Page 38: of Maritime Reporter Magazine (June 1988)

Read this page in Pdf, Flash or Html5 edition of June 1988 Maritime Reporter Magazine

U.S. MERCHANT

SHIPBUILDING

SHIPBUILDING AND REPAIR

IN U.S. SHIPYARDS

These days, any privately owned shipyard that was formerly occu- pied strictly with building new mer- chant ships has either swung around to the repair and conversion market, has made plans to do so, or is active- ly pursuing Navy work—which cer- tainly continues to be more than substantial.

The Navy is spending $34 billion annually for ships, weapons, sup- port equipment and maintenance, all to the benefit of both the yards and marine equipment manufactur- ers.

There are no large, oceangoing merchant ships under construction or on order in any U.S. shipyard.

However, plans at present call for two new containerships for the Ha- waiian trade to be ordered from a

U.S. yard by Matson Navigation Co.

The vessels would enter service in the 1990s.

The majority of U.S. yards are almost totally reliant on U.S. Navy,

U.S. Coast Guard and Military Seal- ift Command repair, maintenance and conversion work. Cruise ship drydockings and occasional mer- chant ship repairs also contribute some work. Currently some 22 ship- yards have contracts for work for redelivery between 1988 and 1991.

For the most part, six large U.S. yards are almost totally occupied by

Navy ship construction. Some dozen smaller yards are busy with smaller surface vessels for the Navy, MSC,

Army and Coast Guard. Several yards have built military vessels for foreign navies and negotiations are now underway for more such con- tracts.

Tacoma Boatbuilding Co., for ex- ample, recently announced that it had signed a $116-million contract with the Egyptian Navy to retrofit four Romeo Class submarines.

According to the Shipbuilders

Council of America (SCA), 84 naval vessels are currently under con- struction in U.S. shipyards. In 1976, less than half of the 155 ships under construction in U.S. yards were for the Navy.

Last November, when Bay Ship- building delivered the third of a series of three containerships to

Sea-Land—and the last large mer- chant ship to be built in the U.S.—it marked the first time in the coun- try's history that no commercial ships were under construction.

As of June 1987, six merchant ships totaling 80,680 deadweight tons were under construction or on order in three U.S. yards. Besides the three containerships for Sea-

Land, which were all delivered dur- ing the year, McDermott's New Or- leans yard delivered a hopper dredge, the Atlantic American, and

Tacoma Boatbuilding was building two incinerator ships. The order for the two incinerator ships was can- celled when the yard filed for Chap- ter 11 protection.

It has been noted that the De- partment of Defense relies on the private sector shipyards to provide it with essential support capabili- ties. Apparently, now, the private sector is not able to provide these capabilities, according to the SCA.

One study suggested a minimum need of 112,000 production workers in 110 shipyards of all kinds. At the end of 1987, the industry stood at 80,000 production workers in 69 shipyards.

Cruise Market Work

On The Rise

Location is a prime factor in cruise ship repairs and regular maintenance and drydocking pro- grams. Such jobs, involving the large oceangoing cruise vessels, have been on the increase in the middle and

South Atlantic coasts and the cen- tral and North Pacific coasts.

In a U.K. report on the World

Cruise Market 1987-88 from MRC

Hawkedon Publications, it is noted that the U.S. West Coast (Mexico and Alaska) will continue to in- crease the number of berths offered because the cruise market is con- stantly growing and these are the least expensive, and usually most convenient areas for first-time cruisers to visit. All this means more ships amd more maintenance and repair work for U.S. yards.

In FY 1987, the U.S. shipbuilding and ship repair industry invested more than $150 million in moderni- zation of its facilities. As of July 1987, the industry planned to spend an additional $70 million during the first half of this year. Most of these improvements will increase and modernize the repair sector.

Conversion Contracts

Last year, three National Defense

Reserve Fleet ships were converted into auxiliary crane ships (T-ACS).

The work on the USNS Gopher

State (T-ACS-4), the USNS Flick- ertail State (T-ACS-5) and the

USNS Cornhusker State (T-ACS-6) was performed by Norfolk Ship- building under a $47 million con- tract. Tampa Shipyards currently holds a $43.2-million contract for the conversion of the USNS Dia- mond State (T-ACS-7) and the

USNS Equality State (T-ACS-8). A total of 12 auxiliary crane ships is planned.

Aloha Pacific Cruises' 34-year-old passenger ship Monterey underwent extensive refurbishing work at

Northwest Marine Iron Works and

Tacoma Boatbuilding. Conversion of the 563-foot vessel into a luxury cruise liner is being completed at

Warstila-Helsinki in Finland. She will be delivered in time for her "re- maiden" voyage from Copenhagen on July 31.

Last September, the Admiral

Cruise Lines ship Emerald Seas was in drydock at Newport News Ship- building for hull and propeller work.

Review Of

Major Shipyards

A number of U.S. yards are cur- rently involved in U.S. Navy, Coast

Guard and Government ship con- struction. They include: Avondale

Shipyards, New Orleans, La.; Bath

Iron Works, Bath, Maine; Bethle- hem Steel, Sparrows Point, Md.;

Robert E. Derecktor, Middleton,

R.I.; General Dynamics-Electric

Boat Division, Groton, Conn.; Halt- er Marine, New Orleans, La.; Lit- ton-Ingalls Shipbuilding, Pascagou- la, Miss.; Marinette Marine, Ma- rinette, Wis.; McDermott Ship- yards, New Orleans, La.; Moss Point

Marine, Moss Point, Miss.; National

Steel & Shipbuilding Co., San Die- go, Calif.; Newport News Shipbuild- ing, Newport News, Va.; Pennsylva- nia Shipbuilding, Chester, Pa.; Pe- terson Builders Inc., Sturgeon Bay,

Wis.; Tacoma Boatbuilding, Taco- ma, Wash.; Textron Marine, New

Orleans, La.; and Todd Pacific

Shipyards, San Pedro, Calif.

