Page 3rd Cover: of Maritime Reporter Magazine (January 15, 1985)

Read this page in Pdf, Flash or Html5 edition of January 15, 1985 Maritime Reporter Magazine

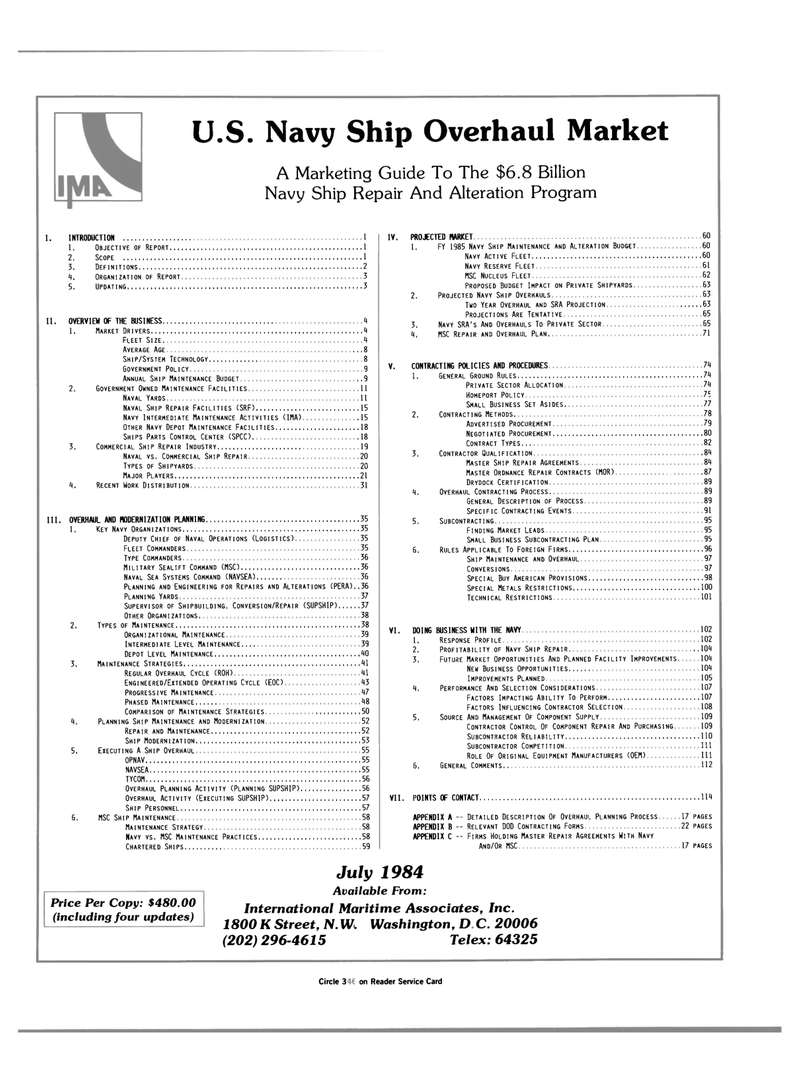

U.S. Navy Ship Overhaul Market

A Marketing Guide To The $6.8 Billion

Navy Ship Repair And Alteration Program

I. INTRODUCTION 1 1. OBJECTIVE OF REPORT 1 2. SCOPE 3. DEFINITIONS 2 4. ORGANIZATION OF REPORT 3 5. UPDATING 3

II. OVERVIEW OF THE BUSINESS 4 1. MARKET DRIVERS

FLEET SIZE

AVERAGE AGE 8

SHIP/SYSTEM TECHNOLOGY 8

GOVERNMENT POLICY 9

ANNUAL SHIP MAINTENANCE BUDGET 9 2. GOVERNMENT OWNED MAINTENANCE FACILITIES 11

NAVAL YARDS 1

NAVAL SHIP REPAIR FACILITIES (SRF) 15

NAVY INTERMEDIATE MAINTENANCE ACTIVITIES (IMA) 1

OTHER NAVY DEPOT MAINTENANCE FACILITIES 18

SHIPS PARTS CONTROL CENTER (SPCC) 1 3. COMMERCIAL SHIP REPAIR INDUSTRY 19

NAVAL VS, COMMERCIAL SHIP REPAIR 20

TYPES OF SHIPYARDS 2

MAJOR PLAYERS 1 4. RECENT WORK DISTRIBUTION 3

IV. PROJECTED MARKET 60 1. FY 1985 NAVY SHIP MAINTENANCE AND ALTERATION BUDGET 6

NAVY ACTIVE FLEET 6

NAVY RESERVE FLEET 1

MSC NUCLEUS FLEET 2

PROPOSED BUDGET IMPACT ON PRIVATE SHIPYARDS 63 2. PROJECTED NAVY SHIP OVERHAULS 6

TWO YEAR OVERHAUL AND SRA PROJECTION 63

PROJECTIONS ARE TENTATIVE 5 3. NAVY SRA'S AND OVERHAULS TO PRIVATE SECTOR 6 4. MSC REPAIR AND OVERHAUL PLAN 71

V. CONTRACTING POLICIES AND PROCEDURES 74 1. GENERAL GROUND RULES 7

PRIVATE SECTOR ALLOCATION

HOMEPORT POLICY 5

III. OVERHAUL AND MODERNIZATION PLANNING 35 1. KEY NAVY ORGANIZATIONS

DEPUTY CHIEF OF NAVAL OPERATIONS (LOGISTICS) 35

FLEET COMMANDERS

TYPE COMMANDERS 36

MILITARY SEALIFT COMMAND (MSC) 3

NAVAL SEA SYSTEMS COMMAND (NAVSEA) 6

PLANNING AND ENGINEERING FOR REPAIRS AND ALTERATIONS (PERA)..36

PLANNING YARDS 37

SUPERVISOR OF SHIPBUILDING, CONVERSION/REPAIR (SUPSHIP) 37

OTHER ORGANIZATIONS 8 2. TYPES OF MAINTENANCE

ORGANIZATIONAL MAINTENANCE 39

INTERMEDIATE LEVEL MAINTENANCE

DEPOT LEVEL MAINTENANCE 40 3. MAINTENANCE STRATEGIES 41

REGULAR OVERHAUL CYCLE (ROH)

ENGINEERED/EXTENDED OPERATING CYCLE (EOC) 43

PROGRESSIVE MAINTENANCE 47

PHASED MAINTENANCE 8

