Page 41: of Maritime Reporter Magazine (April 2011)

Offshore Annual

Read this page in Pdf, Flash or Html5 edition of April 2011 Maritime Reporter Magazine

April 2011 www.marinelink.com 41

Which are your main clients in Brazil and worldwide?

Well, I told you about of $8 billion back- log. 35% of this total is from Petrobras, which means that Petrobras is much big- ger than any other client for us. Next in line comes Apache with 11%.

What about the OSX 1 FPSO?

Last year when we spoke, I commented on the possibility of working on this project and now we are doing this project for

OSX. It isn´t really a conversion, it was a new built FPSO, originally built for a com- pany called Nexus, which invested and speculated in the FPSO market by making this generic project. When we bought APL in 2007, we were in a good position, as

APL owned 50% of Nexus. What hap- pened is that OSX basically bought the

FPSO from the bank but with our technol- ogy aboard we got the contracts to ade- quate this new FPSO for the first OGX field, called Waimea. The FPSO is being fitted out in Singapore and will be com- pleted in a few months, then it will sail to

Brazil. It is a project where we are doing the engineering and project modifications but they will operate it.

How do you work with equipment suppli- ers here in Brazil?

In the Papa Terra project, for example, we made a joint venture with Quip that is making modules in Brazil while we are making the modules outside Brazil.

We have two teams working with suppli- ers, one for technical support, which works with a listing of companies specialized in offshore construction and various other services. The other team works with sup- plies, buying supplies from companies in

Brazil, as 85% of our supplies need to be bought in Brazil.

For now, we are not building new FPSOs in Brazil. We are open to it but for now we have no plans to build in Brazil. Our rela- tion with Quip is very good and for now we are happy with them building in Brazil while we build in the foreign market. For new projects we will have to see the alter- natives. There is still need for more devel- opment from EPC suppliers in Brazil, for processing plants for example. These need more development to compete internation- ally. Some areas of manufacture are com- petitive here in Brazil, but many areas still need more development in order to be competitive.

Who are your main competitors in Brazil?

Definitely SBM and Modec, other than these there is Teekay and Saipem. We are in third in size in Brazil, with SBM in first and Modec second, other companies only have one FPSO in operation in Brazil. (Image Petr obras and Devon)

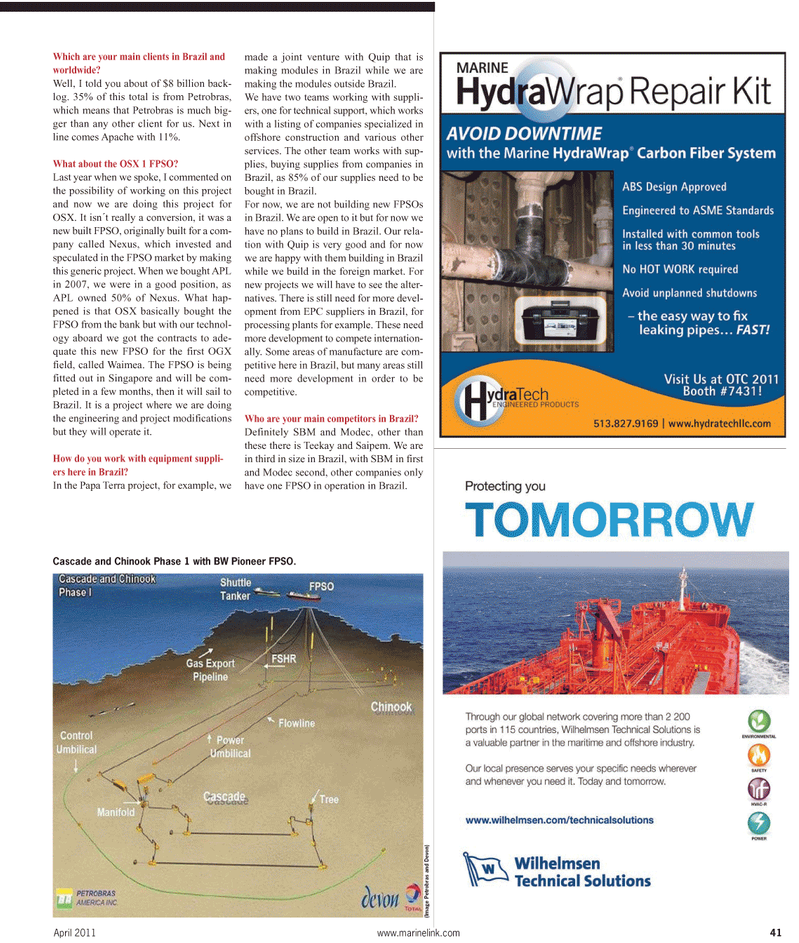

Cascade and Chinook Phase 1 with BW Pioneer FPSO.

40

40

42

42