Page 8: of Maritime Reporter Magazine (April 2, 2010)

Read this page in Pdf, Flash or Html5 edition of April 2, 2010 Maritime Reporter Magazine

8 Maritime Reporter & Engineering News

PROFILE FIVE MINUTES WITH JIM DODEZ, VICE PRESIDENT, MARKETING & STRATEGIC PLANNING, KVH INDUSTRIES, INC.

Please give a brief introduction to

KVH and its offering.

JD KVH Industries is a manufac- turer of satellite television and communi- cations systems and is also a broadband satellite communications service provider. We offer vessels a variety of re- liable solutions for onboard internet ac- cess, telephone calls, and live satellite television entertainment almost anywhere in the world.

Which maritime niches do you find

KVH at its strongest?

JD We excel at offering affordable, turnkey, end-to-end solutions to cus- tomers who don’t have the time or staff to cobble together hardware from multi- ple manufacturers and those who can’t afford to risk their vital communications connections. We are a broadband mar- itime satellite service provider that man- ufactures an end-to-end hardware solution. To support that solution, we also support our own global satellite network, which makes KVH the only provider of- fering 60cm antennas on an FCC-ap- proved satellite network. Working closely with our technology and business partner,

ViaSat, we’ve created a network that of- fers maritime customers exceptional re- liability and seamless global coverage from a system that automatically switches between satellite beams, and a level of affordability and value that other maritime VSAT companies can’t match.

What maritime niches do you believe hold good potential going forward?

JD Broadband communications in the maritime market have been either prohibitively expensive or, in the case of maritime VSAT, have required equipment so large that it was only practical on the largest vessels. With our mini-VSAT

Broadband service, KVH has brought the size and cost of maritime VSAT down and made it suitable for much smaller vessels.

What key breakthroughs have advanced satcom in this market?

JD The first technology break- through came with the launch of new, high-powered satellites that deliver af- fordable broadband data services to mar- itime customers. This has changed the way ships communicate with shore of- fices, enabling companies to exploit the efficiency of broadband communications for everything from navigation and route planning to engine monitoring and main- tenance and even improving crew morale.

Inmarsat pioneered onboard broadband communications. Innovative companies adapted VSAT technology to maritime applications using stabilized antennas, which offered significantly lower cost bandwidth to the vessels large enough to carry their antennas.

The next big technology breakthrough was the introduction of spread spectrum technology, which enables satellite re- ception for dramatically smaller anten- nas. This breakthrough made maritime

VSAT a practical alternative for just about any size vessel. Just as Inmarsat equipment has evolved from huge anten- nas to small Fleetbroadband antennas, modern maritime VSAT services no longer need large 1-meter antennas to provide fast, high quality service. New adaptive transmission technologies en- able small antennas to provide continu- ous service, even in poor weather conditions. The advantages of smaller equipment include dramatically lower hardware prices, lower installation costs, and more options for installing antennas where they won’t be blocked by the ship’s superstructure.

How have the use of comms on vessels evolved in the last 5 years?

JD The biggest changes in satellite services onboard ships over the past five years has been the introduction of a new generation of smaller, more powerful technology. As a result, mariners can now enjoy the benefits of significantly lower equipment and per-megabyte service costs.

What are users demanding today?

JD Many maritime customers have been badly burned by accidental misuse of metered L-band satellite service re- sulting in huge bills. Inmarsat has done a great job implementing new account management services to help customers protect themselves from unbudgeted costs, which addresses part of the prob- lem, but customers are generally looking for lower connectivity costs than L-band services are able to provide. In the mar- itime VSAT market, companies have grossly overpromised the amount of serv- ice they will provide for a fixed cost.

