Page 35: of Maritime Reporter Magazine (December 1991)

Read this page in Pdf, Flash or Html5 edition of December 1991 Maritime Reporter Magazine

Product Tanker Prospects

Outlook For Trade And Profitability

The latest comprehensive sur-vey to be published reviews in detail recent market activity and highlights the way in which future products movements will determine the operating environ- ment over the remainder of the decade.

The main conclusions focus on the developments of products ex- ports from the main source refin- ers to the principal consuming nations. The report examines the way in which operating profit- ability will be substantially im- proved in the middle of the de- cade, but warns of the need for ordering restraint at this time.

The nature of the product tanker market has changed steadily since the oil crisis of the late 1970s. This brought about a progressive change in the loca- tion of refining capacity, the con- sequence of which was an increase in products exports from the source refiners.

The product carrier fleet ex- panded rapidly during the late 1980s, bolstered by demand for larger tankers, to meet growing shipments from the Middle East.

This may be clearly illustrated, by making reference to the year of build and corresponding aver- age tanker size.

Cargoes of around 50,000 dwt are now relatively commonplace on trades from the Middle East to the Far East, and one or two 70,000 dwt cargoes are noted in most months. This contrasts sharply with the 30,000 dwt car- goes which are the norm for move- ments elsewhere in the world.

Over the same period, many new product tankers have been characterized by an increase in their sophistication. In particu- lar, there are now a large number of vessels which may be regarded as "dual purpose"—i.e. capable of working chemical or crude, as well as product trades.

Nevertheless, many con- straints are still apparent for the larger and newer vessels, by way of limited draft ports, poor termi- nal facilities, and a non-avail- ability of suitably sized cargoes.

The future structure of the fleet will depend on how these issues are addressed.

Product carrier fleet develop- ment during the 1990s will re- flect a continued growth in ex- port volumes from the source re- finers which will provide the ba- sis for new trade opportunities.

In any event, rapidly escalat- ing cost pressures will provide the stimulus for a significant re- alignment in freight rates. This will be prerequisite if the neces- sary capital is to be secured for future investment in the indus- try.

For further information regarding "Product Tanker Prospects", or any inquiries regarding the report, please contact Drewry Shipping

Consultants Ltd., 11, Heron Quay,

London E14 4JF.