COMPARISON OF MAINTENANCE STRATEGIES 50 4. PLANNING SHIP MAINTENANCE AND MODERNIZATION 2

REPAIR AND MAINTENANCE 5

SHIP MODERNIZATION 3 5. EXECUTING A SHIP OVERHAUL 5

OPNAV 5

NAVSEA

TYCOM 6

OVERHAUL PLANNING ACTIVITY (PLANNING SUPSHIP) 5

OVERHAUL ACTIVITY (EXECUTING SUPSHIP) 57

SHIP PERSONNEL 5 6. MSC SHIP MAINTENANCE 8

MAINTENANCE STRATEGY

NAVY VS. MSC MAINTENANCE PRACTICES 58

CHARTERED SHIPS 59

SMALL BUSINESS SET ASIDES 77 2. CONTRACTING METHODS 78

ADVERTISED PROCUREMENT 9

NEGOTIATED PROCUREMENT 80

CONTRACT TYPES 2 3. CONTRACTOR QUALIFICATION 4

MASTER SHIP REPAIR AGREEMENTS 8

MASTER ORDNANCE REPAIR CONTRACTS (MOR) 87

DRYDOCK CERTIFICATION 89 4. OVERHAUL CONTRACTING PROCESS

GENERAL DESCRIPTION OF PROCESS 8

SPECIFIC CONTRACTING EVENTS 91 5. SUBCONTRACTING 95

FINDING MARKET LEADS

SMALL BUSINESS SUBCONTRACTING PLAN 95 6. RULES APPLICABLE TO FOREIGN FIRMS 96

SHIP MAINTENANCE AND OVERHAUL 7

CONVERSIONS 9

SPECIAL BUY AMERICAN PROVISIONS 98

SPECIAL METALS RESTRICTIONS 100

TECHNICAL RESTRICTIONS 101

VI. DOING BUSINESS WITH THE NAVY 102 1. RESPONSE PROFILE 2. PROFITABILITY OF NAVY SHIP REPAIR 104 3. FUTURE MARKET OPPORTUNITIES AND PLANNED FACILITY IMPROVEMENTS 104

NEW BUSINESS OPPORTUNITIES 10

IMPROVEMENTS PLANNED 105 4. PERFORMANCE AND SELECTION CONSIDERATIONS 107

FACTORS IMPACTING ABILITY TO PERFORM 10

FACTORS INFLUENCING CONTRACTOR SELECTION 108 5. SOURCE AND MANAGEMENT OF COMPONENT SUPPLY 109

CONTRACTOR CONTROL OF COMPONENT REPAIR AND PURCHASING 109

SUBCONTRACTOR RELIABILITY 110

SUBCONTRACTOR COMPETITION ILL

ROLE OF ORIGINAL EQUIPMENT MANUFACTURERS (OEM) IL 6. GENERAL COMMENTS 112

VII. POINTS OF CONTACT 114

APPENDIX A -- DETAILED DESCRIPTION OF OVERHAUL PLANNING PROCESS 17 PAGES

APPENDIX B -- RELEVANT DOD CONTRACTING FORMS 22 PAGES

APPENDIX C — FIRMS HOLDING MASTER REPAIR AGREEMENTS WITH NAVY

AND/OR MSC 17 PAGES

Price Per Copy: $480.00 (including four updates)

July 1984

Available From:

International Maritime Associates, Inc. 1800 K Street, N. W. Washington, DC. 20006 (202) 296-4615 Telex: 64325

Circle 143 on Reader Service Card ->|

40

40

4th Cover

4th Cover