Page 41: of Maritime Reporter Magazine (October 1997)

Read this page in Pdf, Flash or Html5 edition of October 1997 Maritime Reporter Magazine

MARKET REPORT

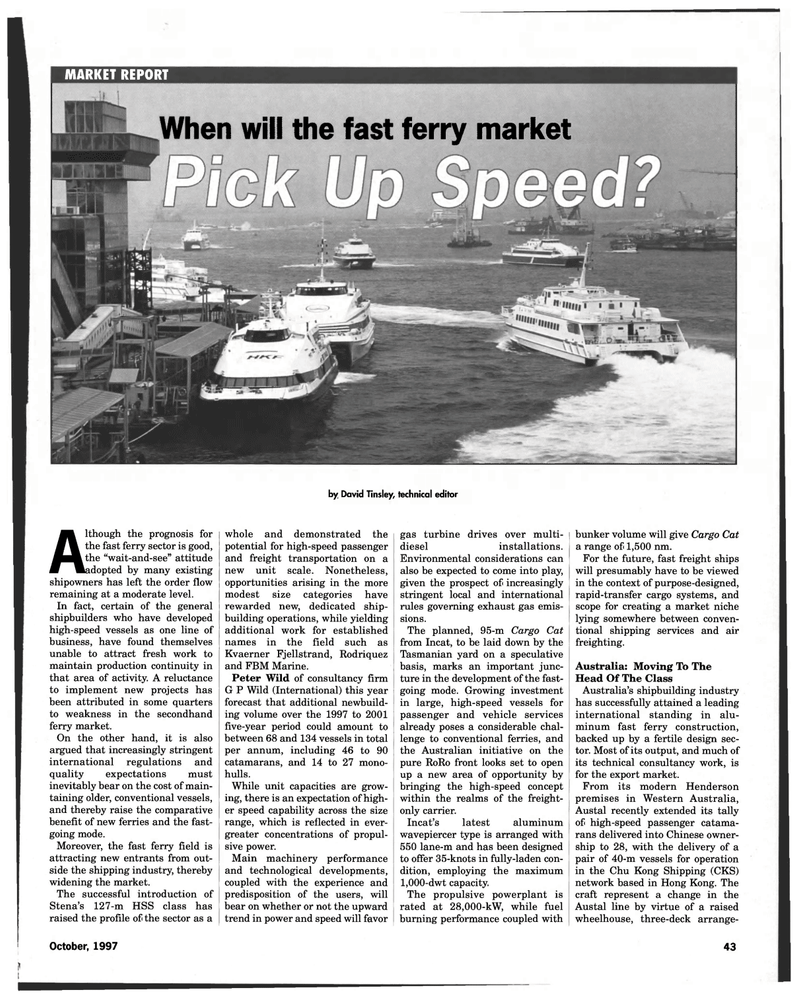

When will the fast ferry market by David Tinsley, technical editor

Although the prognosis for the fast ferry sector is good, the "wait-and-see" attitude adopted by many existing shipowners has left the order flow remaining at a moderate level.

In fact, certain of the general shipbuilders who have developed high-speed vessels as one line of business, have found themselves unable to attract fresh work to maintain production continuity in that area of activity. A reluctance to implement new projects has been attributed in some quarters to weakness in the secondhand ferry market.

On the other hand, it is also argued that increasingly stringent international regulations and quality expectations must inevitably bear on the cost of main- taining older, conventional vessels, and thereby raise the comparative benefit of new ferries and the fast- going mode.

Moreover, the fast ferry field is attracting new entrants from out- side the shipping industry, thereby widening the market.

The successful introduction of

Stena's 127-m HSS class has raised the profile of the sector as a whole and demonstrated the potential for high-speed passenger and freight transportation on a new unit scale. Nonetheless, opportunities arising in the more modest size categories have rewarded new, dedicated ship- building operations, while yielding additional work for established names in the field such as

Kvaerner Fjellstrand, Rodriquez and FBM Marine.

Peter Wild of consultancy firm

G P Wild (International) this year forecast that additional newbuild- ing volume over the 1997 to 2001 five-year period could amount to between 68 and 134 vessels in total per annum, including 46 to 90 catamarans, and 14 to 27 mono- hulls.

While unit capacities are grow- ing, there is an expectation of high- er speed capability across the size range, which is reflected in ever- greater concentrations of propul- sive power.

Main machinery performance and technological developments, coupled with the experience and predisposition of the users, will bear on whether or not the upward trend in power and speed will favor gas turbine drives over multi- diesel installations.

Environmental considerations can also be expected to come into play, given the prospect of increasingly stringent local and international rules governing exhaust gas emis- sions.

The planned, 95-m Cargo Cat from Incat, to be laid down by the

Tasmanian yard on a speculative basis, marks an important junc- ture in the development of the fast- going mode. Growing investment in large, high-speed vessels for passenger and vehicle services already poses a considerable chal- lenge to conventional ferries, and the Australian initiative on the pure RoRo front looks set to open up a new area of opportunity by bringing the high-speed concept within the realms of the freight- only carrier.

Incat's latest aluminum wavepiercer type is arranged with 550 lane-m and has been designed to offer 35-knots in fully-laden con- dition, employing the maximum 1,000-dwt capacity.

The propulsive powerplant is rated at 28,000-kW, while fuel burning performance coupled with bunker volume will give Cargo Cat a range of 1,500 nm.

For the future, fast freight ships will presumably have to be viewed in the context of purpose-designed, rapid-transfer cargo systems, and scope for creating a market niche lying somewhere between conven- tional shipping services and air freighting.

Australia: Moving To The

Head Of The Class

Australia's shipbuilding industry has successfully attained a leading international standing in alu- minum fast ferry construction, backed up by a fertile design sec- tor. Most of its output, and much of its technical consultancy work, is for the export market.

From its modern Henderson premises in Western Australia,

Austal recently extended its tally of high-speed passenger catama- rans delivered into Chinese owner- ship to 28, with the delivery of a pair of 40-m vessels for operation in the Chu Kong Shipping (CKS) network based in Hong Kong. The craft represent a change in the

Austal line by virtue of a raised wheelhouse, three-deck arrange-

October, 1997 43

40

40

42

42