Page 46: of Maritime Reporter Magazine (June 2011)

Feature: Annual World Yearbook

Read this page in Pdf, Flash or Html5 edition of June 2011 Maritime Reporter Magazine

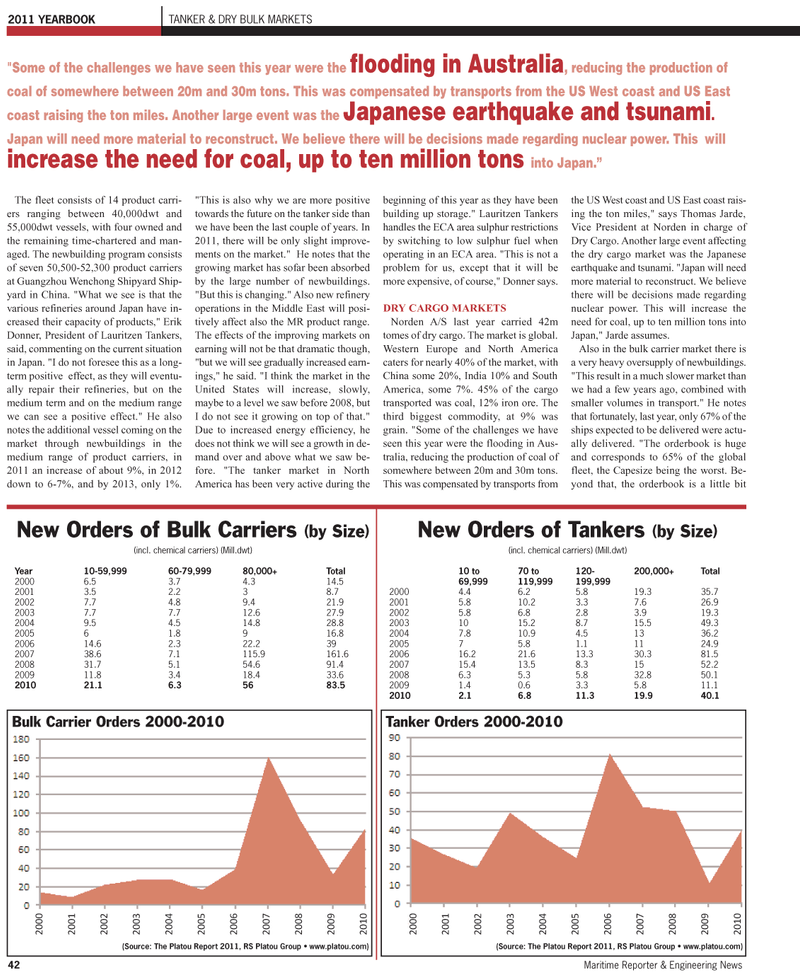

The fleet consists of 14 product carri- ers ranging between 40,000dwt and55,000dwt vessels, with four owned and the remaining time-chartered and man-aged. The newbuilding program consists of seven 50,500-52,300 product carriers at Guangzhou Wenchong Shipyard Ship- yard in China. "What we see is that thevarious refineries around Japan have in- creased their capacity of products," ErikDonner, President of Lauritzen Tankers, said, commenting on the current situationin Japan. "I do not foresee this as a long-term positive effect, as they will eventu- ally repair their refineries, but on the medium term and on the medium rangewe can see a positive effect." He also notes the additional vessel coming on the market through newbuildings in the medium range of product carriers, in2011 an increase of about 9%, in 2012down to 6-7%, and by 2013, only 1%. "This is also why we are more positive towards the future on the tanker side than we have been the last couple of years. In 2011, there will be only slight improve- ments on the market." He notes that the growing market has sofar been absorbed by the large number of newbuildings. "But this is changing." Also new refinery operations in the Middle East will posi-tively affect also the MR product range. The effects of the improving markets on earning will not be that dramatic though,"but we will see gradually increased earn- ings," he said. "I think the market in the United States will increase, slowly, maybe to a level we saw before 2008, but I do not see it growing on top of that." Due to increased energy efficiency, he does not think we will see a growth in de- mand over and above what we saw be- fore. "The tanker market in North America has been very active during the beginning of this year as they have been building up storage." Lauritzen Tankers handles the ECA area sulphur restrictionsby switching to low sulphur fuel when operating in an ECA area. "This is not aproblem for us, except that it will be more expensive, of course," Donner says. DRY CARGO MARKETS Norden A/S last year carried 42m tomes of dry cargo. The market is global. Western Europe and North America caters for nearly 40% of the market, with China some 20%, India 10% and SouthAmerica, some 7%. 45% of the cargo transported was coal, 12% iron ore. The third biggest commodity, at 9% was grain. "Some of the challenges we have seen this year were the flooding in Aus- tralia, reducing the production of coal ofsomewhere between 20m and 30m tons. This was compensated by transports from the US West coast and US East coast rais- ing the ton miles," says Thomas Jarde, Vice President at Norden in charge of Dry Cargo. Another large event affecting the dry cargo market was the Japanese earthquake and tsunami. "Japan will need more material to reconstruct. We believe there will be decisions made regarding nuclear power. This will increase the need for coal, up to ten million tons intoJapan," Jarde assumes. Also in the bulk carrier market there is a very heavy oversupply of newbuildings. "This result in a much slower market than we had a few years ago, combined with smaller volumes in transport." He notes that fortunately, last year, only 67% of the ships expected to be delivered were actu- ally delivered. "The orderbook is huge and corresponds to 65% of the globalfleet, the Capesize being the worst. Be- yond that, the orderbook is a little bit42Maritime Reporter & Engineering News 2011 YEARBOOKTANKER & DRY BULK MARKETS "Some of the challenges we have seen this year were the flooding in Australia, reducing the production of coal of somewhere between 20m and 30m tons. This was compensated by transports from the US West coast and US East coast raising the ton miles. Another large event was the Japanese earthquake and tsunami .Japan will need more material to reconstruct. We believe there will be decisions made regarding nuclear power.Thiswill increase the need for coal, up to ten million tons into Japan.?20002001200220032004200520062007200820092010(Source: The Platou Report 2011, RS Platou Group ? www.platou.com) Bulk Carrier Orders 2000-2010 20002001200220032004200520062007200820092010(Source: The Platou Report 2011, RS Platou Group ? www.platou.com) Tanker Orders 2000-2010 New Orders of Tankers (by Size)(incl. chemical carriers) (Mill.dwt)10 to70 to120-200,000+Total 69,999119,999199,999 20004.46.25.819.335.7 20015.810.23.37.626.9 20025.86.82.83.919.3 20031015.28.715.549.3 20047.810.94.51336.2 200575.81.11124.9 200616.221.613.330.381.5 200715.413.58.31552.2 20086.35.35.832.850.1 20091.40.63.35.811.1 20102.16.811.319.940.1 New Orders of Bulk Carriers (by Size)(incl. chemical carriers) (Mill.dwt)Year10-59,99960-79,99980,000+Total 20006.53.74.314.5 20013.52.238.7 20027.74.89.421.9 20037.77.712.627.9 20049.54.514.828.8 200561.8916.8 200614.62.322.239 200738.67.1115.9161.6 200831.75.154.691.4 200911.83.418.433.6 201021.16.35683.5

45

45

47

47