Page 131: of Maritime Reporter Magazine (September 1993)

Read this page in Pdf, Flash or Html5 edition of September 1993 Maritime Reporter Magazine

Options For Bulk Carrier Trading:

Cargo Opportunities, Trade Practices, Size Preferences in the '90s

As the emerging world econo- mies — almost certainly led by the

Asian Pacific States — continue to expand and the established mar- kets achieve some recovery from the recession, the prospects for bulk cargo demand and the consequent options for bulk carrier trading be- ?in to look brighter. Currently, total annual seaborne trade volumes in the dry bulk sector are put at iround 1,600 million tons. By the fear 2000, the corresponding figure s expected to be nearer 1,865 mil- ion tons. Over the period, an in- :rease in shipping requirements rom around 7,785 to almost 9,100 >illion (thousand million) ton-miles s projected.

Not all of this requirement will ie handled by bulk carriers. The xpectations for this fleet sector are ir a rise from 6,800 to 7,975 ton-

Hies. Less clear is the precise mnage of active, trading bulk car- ters that will be required to work lis traffic. The key determinant ill be the achieved level of vessel roductivity (i.e., the ton-mile/dwt itio). The actual level will be de- to current levels. To improve pro- ductivity levels beyond this is un- likely, but if maintained could push needs as low as 205 million dwt by 2000. Should productivity levels slump, a case can be built for needs of nearly 300 million dwt by 2000 but this is only likely if speculative over-ordering combines with the vir- tual demise of the shipbreaking in- dustry. Rates would be driven by lost cost units with new tonnage kept going under pressure to main- tain a cash flow. While highly un- likely in unison, each of these ele- ments has been seen before.

Optimizing the trade potential of a bulk carrier can be a complex exer- cise. Much depends on the nature of the shipowner and, in particular, the stance taken over committing ships long term as opposed to work- ing spot opportunities. Equally, the commodity shipped — and its mar- ket needs — Will shape charterers' attitudes and shipping strategies.

Added to the conundrum is the role played by state-owned bulk carriers — over 38 million dwt or approach- ing 20 percent of the available fleet.

The bulk carrier": nined by a combination of fac- 5 including the composition of k trade (cargo type, route pat- l, cargo size preferences), the itive strength of the shipping "ket, the fleet's ownership pro- charterer's strategies and inci- tal factors such as port conges- . Assuming a broad balance can chieved between the rate of ship pping and tonnage replacement, ch would lead to average bulk "ier productivity remaining ind the level recorded in 1992, implications are that by the end ie decade there will be a bulk ier requirement of approxi- sly 258 million dwt — an overall 3ase in the period from 1992 of

Lt 17 percent. tie delicacy of this balance, how- , is such that only a relatively il increase in average produc- er (say two percent or around ton-miles/dwt per year) would flicient to leave end-decade bulk er tonnage requirements close sabulk America."

Finally, at the ship level there may be a choice between the specialized and the versatile bulk carrier.

The final element in the bulk equation — which normally acts as the ultimate constraint on bulk car- rier size preferences in individual trades — is the available port infra- structure and the physical con- straints applicable at key bulk cargo berths. A new report, "Options For

Bulk Carrier Trading," by Drewry

Shipping Consultants, addresses the vital issue of the impact of chang- ing trade patterns and port con- straints on bulk carrier trading op- portunities by examining, for 35 com- modity types encompassing both major, minor and neo-bulk cargoes, key topics including trade overview and potential (main importers and exporters, prospects and influences on trade), handling characteristics, port constraints (identification of key load and discharge ports and their limiting factors) and vessel size/type preferences.

