Page 5: of Maritime Reporter Magazine (August 1977)

Read this page in Pdf, Flash or Html5 edition of August 1977 Maritime Reporter Magazine

Waterman Plans To Build

Either An $80-Million Or

An $87-Million Vessel

Waterman Steamship Corpora- tion, 120 Wall Street, New York,

N.Y., has applied for both con- struction-differential subsidy (CDS) and Title XI guarantees to aid in financing the construction of either a roll-on/roll-off (ro/ro) vessel or a lighter-aboard-ship (LASH) vessel to replace two 1945-built freighters operating on its Trade Route 18 service.

The proposed ro/ro vessel would be 684 feet long, with a dead- weight capacity of 19,534 tons and a speed of 23 knots. Esti- mated actual cost, for which Wa- terman is seeking 50 percent CDS, is $87.8 million. The vessel would contain four decks and four cargo holds: one for breakbulk cargo and the other three for roll-on/ off cargo. Containers would be stowed on the "A" deck. Al- though the application does not specify the container/trailer ca- pacity, it does indicate that 900 containers, 500 chassis, and 300 trailers would be required to sup- port the ship. It would be used to carry containers, wheeled cargo, and heavy-lift cargo from U.S.

Atlantic and Gulf ports to South- west Asia from Suez to Burma, and Africa in the Red Sea and the Gulf of Aden.

The proposed LASH vessel would be 893 feet long, with a deadweight capacity of 38,500 tons and a speed of 22 knots. Es- timated actual cost is $80.9 mil- lion; Waterman seeks 50 percent

CDS. It would be used for the same trade as the ro/ro vessel.

The LASH vessel would have a capacity of 89 barges—36 on deck and 53 in seven holds. Its lighter crane capacity would be 550 short tons.

Waterman is required by the replacement obligation of its op- erating-differential subsidy (ODS) contract for T.R. 18 to contract for the construction of one LASH or one ro/ro vessel by Novem- ber 26, 1977. Presently, Water- man operates three LASH vessels, two Mariners, and two reconverted

C4 freighters on T.R. 18. It also operates vessels, without ODS, in services between Gulf and At- lantic ports and the Far East,

Scandinavia, the Baltic, and the

USSR. ODS applications have been filed for these services.

Burmeister & Wain

Sign With AMT-Miami

Burmeister & Wain Engineer- ing Co. Ltd. of Copenhagen, Den- mark, has announced the signing of an agreement with AMT-

Miami, Incorporated, which gives

AMT authorization as repair fa- cility and spare parts provider for B&W diesel engines in South

Carolina, Georgia, Florida, Ba- hamas and the Caribbean, exclud- ing Jacksonville Shipyards and

Curacao Drydock Co., Inc.

Boston VLCC Tankers, Inc.

Submits Application

To Enter Alaska Trade

The Maritime Administration has received an application from

Boston VLCC Tankers, Inc. VI,

Wilmington, Del., to enter the 265,000-dwt tanker Maryland in the Alaskan oil trade. The ship would be operated by Atlantic

Richfield Company, which entered into a time charter with the own- ers on April 17, 1977.

On June 24, 1977, MarAd an- nounced new regulations that pre- scribe procedures under which tankers of 100,000 dwt or more, built under construction-differen- tial subsidy (CDS) , could be em- ployed temporarily in the Alaskan oil trade. The regulations limit the use of such vessels to the trade between Alaska and the

Panama Canal. Participation is also limited to six months in any one year, and CDS funds must be repaid on a prorated basis during such periods.

The Maryland was built under

CDS and delivered August 18, 1976, from Bethlehem Steel Cor- poration's Sparrows Point, Md., shipyard. Total cost of the ship was $71.2 million.

