Page 26: of Maritime Reporter Magazine (April 2014)

Offshore Edition

Read this page in Pdf, Flash or Html5 edition of April 2014 Maritime Reporter Magazine

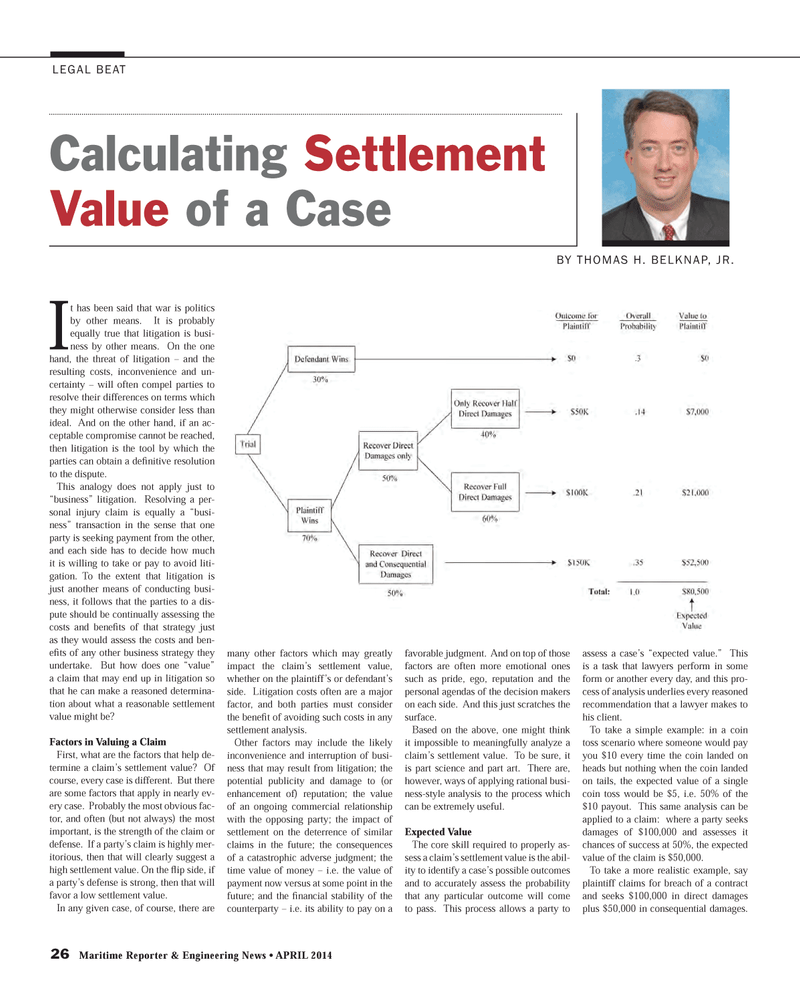

26 Maritime Reporter & Engineering News ? APRIL 2014 LEGAL BEAT It has been said that war is politics by other means. It is probably equally true that litigation is busi-ness by other means. On the one hand, the threat of litigation ? and the resulting costs, inconvenience and un-certainty ? will often compel parties to resolve their differences on terms which they might otherwise consider less than ideal. And on the other hand, if an ac- ceptable compromise cannot be reached, then litigation is the tool by which the parties can obtain a deÞ nitive resolution to the dispute.This analogy does not apply just to ?business? litigation. Resolving a per- sonal injury claim is equally a ?busi-ness? transaction in the sense that one party is seeking payment from the other, and each side has to decide how much it is willing to take or pay to avoid liti-gation. To the extent that litigation is just another means of conducting busi-ness, it follows that the parties to a dis-pute should be continually assessing the costs and beneÞ ts of that strategy just as they would assess the costs and ben-eÞ ts of any other business strategy they undertake. But how does one ?value? a claim that may end up in litigation so that he can make a reasoned determina-tion about what a reasonable settlement value might be?Factors in Valuing a Claim First, what are the factors that help de-termine a claim?s settlement value? Of course, every case is different. But there are some factors that apply in nearly ev-ery case. Probably the most obvious fac-tor, and often (but not always) the most important, is the strength of the claim or defense. If a party?s claim is highly mer- itorious, then that will clearly suggest a high settlement value. On the ß ip side, if a party?s defense is strong, then that will favor a low settlement value.In any given case, of course, there are many other factors which may greatly impact the claim?s settlement value, whether on the plaintiff?s or defendant?s side. Litigation costs often are a major factor, and both parties must consider the beneÞ t of avoiding such costs in any settlement analysis. Other factors may include the likely inconvenience and interruption of busi-ness that may result from litigation; the potential publicity and damage to (or enhancement of) reputation; the value of an ongoing commercial relationship with the opposing party; the impact of settlement on the deterrence of similar claims in the future; the consequences of a catastrophic adverse judgment; the time value of money ? i.e. the value of payment now versus at some point in the future; and the Þ nancial stability of the counterparty ? i.e. its ability to pay on a favorable judgment. And on top of those factors are often more emotional ones such as pride, ego, reputation and the personal agendas of the decision makers on each side. And this just scratches the surface.Based on the above, one might think it impossible to meaningfully analyze a claim?s settlement value. To be sure, it is part science and part art. There are, however, ways of applying rational busi- ness-style analysis to the process which can be extremely useful.Expected Value The core skill required to properly as-sess a claim?s settlement value is the abil- ity to identify a case?s possible outcomes and to accurately assess the probability that any particular outcome will come to pass. This process allows a party to assess a case?s ?expected value.? This is a task that lawyers perform in some form or another every day, and this pro- cess of analysis underlies every reasoned recommendation that a lawyer makes to his client.To take a simple example: in a coin toss scenario where someone would pay you $10 every time the coin landed on heads but nothing when the coin landed on tails, the expected value of a single coin toss would be $5, i.e. 50% of the $10 payout. This same analysis can be applied to a claim: where a party seeks damages of $100,000 and assesses it chances of success at 50%, the expected value of the claim is $50,000.To take a more realistic example, say plaintiff claims for breach of a contract and seeks $100,000 in direct damages plus $50,000 in consequential damages. Calculating Settlement Value of a CaseBY THOMAS H. BELKNAP, JR. MR #4 (26-33).indd 26MR #4 (26-33).indd 264/4/2014 10:48:55 AM4/4/2014 10:48:55 AM

25

25

27

27