Page 98: of Maritime Reporter Magazine (June 1993)

Read this page in Pdf, Flash or Html5 edition of June 1993 Maritime Reporter Magazine

Risks And Rewards

In The Tanker Market

Implications For Owners And Charterers

Risks and Rewards in the Tanker Market" is the latest ~vey to be published. The report monstrates risks have risen "ough higher costs and poorer em- >yment guarantees, and how the rden of risks has moved from the irket as a whole, to shipowners me. It also plots the diminishing wards observed by owners through e letting out of their ships.

In 1990-91, the Gulf crisis pro- ded many shipowners with wind- 11 profits. Yet by early 1992 freight ites had collapsed again and many 3ssels were failing to cover their inning costs. As cost pressures con- nue to mount, the outlook remains ighly uncertain. Consequently, the isks are increasingly falling on the wners alone, with few rewards in rospect.

It has not always been so. In the ood old days charterers could offer wners long-term employment and vere prepared to pay reasonable ates, even though the cost of freight vas a greater proportion of the anded cost of oil. And owners could mprove profitability by regularly "educing costs through technologi- cal progress. This enabled fleet re- placements and expansion to be readily financed.

However, the collapse in freight rates which followed the extraordi- nary peak seen in 1973, heralded a decline which has subsequently seen a restructuring of the market. Over the same period oil supplies have been increasingly sold under mar- ket-related formula prices with link- age to the spot market, and ship- ping needs have thus required more flexibility.

The major international oil com- panies which once owned and con- trolled much of the world's tonnage, either through ownership or long- term charters, have become increas- ingly reliant on the spot market.

However, the combination of rising oil prices and weak freight rates has meant that the freight element in the landed cost of oil has shrunk to historically low levels.

Obviously, in order to maximize revenues, it is in the shipowners' interest to operate vessels which are in the greatest demand but at the same time economical. In this way rewards should be maximized.

The report shows the increasing cost of "quality" ships and examines whether or not those owners who are apparently being asked to pro- vide ships of the highest quality are being rewarded for their efforts through premium rates.

There is a limit to the extent by which operating costs can be varied.

Underlying operating costs are esti- mated to have risen by no less than 60 percent since 1988. And new- building costs have risen rapidly, while declining secondhand values have led to a risk of negative equity.

Independent shipowners cannot reconcile the risks of massive in- vestment in new tonnage and few long-term contract opportunities with the insubstantial rewards cur- rently being yielded by the market.

If this situation persists, charterers might have to pay for their penny- pinching: eventually there will not be enough good ships for their needs.

For copies of this report contact:

Drewry Shipping Consultants Ltd. 11, Heron Quay, London E14 4JF.

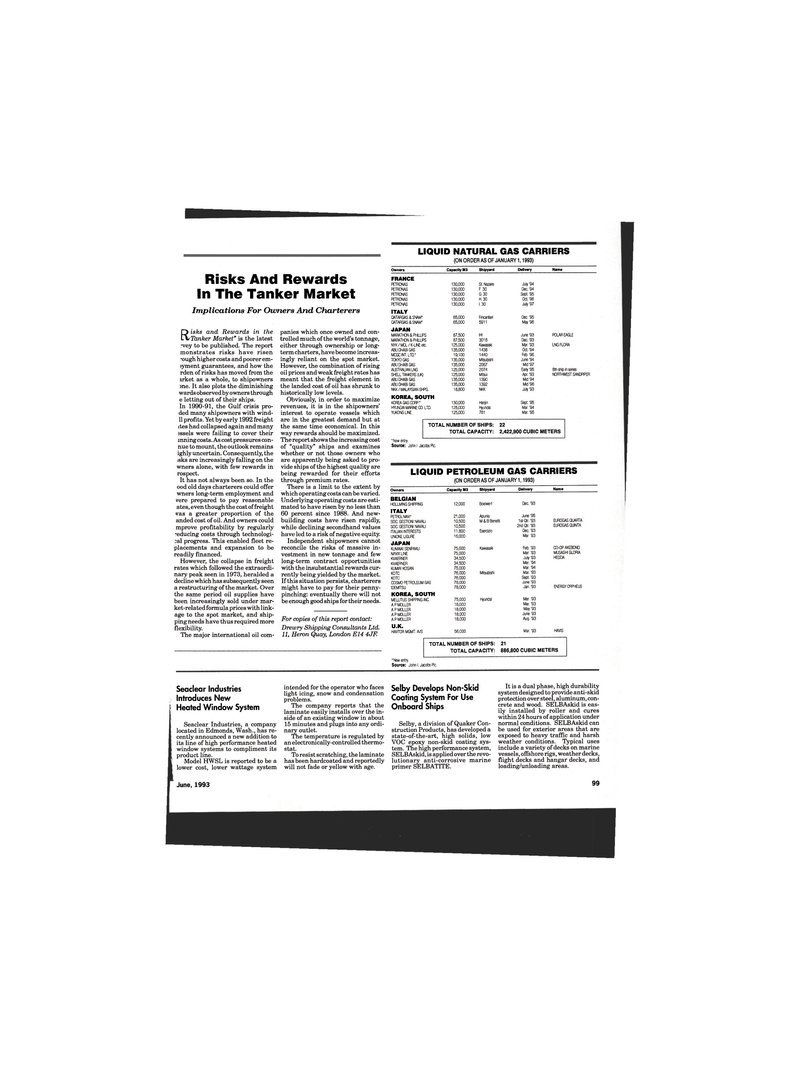

LIQUID NATURAL GAS CARRIERS (ON ORDER AS OF JANUARY 1,1993)

