Page 51: of Maritime Logistics Professional Magazine (May/Jun 2018)

Container Ports

Read this page in Pdf, Flash or Html5 edition of May/Jun 2018 Maritime Logistics Professional Magazine

STATISTICS a Y eardstiCk for the ConomY relevant. And, each piece of data by itself sometimes needs a Transport, and Hapag-Lloyd.

little explanation. Separately, and in 2015, the Port of Miami completed an

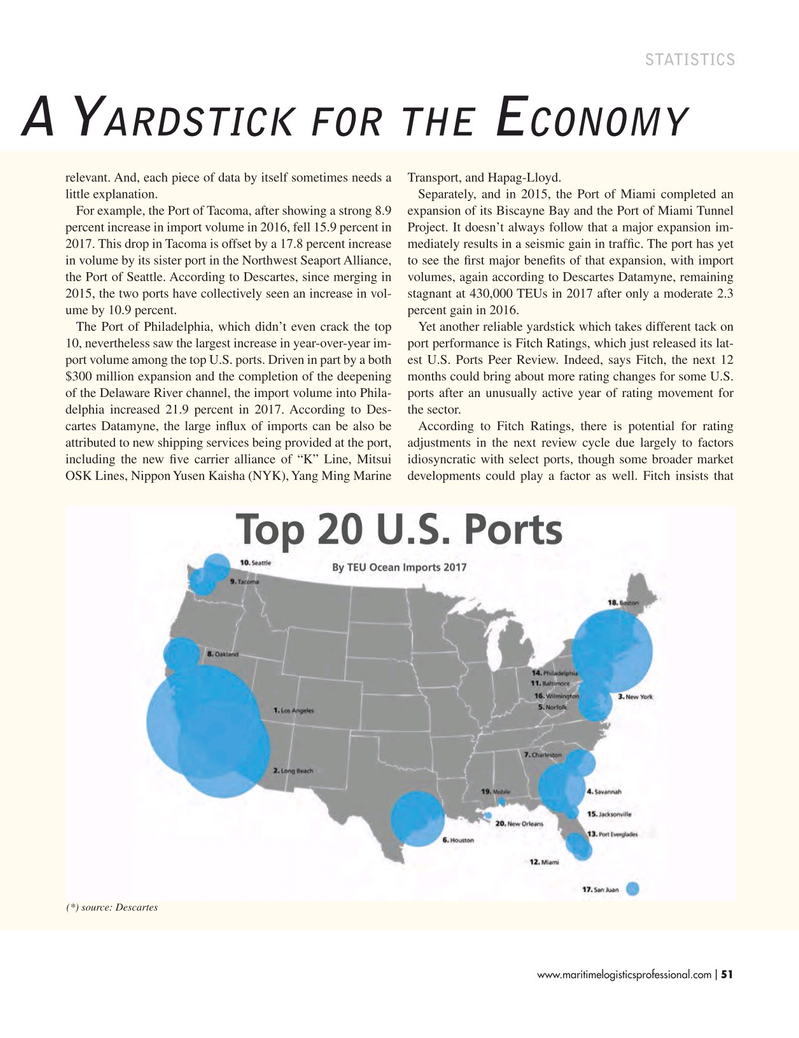

For example, the Port of Tacoma, after showing a strong 8.9 expansion of its Biscayne Bay and the Port of Miami Tunnel percent increase in import volume in 2016, fell 15.9 percent in Project. It doesn’t always follow that a major expansion im- 2017. This drop in Tacoma is offset by a 17.8 percent increase mediately results in a seismic gain in traffc. The port has yet in volume by its sister port in the Northwest Seaport Alliance, to see the frst major benefts of that expansion, with import the Port of Seattle. According to Descartes, since merging in volumes, again according to Descartes Datamyne, remaining 2015, the two ports have collectively seen an increase in vol- stagnant at 430,000 TEUs in 2017 after only a moderate 2.3 ume by 10.9 percent. percent gain in 2016.

The Port of Philadelphia, which didn’t even crack the top Yet another reliable yardstick which takes different tack on 10, nevertheless saw the largest increase in year-over-year im- port performance is Fitch Ratings, which just released its lat- port volume among the top U.S. ports. Driven in part by a both est U.S. Ports Peer Review. Indeed, says Fitch, the next 12 $300 million expansion and the completion of the deepening months could bring about more rating changes for some U.S. of the Delaware River channel, the import volume into Phila- ports after an unusually active year of rating movement for delphia increased 21.9 percent in 2017. According to Des- the sector. cartes Datamyne, the large infux of imports can be also be According to Fitch Ratings, there is potential for rating attributed to new shipping services being provided at the port, adjustments in the next review cycle due largely to factors including the new fve carrier alliance of “K” Line, Mitsui idiosyncratic with select ports, though some broader market

OSK Lines, Nippon Yusen Kaisha (NYK), Yang Ming Marine developments could play a factor as well. Fitch insists that (*) source: Descartes www.maritimelogisticsprofessional.com 51

I

50

50

52

52