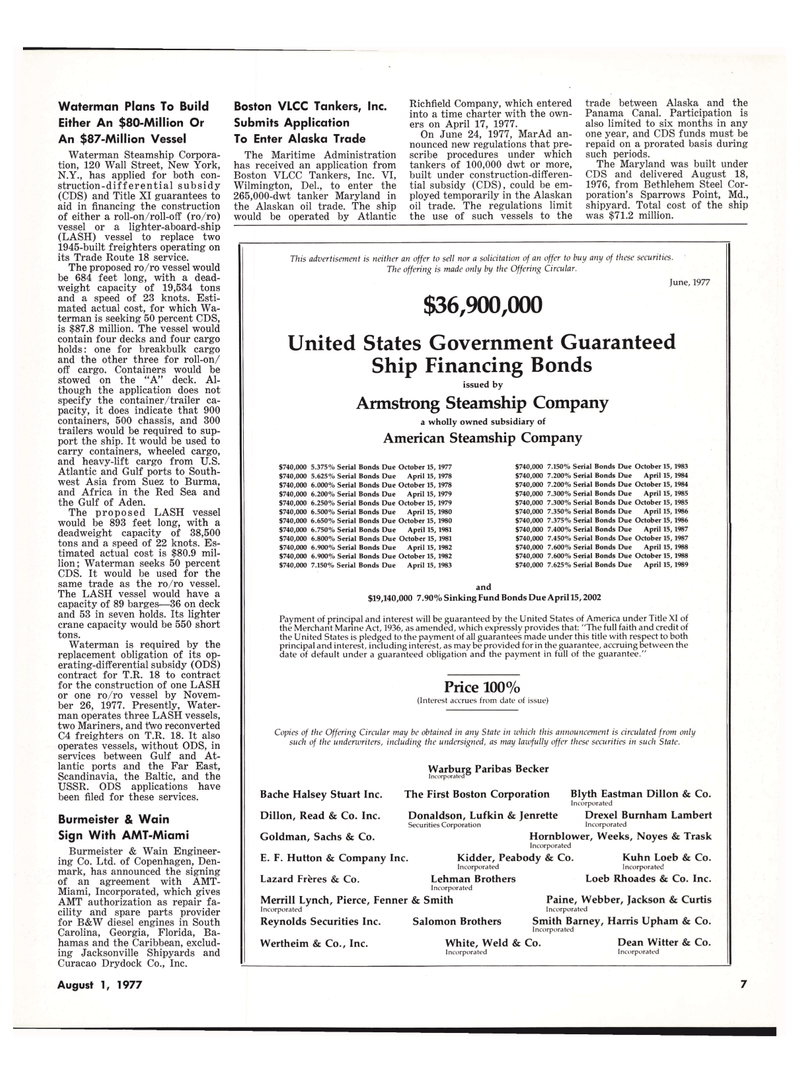

This advertisement is neither an offer to sell nor a solicitation of an offer to buy any of these securities.

The offering is made only by the Offering Circular.

June, 1977 $36,900,000

United States Government Guaranteed

Ship Financing Bonds issued by

Armstrong Steamship Company a wholly owned subsidiary of

American Steamship Company $740,000 5.375% Serial Bonds Due October 15, 1977 $740,000 5.625% Serial Bonds Due April 15, 1978 $740,000 6.000% Serial Bonds Due October 15, 1978 $740,000 6.200% Serial Bonds Due April 15, 1979 $740,000 6.250% Serial Bonds Due October 15,1979 $740,000 6.500% Serial Bonds Due April 15, 1980 $740,000 6.650% Serial Bonds Due October 15, 1980 $740,000 6.750% Serial Bonds Due April 15,1981 $740,000 6.800% Serial Bonds Due October 15, 1981 $740,000 6.900% Serial Bonds Due April 15, 1982 $740,000 6.900% Serial Bonds Due October 15,1982 $740,000 7.150% Serial Bonds Due April 15, 1983 $740,000 7.150% Serial Bonds Due October 15,1983 $740,000 7.200% Serial Bonds Due April 15, 1984 $740,000 7.200% Serial Bonds Due October 15,1984 $740,000 7.300% Serial Bonds Due April 15, 1985 $740,000 7.300% Serial Bonds Due October 15,1985 $740,000 7.350% Serial Bonds Due April 15,1986 $740,000 7.375% Serial Bonds Due October 15, 1986 $740,000 7.400% Serial Bonds Due April 15, 1987 $740,000 7.450% Serial Bonds Due October 15,1987 $740,000 7.600% Serial Bonds Due April 15, 1988 $740,000 7.600% Serial Bonds Due October 15, 1988 $740,000 7.625% Serial Bonds Due April 15, 1989 and $19,140,000 7.90% Sinking Fund Bonds Due April 15,2002

Payment of principal and interest will be guaranteed by the United States of America under Title XI of the Merchant Marine Act, 1936, as amended, which expressly provides that: "The full faith and credit of the United States is pledged to the payment of all guarantees made under this title with respect to both principal and interest, including interest, as may be provided for in the guarantee, accruing between the date of default under a guaranteed obligation ana the payment in full of the guarantee."

Price 100% (Interest accrues from date of issue)

Copies of the Offering Circular may be obtained in any State in which this announcement is circulated from only such of the underwriters, including the undersigned, as may laii'fully offer these securities in such State.

Bache Halsey Stuart Inc.

Dillon, Read & Co. Inc.

Goldman, Sachs & Co.

Warburg Paribas Becker

Incorporated

The First Boston Corporation Blyth Eastman Dillon & Co.

Incorporated

Donaldson, Lufkin & Jenrette Drexel Burnham Lambert

Securities Corporation Incorporated

Hornblower, Weeks, Noyes & Trask

Incorporated

E. F. Hutton & Company Inc. Kidder, Peabody & Co. Kuhn Loeb & Co.

Incorporated Incorporated

Lazard Freres & Co. Lehman Brothers Loeb Rhoades & Co. Inc.

Incorporated

Merrill Lynch, Pierce, Fenner & Smith Paine, Webber, Jackson & Curtis

Incorporated Incorporated

Reynolds Securities Inc. Salomon Brothers Smith Barney, Harris Upham & Co.

Incorporated

Wertheim & Co., Inc. White, Weld & Co.

Incorporated

Dean Witter & Co.

Incorporated

August 1, 1977 7

4

4

6

6