Page 30: of Maritime Reporter Magazine (January 2002)

Read this page in Pdf, Flash or Html5 edition of January 2002 Maritime Reporter Magazine

Money Talks

The American Shipbuilding Association has long bemoaned the level of U.S. Navy funding, arguing that the amount of spending on new ships would, in the future, leave the force woefully under-equipped to handle its duties of defense.

Though the ASA is but the lobbying voice of the country's "Big Six" shipbuilders — by consolida- tion now reduced to, in effect, the Big Two — would be the primary beneficiaries of a spending splurge, it now seems the arguments presented were visionary, as the U.S. enters a gray area in international relations with the recent terrorist attacks in New York and Washington and the resul- tant war in Afghanistan.

The ASA fight for dollars was taken up in an

August 2001 report from the General Accounting

Office, a report entitled "Military Transformation:

Navy Efforts Should be More Integrated and

Focused." (GAO-Ol-853). On the topic of Fiscal and Force Structure, the report reads: "The Navy has not been building enough ships to maintain the roughly 300 ship force mandated by the 1997

Quadrennial Defense Review. The high costs of supporting the current force, the time needed to acquire new ships, and the prospect of a continued mismatch between fiscal resources and force structure requirements increase the urgency of planning for and carrying out transformation ... the Congressional Budget Office has estimated that the Navy would require roughly $17 billion more each year for fiscal years 2001 through 2005 than it is currently expected to receive to sustain this force level. If current construction rates and funding levels remain the same, the Navy's force could decrease to approximately 260 ships or lower after 2020."

By the Numbers

In 1987, the U.S. had a naval fleet of 594 ships.

While a fleet of that stature is likely unnecessary and uneconomical based on the current world political situation that is devoid of a second legiti- mate superpower, the fleet today is vastly different from that of less than 15 years ago. Current esti- mates show the U.S. Navy fleet hovering around the 300-ship level, but most troubling is the pro- curement level. Simply put, the U.S. has not been ordering enough ships on an annual basis to sus- tain a 300-ship fleet, the adopted psychological barrier to providing the nation with adequate defense resources. In fact, as ASA reports, annual numbers of naval ships procured is at the lowest level since 1932; the size of the Navy's fleet is the smallest since the year before we entered WWI; and while the fleet has been cut almost in half, the number of overseas deployments has increased 300 percent.

But the "business-as-usual" model is effectively out the window in terms of naval ship construc- tion, as nearly a decade of consolidation of defense resources has effectively left the U.S. with two large companies — Northrop Grumman and

General Dynamics — operating the shipyards that build most navy vessels. The latest acquisition has been the high profile pursuit of nuclear aircraft carrier and nuclear submarine builder Newport

News Shipbuilding, which was recently concluded with its acquisition by Northrop Grumman.

While the oceangoing, deep draft fleet will undoubtedly remain the central focus of U.S. sea power, the winds of change have blown in hurri-

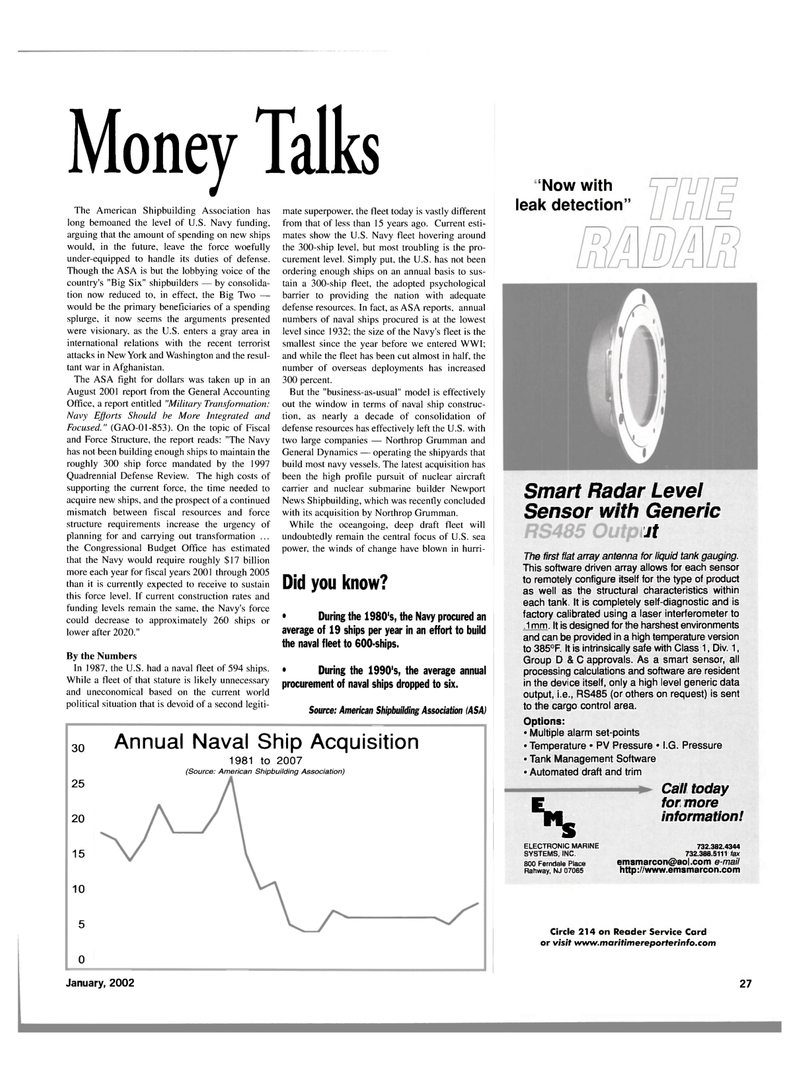

Did you know? • During the 1980's, the Navy procured an average of 19 ships per year in an effort to build the naval fleet to 600-ships. • During the 1990's, the average annual procurement of naval ships dropped to six.

Source: American Shipbuilding Association (ASA) 30 25 20 15 10 5 0

Annual Naval Ship Acquisition 1981 to 2007 (Source: American Shipbuilding Association) 'Now with leak detection"

Smart Radar Level

Sensor with Generic

Jt

The first flat array antenna for liquid tank gauging.

This software driven array allows for each sensor to remotely configure itself for the type of product as well as the structural characteristics within each tank. It is completely self-diagnostic and is factory calibrated using a laser interferometer to •1mm. It is designed for the harshest environments and can be provided in a high temperature version to 385°F. It is intrinsically safe with Class 1, Div. 1,

Group D & C approvals. As a smart sensor, all processing calculations and software are resident in the device itself, only a high level generic data output, i.e., RS485 (or others on request) is sent to the cargo control area.

Options: • Multiple alarm set-points • Temperature • PV Pressure • I.G. Pressure • Tank Management Software • Automated draft and trim s

ELECTRONIC MARINE

SYSTEMS, INC. 800 Femdale Place

Rahway, NJ 07065

Call today for more information! 732.382.4344 732.388.5111 fax [email protected] e-mail http://www.emsmarcon.com

Circle 214 on Reader Service Card or visit www.maritimereporterinfo.com

January, 2002 27

29

29

31

31