Bath Iron Works, the lead yard for the Navy's Arleigh Burke Class destroyer (DDG-51) and a builder of

CG-47 Class cruisers, reportedly is the choice of Taiwan to build a fleet of new frigates for her navy.

Rhode Island's Derecktor Ship- yards currently is constructing me- dium endurance U.S. Coast Guard cutters and has an order for two

U.S. Army 128-foot tugs.

Boston's General Ship Repair re- mains active and will complete an $11-million SRA of a Navy frigate shortly.

Blount Marine, Warren, R.I., completed a 101-foot ferry for Ohio owners. They also delivered the 600- passenger cruise boat Spirit of New

York during 1987.

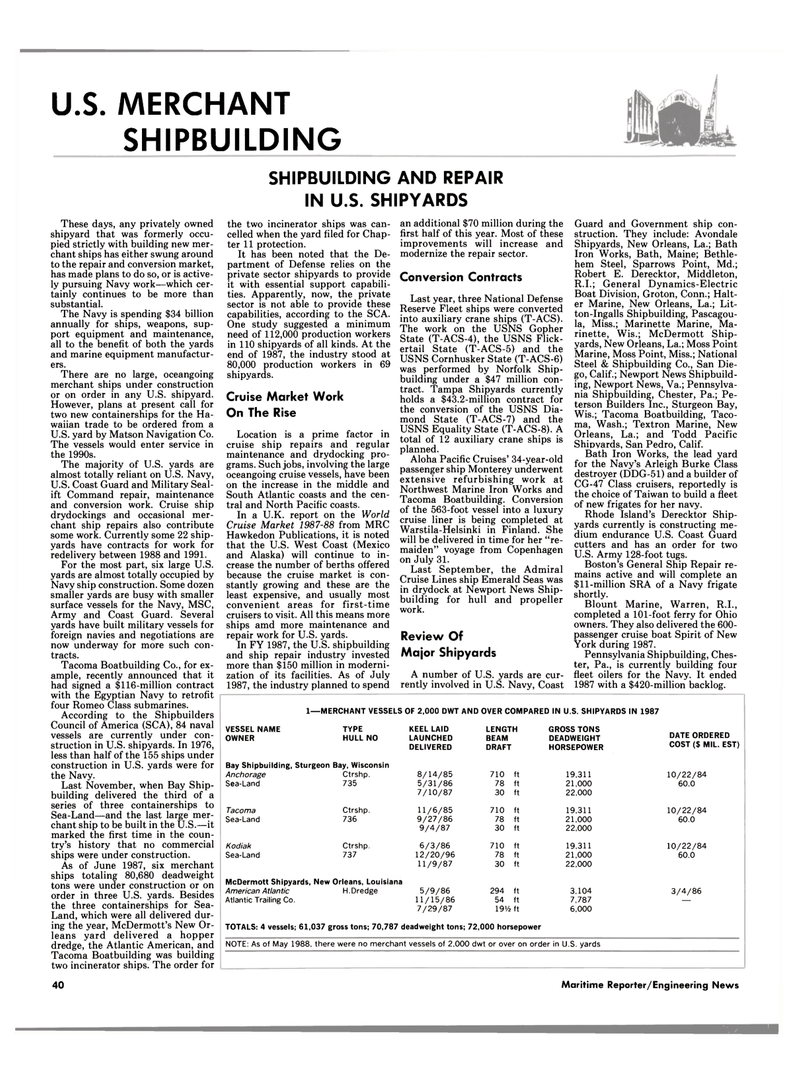

Pennsylvania Shipbuilding, Ches- ter, Pa., is currently building four fleet oilers for the Navy. It ended 1987 with a $420-million backlog. 1—MERCHANT VESSELS OF 2,000 DWT AND OVER COMPARED IN U.S. SHIPYARDS IN 1987

VESSEL NAME TYPE KEEL LAID LENGTH GROSS TONS DATE ORDERED

OWNER HULL NO LAUNCHED BEAM DEADWEIGHT

DELIVERED DRAFT HORSEPOWER COST ($ MIL. EST)

Bay Shipbuilding, Sturgeon Bay, Wisconsin

Anchorage Ctrshp. 8/14/85 710 ft 19,311 10/22/84

Sea-Land 735 5/31/86 78 ft 21,000 60.0 7/10/87 30 ft 22,000

Tacoma Ctrshp. 11/6/85 710 ft 19,311 10/22/84

Sea-Land 736 9/27/86 78 ft 21,000 60.0 9/4/87 30 ft 22,000

Kodiak Ctrshp. 6/3/86 710 ft 19,311 10/22/84

Sea-Land 737 12/20/96 78 ft 21,000 60.0 11/9/87 30 ft 22,000

McDermott Shipyards, New Orleans, Louisiana

American Atlantic H. Dredge 5/9/86 294 ft 3,104 3/4/86

Atlantic Trailing Co. 11/15/86 54 ft 7,787 — 7/29/87 19y2 ft 6,000

TOTALS: 4 vessels; 61,037 gross tons; 70,787 deadweight tons; 72,000 horsepower

NOTE: As of May 1988, there were no merchant vessels of 2,000 dwt or over on order in U.S. yards 40 Maritime Reporter/Engineering News

37

37

39

39