Page 48: of Maritime Reporter Magazine (June 1998)

Read this page in Pdf, Flash or Html5 edition of June 1998 Maritime Reporter Magazine

CONTAINERSHIP MARKET

Crisis And Opportunity: Carrier Prospects After The Asian Turmoil n s Drewry T! Ihe fallout from the Asian currency crisis has cast a giant shadow over an already depressed container market, and threatens the 20+ year record of uninterrupted global growth, which has always given consolation to carriers for poor profitabil- ity and declining freight rates. However, there may be some considerable longer term benefits from the market dislocation currently taking place.

The general collapse of Asian imports (down at least 10 percent) in the wake of the massive currency devaluations in Korea (50 percent),

Indonesia (80 percent), Thailand (55 percent) and elsewhere has worsened already costly con- tainer imbalance problems in both the transpa- cific and Europe-Far East trades, but Asian exports have risen equally dramatically (esti- mated at around 12 percent), prompting both equipment and space shortages on outbound trades.

Given that eastbound t/pac and westbound E-

FE rates are substantially higher than rates on the trades' weaker legs, carriers have received an infusion of higher paying traffic and a loss of by Mark Page, director

Drewry Shipping Consultants Ltd. marginally priced cargo — albeit at the cost of much greater container repositioning expenses.

Asian exporters have found themselves in the unaccustomed position of being on the wrong side of the supply/demand equation, giving car- riers a strong hand in contract negotiations.

Moreover, carrier cohesion has, forcibly, been strengthened by the severe financial impact of the crisis on Asian lines who are no longer in a position to be so aggressive on price.

What should be the response of carriers to this shift in the balance of power?

Perhaps most importantly, they need to final- ly accept that the past approach of operating a liner service with a one way (i.e. downward) pricing policy to fill marginal vacant space has been ruinous, and use the opportunity which the Asian export boom has created to change the direction of freight rates — if not perma- nently then certainly in the short term.

Historically, liner shipping offered stable rates for a known level of service, but some- where in the containerization process this rela- tionship got separated. The level of service remained — in fact it got much better — but rate stability disappeared, and in the process so

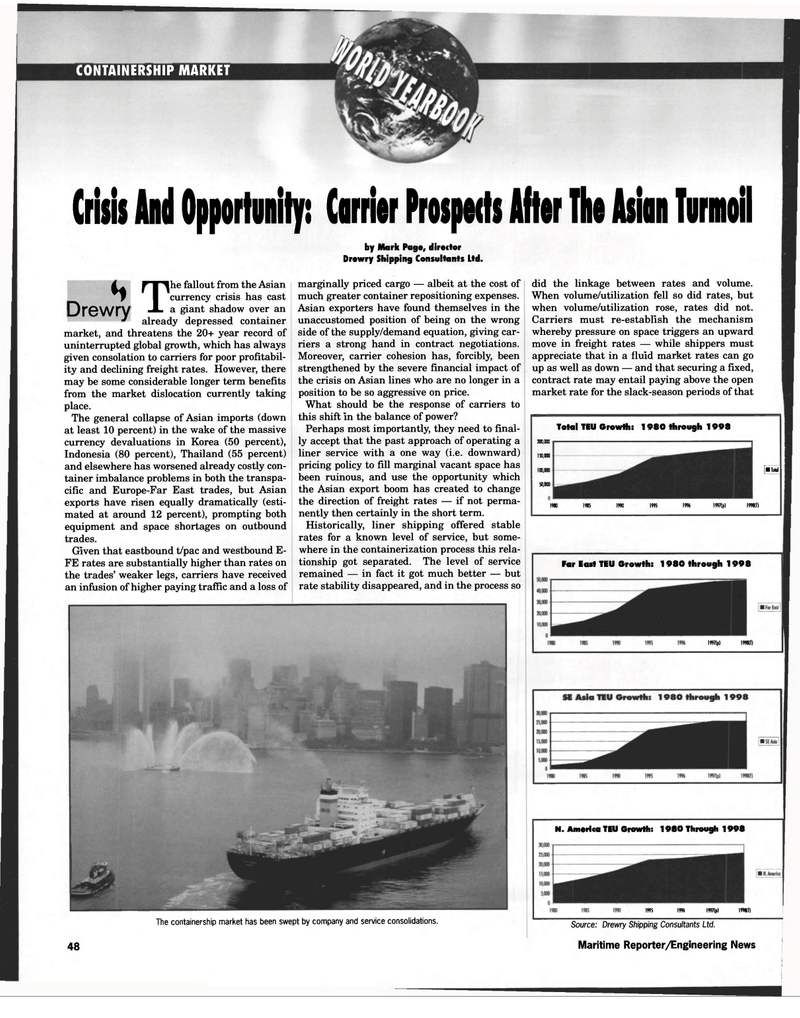

The containership market has been swept by company and service consolidations. did the linkage between rates and volume.

When volume/utilization fell so did rates, but when volume/utilization rose, rates did not.

Carriers must re-establish the mechanism whereby pressure on space triggers an upward move in freight rates — while shippers must appreciate that in a fluid market rates can go up as well as down — and that securing a fixed, contract rate may entail paying above the open market rate for the slack-season periods of that 200,000

Total TEU Growth: 1980 through 1998 150,000 100,000 [•Total 50,000 1980 1985 1990 1995 1995 1997(p| 1998(f)

Far East TEU Growth: 1980 through 1998 1997(p) 1998(f)

N. America TEU Growth: 1980 Through 1998 1995 1996 1997(p) 1998(f) 48

Source: Drewry Shipping Consultants Ltd.

Maritime Reporter/Engineering News

47

47

49

49