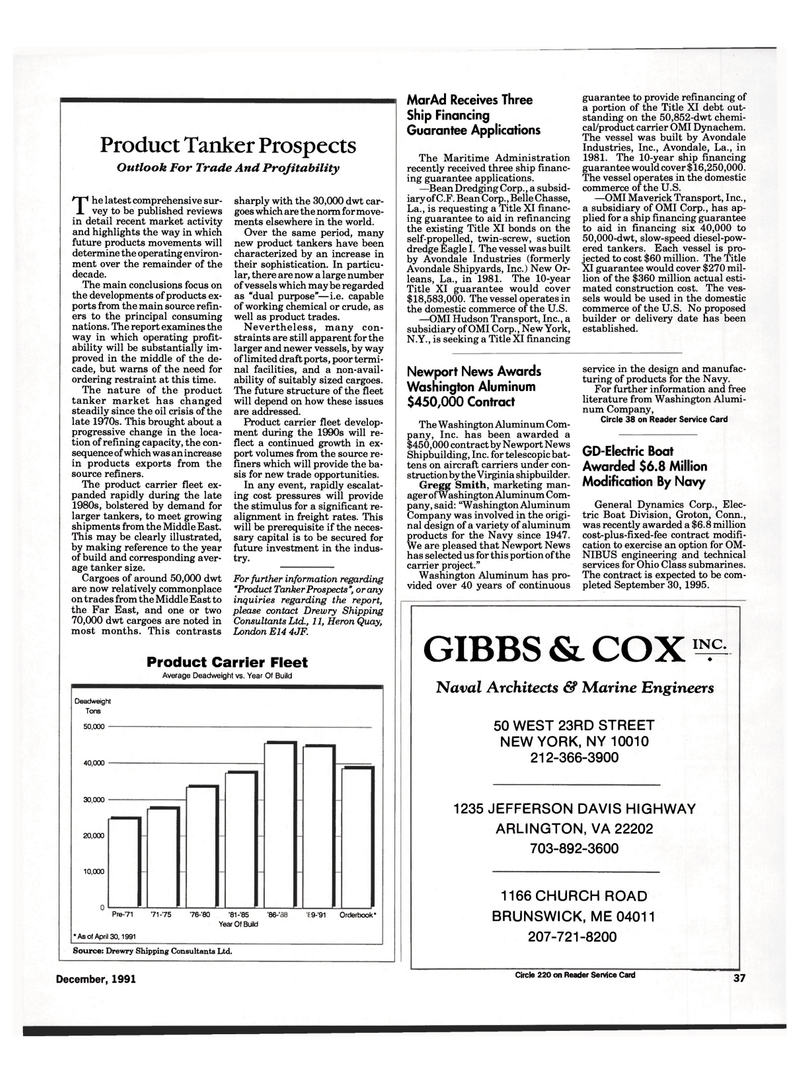

Product Carrier Fleet

Average Deadweight vs. Year Of Build

Deadweight

Tons 50,000 40,000 30,000 20,000 10,000

Pre-71 '71-75 76-'80 '81-'85 '86-'

Year Of Build 9-'91 Orderbook* * As of April 30,1991

Source: Drewry Shipping Consultants Ltd.

MarAd Receives Three

Ship Financing

Guarantee Applications

The Maritime Administration recently received three ship financ- ing guarantee applications. —Bean Dredging Corp., a subsid- iary of C.F. Bean Corp., Belle Chasse,

La., is requesting a Title XI financ- ing guarantee to aid in refinancing the existing Title XI bonds on the self-propelled, twin-screw, suction dredge Eagle I. The vessel was built by Avondale Industries (formerly

Avondale Shipyards, Inc.) New Or- leans, La., in 1981. The 10-year

Title XI guarantee would cover $18,583,000. The vessel operates in the domestic commerce of the U.S. —OMI Hudson Transport, Inc., a subsidiary of OMI Corp., New York,

N.Y., is seeking a Title XI financing guarantee to provide refinancing of a portion of the Title XI debt out- standing on the 50,852-dwt chemi- cal/product carrier OMI Dynachem.

The vessel was built by Avondale

Industries, Inc., Avondale, La., in 1981. The 10-year ship financing guarantee would cover $ 16,250,000.

The vessel operates in the domestic commerce of the U.S. —OMI Maverick Transport, Inc., a subsidiary of OMI Corp., has ap- plied for a ship financing guarantee to aid in financing six 40,000 to 50,000-dwt, slow-speed diesel-pow- ered tankers. Each vessel is pro- jected to cost $60 million. The Title

XI guarantee would cover $270 mil- lion of the $360 million actual esti- mated construction cost. The ves- sels would be used in the domestic commerce of the U.S. No proposed builder or delivery date has been established.

Newport News Awards

Washington Aluminum $450,000 Contract

The Washington Aluminum Com- pany, Inc. has been awarded a $450,000 contract by Newport News

Shipbuilding, Inc. for telescopic bat- tens on aircraft carriers under con- struction by the Virginia shipbuilder.

Gregg Smith, marketing man- ager of Washington Aluminum Com- pany, said: "Washington Aluminum

Company was involved in the origi- nal design of a variety of aluminum products for the Navy since 1947.

We are pleased that Newport News has selected us for this portion of the carrier project."

Washington Aluminum has pro- vided over 40 years of continuous service in the design and manufac- turing of products for the Navy.

For further information and free literature from Washington Alumi- num Company,

Circle 38 on Reader Service Card

GD-Electric Boat

Awarded $6.8 Million

Modification By Navy

General Dynamics Corp., Elec- tric Boat Division, Groton, Conn., was recently awarded a $6.8 million cost-plus-fixed-fee contract modifi- cation to exercise an option for OM-

NIBUS engineering and technical services for Ohio Class submarines.

The contract is expected to be com- pleted September 30, 1995.

GIBBS & COX ^

Naval Architects & Marine Engineers 50 WEST 23RD STREET

NEW YORK, NY 10010 212-366-3900 1235 JEFFERSON DAVIS HIGHWAY

ARLINGTON, VA 22202 703-892-3600 1166 CHURCH ROAD

BRUNSWICK, ME 04011 207-721-8200

December, 1991 Circle 220 on Reader Service Card 37

34

34

36

36