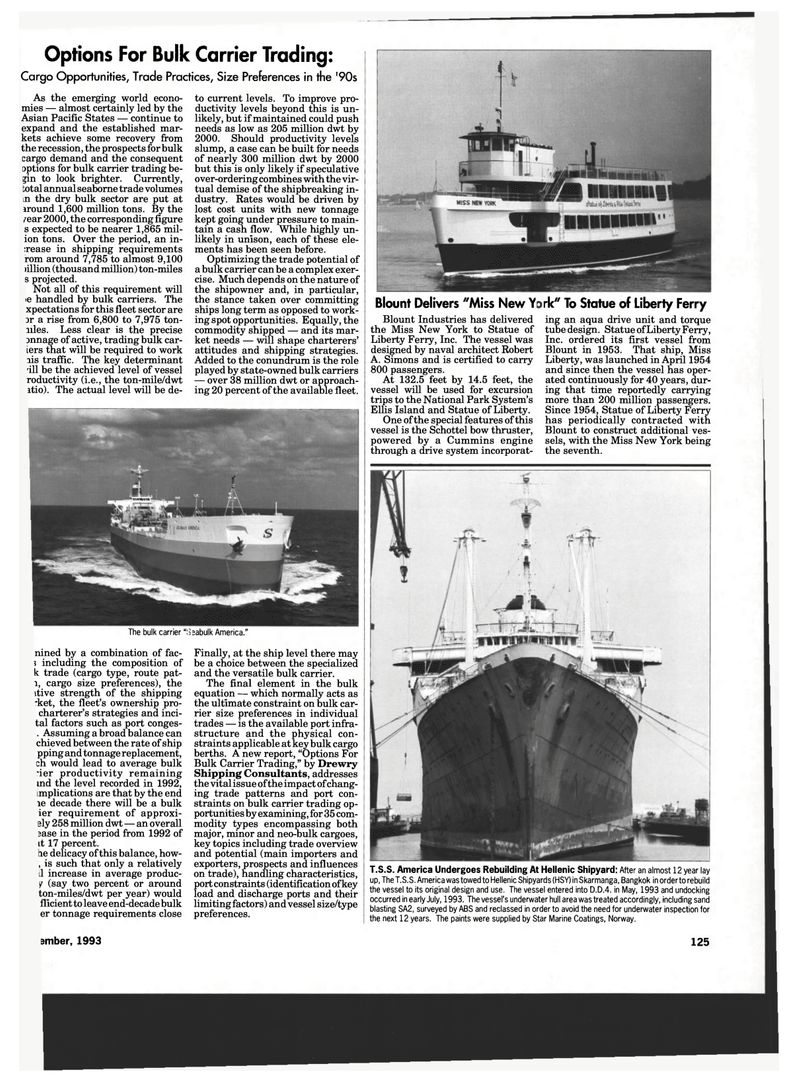

Blount Delivers "Miss New Y

Blount Industries has delivered the Miss New York to Statue of

Liberty Ferry, Inc. The vessel was designed by naval architect Robert

A. Simons and is certified to carry 800 passengers.

At 132.5 feet by 14.5 feet, the vessel will be used for excursion trips to the National Park System's

Ellis Island and Statue of Liberty.

One of the special features of this vessel is the Schottel bow thruster, powered by a Cummins engine through a drive system incorporat- rlc" To Statue of Liberty Ferry ing an aqua drive unit and torque tube design. Statue of Liberty Ferry,

Inc. ordered its first vessel from

Blount in 1953. That ship, Miss

Liberty, was launched in April 1954 and since then the vessel has oper- ated continuously for 40 years, dur- ing that time reportedly carrying more than 200 million passengers.

Since 1954, Statue of Liberty Ferry has periodically contracted with

Blount to construct additional ves- sels, with the Miss New York being the seventh.

T.S.S. America Undergoes Rebuilding At Hellenic Shipyard: After an almost 12 year lay up, The T.S.S. America was towed to Hellenic Shipyards (HSY) in Skarmanga, Bangkok in order to rebuild the vessel to its original design and use. The vessel entered into D.D.4. in May, 1993 and undocking occurred in early July, 1993. The vessel's underwater hull area was treated accordingly, including sand blasting SA2, surveyed by ABS and reclassed in order to avoid the need for underwater inspection for the next 12 years. The paints were supplied by Star Marine Coatings, Norway. ember, 1993 125

130

130

132

132