Name Owners Capacity M3 Shipyard Delivery

FRANCE

PETR0NAS 130,000 St. Nazaire July '94

PETTONAS 130,000 F. 30 Dec. '94

PETR0NAS 130,000 G. 30 Sept. '95

PETR0NAS 130,000 H, 30 Oct.'96

PETR0NAS 130,000 1.30 July '97

ITALY

QATARGAS & SNAM* 65,000 Fincantieri Dec. '95

QATARGAS & SNAM* 65,000 5911 May'96

JAPAN

MARATHON & PHILLIPS 87,500 IHI June '93

MARATHON & PHILLIPS 87,500 3016 Dec. '93

NYK / M0L / K-LINE etc. 125,000 Kawasaki Mar. '93

ABU DHABI GAS 135,000 1438 Oct. '94

MCGC INT, LTD." 19,100 1440 Feb. '96

TOKYO GAS 135,000 Mitsubishi June '94

ABU DHABI GAS 135,000 2067 Mid '97

AUSTRALIAN LNG 125,000 2074 Early'95

SHELL TANKERS (UK) 125,000 Mitsui Apr. '93

ABU DHABI CAS 135,000 1390 Mid '94

ABU DHABI GAS 135,000 1392 Mid '96

NKK/ MALAYSIAN SHPG. 18,800 NKK July '93

KOREA, SOUTH

KOREA GAS CORP." 130,000 Hanjin Sept '95

HYUNDAI MARINE CO. LTD. 125,000 Hyundai Mar. '94

YUK0NG LINE 125,000 761 Mar. '95

POLAR EAGLE

LNG FLORA 8th ship in series

NORTHWEST SANDPIPER

TOTAL NUMBER OF SHIPS:

TOTAL CAPACITY: 22 2,422,900 CUBIC METERS "New entry.

Source: John I. Jacobs Pic.

LIQUID PETROLEUM GAS CARRIERS (ON ORDER AS OF JANUARY 1,1993)

Owners Capacity M3 Shipyard Delivery Name

BELGIAN

HOLLMING SHIPPING 12,000 Boelwerf Dec. '93

ITALY

PETR0LNAVI" 21,000 Apunia June'95

SOC. GESTIONI NAVALI 10,500 M & B Benetti 1 star.'93 EUROGAS QUARTA

SOC. GESTIONI NAVALI 10,500 2nd ar. '93 EUROGAS QUINTA

ITALIAN INTERESTS 11,800 Esercizio Dec. '93

UNIONE LIGURE 16,000 Mar. '93

JAPAN

KUMAIA! SENPAKU 75,000 Kawasaki Feb. '93 CO-OP AKEBOND

NAVIX LINE 75,000 Mar. '93 MUSASHI GLORIA

KVAERNER 34,500 July '93 HEDDA

KVAERNER 34,500 Mar. '94

KUMIAI KOSAN 75,000 Mar. '94

KOTC 76,000 Mitsubishi Mar. '93

KOTC 76,000 Sept. '93

COSMO PETROLEUM GAS 78,000 June '93

IDEMITSU 78,000 Jan. '93 ENERGY ORPHEUS

KOREA, SOUTH

MELLITUS SHIPPING INC. 75,000 Hyundai Mar '93

A P MOLLER 18,000 Mar. '93

A P MOLLER 18,000 May '93

APMOLLER 18,000 June '93

A P MOLLER 18,000 Aug. '93

U.K.

HAVT0R MGMT. A/S 56,000 Mar. '93 HAVIS

TOTAL NUMBER OF SHIPS:

TOTAL CAPACITY: 21 886,800 CUBIC METERS "New entry.

Source: John I. Jacobs Pic.

Seaclear Industries

Introduces New | Heated Window System

Seaclear Industries, a company located in Edmonds, Wash., has re- cently announced a new addition to its line of high performance heated window systems to compliment its product line.

Model HWSL is reported to be a lower cost, lower wattage system intended for the operator who faces light icing, snow and condensation problems.

The company reports that the laminate easily installs over the in- side of an existing window in about 15 minutes and plugs into any ordi- nary outlet.

The temperature is regulated by an electronically-controlled thermo- stat.

To resist scratching, the laminate has been hardcoated and reportedly will not fade or yellow with age.

Selby Develops Non-Skid

Coating System For Use

Onboard Ships

Selby, a division of Quaker Con- struction Products, has developed a state-of-the-art, high solids, low

VOC epoxy non-skid coating sys- tem. The high performance system,

SELBAskid, is applied over the revo- lutionary anti-corrosive marine primer SELBATITE.

It is a dual phase, high durability system designed to provide anti-skid protection over steel, aluminum, con- crete and wood. SELBAskid is eas- ily installed by roller and cures within 24 hours of application under normal conditions. SELBAskid can be used for exterior areas that are exposed to heavy traffic and harsh weather conditions. Typical uses include a variety of decks on marine vessels, offshore rigs, weather decks, flight decks and hangar decks, and loading/unloading areas.

June, 1993 99

97

97

99

99