Page 63: of Maritime Reporter Magazine (April 2012)

Offshore Deepwater Annual

Read this page in Pdf, Flash or Html5 edition of April 2012 Maritime Reporter Magazine

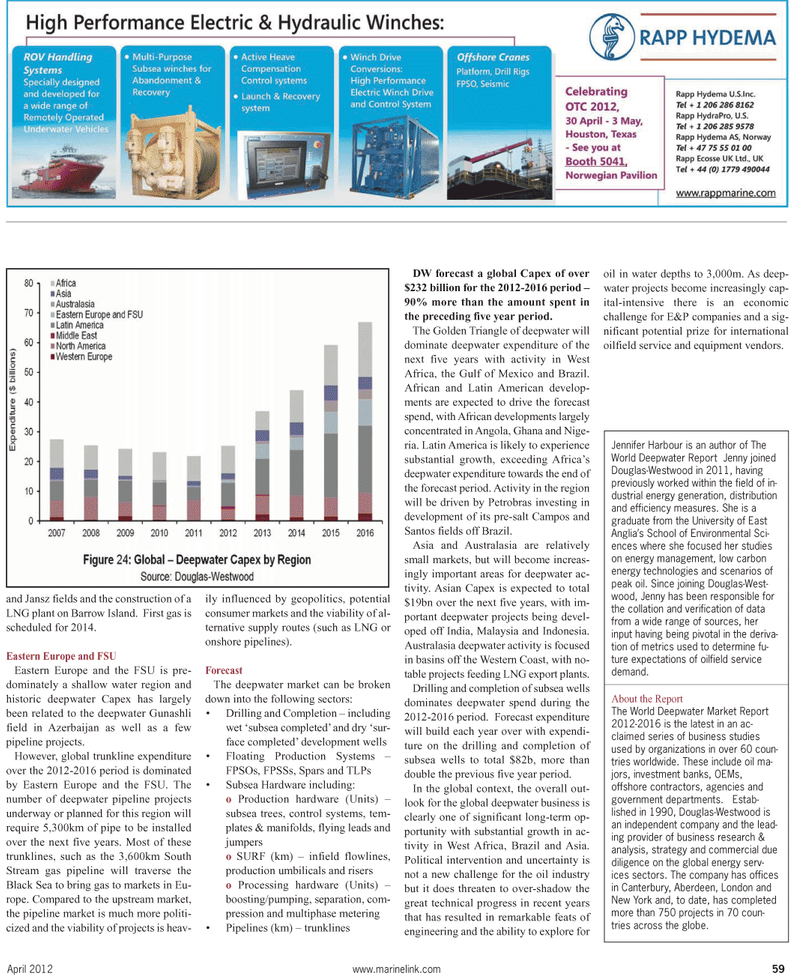

and Jansz fields and the construction of a LNG plant on Barrow Island. First gas is scheduled for 2014. Eastern Europe and FSU Eastern Europe and the FSU is pre-dominately a shallow water region and historic deepwater Capex has largely been related to the deepwater Gunashli field in Azerbaijan as well as a few pipeline projects. However, global trunkline expenditure over the 2012-2016 period is dominated by Eastern Europe and the FSU. The number of deepwater pipeline projects underway or planned for this region will require 5,300km of pipe to be installedover the next five years. Most of these trunklines, such as the 3,600km SouthStream gas pipeline will traverse the Black Sea to bring gas to markets in Eu- rope. Compared to the upstream market, the pipeline market is much more politi- cized and the viability of projects is heav- ily influenced by geopolitics, potentialconsumer markets and the viability of al- ternative supply routes (such as LNG or onshore pipelines).Forecast The deepwater market can be broken down into the following sectors: ?Drilling and Completion ? including wet subsea completed and dry sur- face completed development wells ?Floating Production Systems ? FPSOs, FPSSs, Spars and TLPs ?Subsea Hardware including: o Production hardware (Units) ? subsea trees, control systems, tem-plates & manifolds, flying leads andjumperso SURF (km) ? infield flowlines, production umbilicals and riserso Processing hardware (Units) ? boosting/pumping, separation, com-pression and multiphase metering?Pipelines (km) ? trunklines DW forecast a global Capex of over $232 billion for the 2012-2016 period ? 90% more than the amount spent in the preceding five year period. The Golden Triangle of deepwater will dominate deepwater expenditure of the next five years with activity in West Africa, the Gulf of Mexico and Brazil. African and Latin American develop- ments are expected to drive the forecast spend, with African developments largely concentrated in Angola, Ghana and Nige- ria. Latin America is likely to experience substantial growth, exceeding Africas deepwater expenditure towards the end of the forecast period. Activity in the region will be driven by Petrobras investing in development of its pre-salt Campos and Santos fields off Brazil. Asia and Australasia are relatively small markets, but will become increas- ingly important areas for deepwater ac- tivity. Asian Capex is expected to total $19bn over the next five years, with im- portant deepwater projects being devel- oped off India, Malaysia and Indonesia. Australasia deepwater activity is focused in basins off the Western Coast, with no- table projects feeding LNG export plants. Drilling and completion of subsea wellsdominates deepwater spend during the 2012-2016 period. Forecast expenditure will build each year over with expendi- ture on the drilling and completion ofsubsea wells to total $82b, more thandouble the previous five year period. In the global context, the overall out- look for the global deepwater business is clearly one of significant long-term op- portunity with substantial growth in ac- tivity in West Africa, Brazil and Asia. Political intervention and uncertainty is not a new challenge for the oil industry but it does threaten to over-shadow the great technical progress in recent yearsthat has resulted in remarkable feats ofengineering and the ability to explore for oil in water depths to 3,000m. As deep- water projects become increasingly cap- ital-intensive there is an economic challenge for E&P companies and a sig-nificant potential prize for international oilfield service and equipment vendors. April 2012www.marinelink.com 59Jennifer Harbour is an author of TheWorld Deepwater Report Jenny joined Douglas-Westwood in 2011, having previously worked within the field of in- dustrial energy generation, distribution and efficiency measures. She is a graduate from the University of East Anglias School of Environmental Sci- ences where she focused her studies on energy management, low carbon energy technologies and scenarios of peak oil. Since joining Douglas-West- wood, Jenny has been responsible for the collation and verification of datafrom a wide range of sources, her input having being pivotal in the deriva-tion of metrics used to determine fu-ture expectations of oilfield service demand.About the ReportThe World Deepwater Market Report 2012-2016 is the latest in an ac-claimed series of business studiesused by organizations in over 60 coun- tries worldwide. These include oil ma-jors, investment banks, OEMs,offshore contractors, agencies and government departments. Estab- lished in 1990, Douglas-Westwood is an independent company and the lead-ing provider of business research & analysis, strategy and commercial due diligence on the global energy serv- ices sectors. The company has offices in Canterbury, Aberdeen, London and New York and, to date, has completed more than 750 projects in 70 coun- tries across the globe.

62

62

64

64