Page 56: of Maritime Reporter Magazine (February 1993)

Read this page in Pdf, Flash or Html5 edition of February 1993 Maritime Reporter Magazine

THE TANKER CHARTER MARKET:

Structure, Participants And Trends

Tanker chartering reflects both the needs of the oil industry to balance demand and supply, and the desires of the ship owners to maxi- mize their cashflows and hence prof- itability. Using unique, comprehen- sive and proprietory data covering the last decade, Drewry has ana- lyzed in detail this complex and ex- citing market.

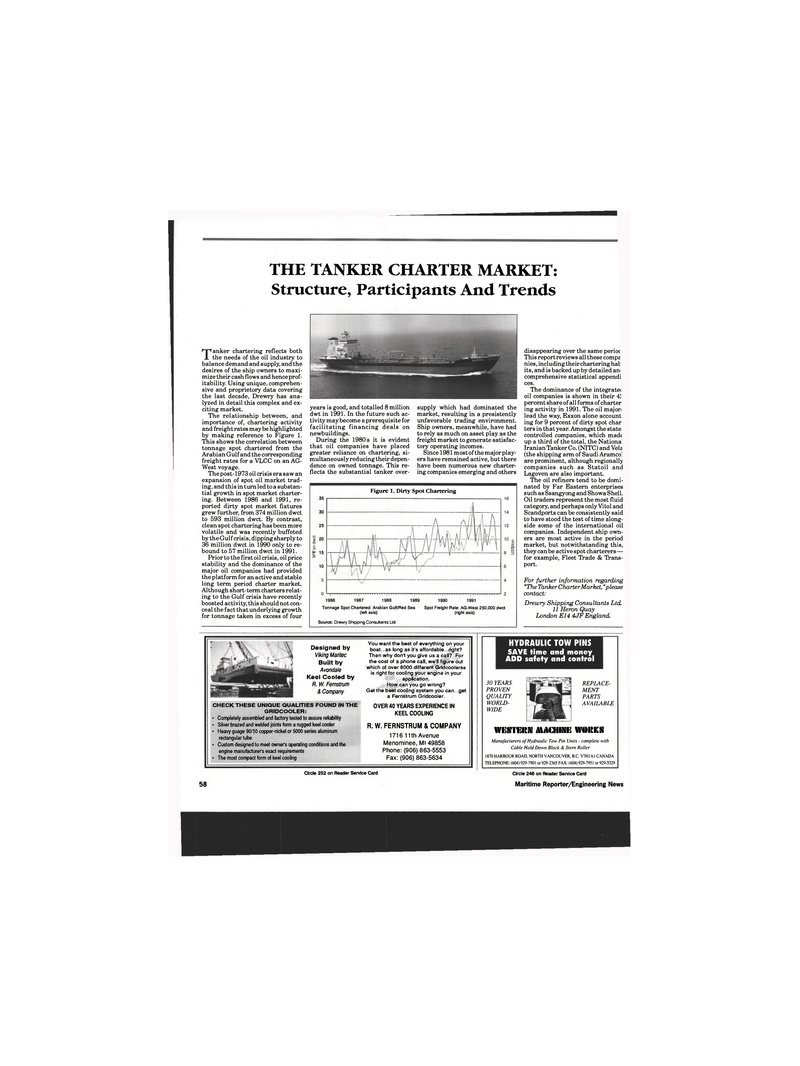

The relationship between, and importance of, chartering activity and freight rates maybe highlighted by making reference to Figure 1.

This shows the correlation between tonnage spot chartered from the

Arabian Gulf and the corresponding freight rates for a VLCC on an AG-

West voyage.

The post-1973 oil crisis era saw an expansion of spot oil market trad- ing, and this in turn led to a substan- tial growth in spot market charter- ing. Between 1986 and 1991, re- ported dirty spot market fixtures grew further, from 374 million dwct to 593 million dwct. By contrast, clean spot chartering has been more volatile and was recently buffeted by the Gulf crisis, dipping sharply to 36 million dwct in 1990 only to re- bound to 57 million dwct in 1991.

