spite of the continued depressed state of the market. Most of the ships which have exchanged hands have been around for eight to ten years. This suggests that many of the buyers foresaw higher earnings from further trad- ing on the ships; however a closer look shows that this was just one of the possible options for the buyers.

The number of transactions reported in the market has start- ed to slow after a record year in 2017. The number of ships 36 Maritime Logistics Professional May/June 2018 | |

35

35

37

37