Hardware manufacturers have made it so easy for new players to enter the mar- itime VSAT market with a small amount of satellite bandwidth by purchasing a stabilized antenna from company “A” and a standardized modem and hub from company “B”. This becomes an issue when services add customers to their net- works without upgrading their satellite capacity, and an ever-growing customer base must compete for a fixed amount of service. Knowledgeable customers now try to protect themselves by monitoring their own satellite services to assure they get what they pay for and aren’t bogged down by over-contended services. This is a heck of a lot of effort and expense that can be easily avoided with an end to end service provider who can offer the kinds of network monitoring tools that KVH provides to mini-VSAT Broadband sub- scribers.

How has the lingering economic downturn affected your business?

JD Short term, customers are look- ing to reduce their existing satellite com- munications costs, which has actually helped KVH to get in the door for many accounts. Our mini-VSAT Broadband service is cheaper on a cost-per-MB basis, and offers lower capital and instal- lation costs. Although many commercial vessel operators have delayed capital in- vestments in new satellite communica- tions equipment, we believe that the longer-term economic benefits of better onboard communications will provide such a compelling ROI that the tougher economy will actually create an opera- tional mandate to improve efficiency.

This will happen as operators realize that they can reduce fuel costs and transit time and utilize manpower more efficiently by enabling shore-based engineers and IT professionals to work with onboard tech- nicians to solve problems that used to re- quire onboard experts or expensive travel.

Jim Dodez

Vice President, Marketing & Strategic Planning, KVH Industries, Inc.

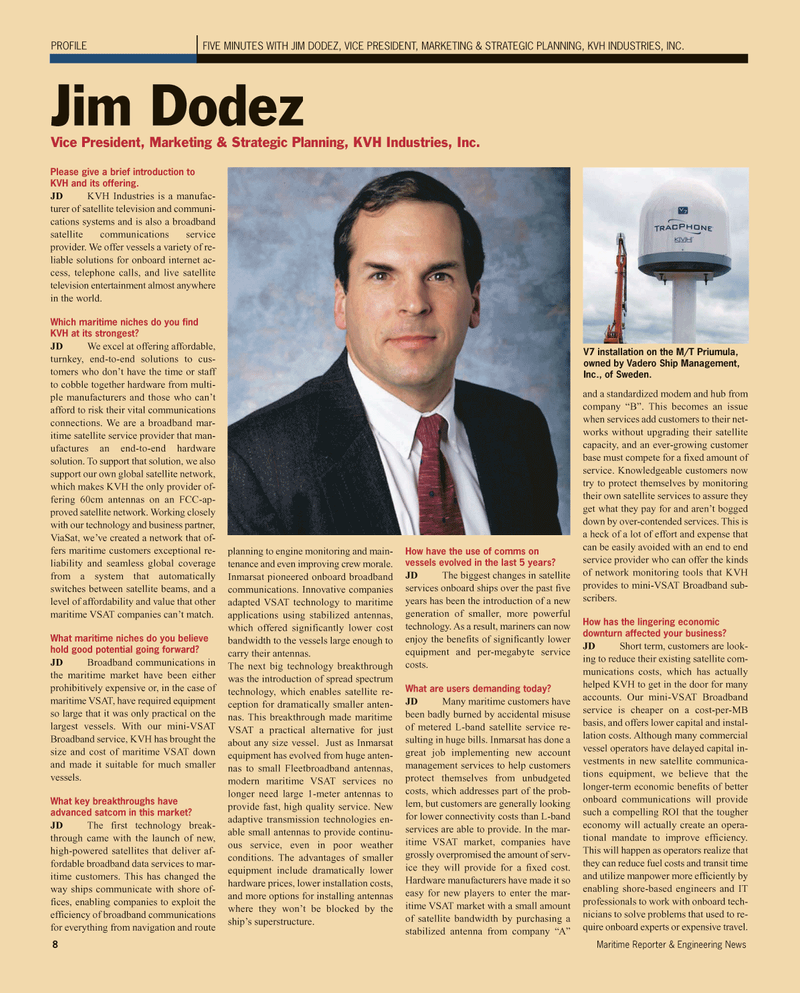

V7 installation on the M/T Priumula, owned by Vadero Ship Management,

Inc., of Sweden.

7

7

9

9