Prior to the first oil crisis, oil price stability and the dominance of the major oil companies had provided the platform for an active and stable long term period charter market.

Although short-term charters relat- ing to the Gulf crisis have recently boosted activity, this should not con- ceal the fact that underlying growth for tonnage taken in excess of four years is good, and totalled 8 million dwt in 1991. In the future such ac- tivity may become a prerequisite for facilitating financing deals on newbuildings.

During the 1980s it is evident that oil companies have placed greater reliance on chartering, si- multaneously reducing their depen- dence on owned tonnage. This re- flects the substantial tanker over- supply which had dominated the market, resulting in a presistently unfavorable trading environment.

Ship owners, meanwhile, have had to rely as much on asset play as the freight market to generate satisfac- tory operating incomes.

Since 1981 mostofthemajorplay- ers have remained active, but there have been numerous new charter- ing companies emerging and others disappearing over the same perioc

This report reviews all these compg nies, including their chartering hah its, and is backed up by detailed an comprehensive statistical appendi ces.

The dominance of the integrate* oil companies is shown in their 4'. percent share of all forms of charter ing activity in 1991. The oil major: lead the way, Exxon alone account ing for 9 percent of dirty spot char ters in that year. Amongst the state controlled companies, which made up a third of the total, the National

Iranian Tanker Co. (NITC) and Vela (the shipping arm of Saudi Aramco" are prominent, although regionally companies such as Statoil and

Lagoven are also important.

The oil refiners tend to be domi- nated by Far Eastern enterprises such as Ssangyong and Showa Shell.

Oil traders represent the most fluid category, and perhaps only Vitol and

Scandports can be consistently said to have stood the test of time along- side some of the international oil companies. Independent ship own- ers are most active in the period market, but notwithstanding this, they can be active spot charterers — for example, Fleet Trade & Trans- port.

For further information regarding "The Tanker Charter Market, "please contact:

Drewry Shipping Consultants Ltd. 11 Heron Quay

London E14 4 JF England. 35 30 25 20 := 15 10 1986

Figure 1. Dirty Spot Chartering 1987 1988 1989 1990 1991

Tonnage Spot Chartered: Arabian Gulf/Red Sea (left axis)

Spot Freight Rate: AG-West 250,000 dwct (right axis)

Source: Drewry Shipping Consultants Ltd.

HYDRAULIC TOW PINS

SAVE time and money

ADD safety and control

Designed by

Viking Maritec

Built by

Avondale

Keel Cooled by

R. W. Fernstrum & Company

CHECK THESE UNIQUE QUALITIES FOUND IN THE

GRIDCOOLER: • Completely assembled and factory tested to assure reliability • Silver brazed and welded joints form a rugged keel cooler • Heavy guage 90/10 copper-nickel or 5000 series aluminum rectangular tube • Custom designed to meet owner's operating conditions and the engine manufacturer's exact requirements • The most compact form of keel cooling

You want the best of everything on your boat...as long as it's affordable...right?

Then why don't you give us a call? For the cost of a phone call, we'll figure out which of over 8000 different Gridcoolers® is right for cooling your engine in your application.

How can you go wrong?

Get the best cooling system you can...get a Fernstrum Gridcooler.

OVER 40 YEARS EXPERIENCE IN

KEEL COOLING

R. W. FERNSTRUM & COMPANY 1716 11th Avenue

Menominee, Ml 49858

Phone: (906) 863-5553

Fax: (906) 863-5634

Circle 252 on Reader Service Card 30 YEARS

PROVEN

QUALITY

WORLD-

WIDE

REPLACE-

MENT

PARTS

AVAILABLE

WtiSTEItN AiACHIKIH WOltKS

Manufacturers of Hydraulic Tow Pin Units - complete with

Cable Hold Down Block & Stern Roller 1870 HARBOUR ROAD, NORTH VANCOUVER, B.C. V7H1A1 CANADA

TELEPHONE: (504) 929-7901 or 929-2365 FAX: (604) 929-7951 or 929-5329 58

Circle 246 on Reader Service Card

Maritime Reporter/Engineering News

55

55

57

57