Page 43: of Maritime Reporter Magazine (June 2017)

U.S. Navy Quarterly

Read this page in Pdf, Flash or Html5 edition of June 2017 Maritime Reporter Magazine

Image: Tärntank Ship Management AB

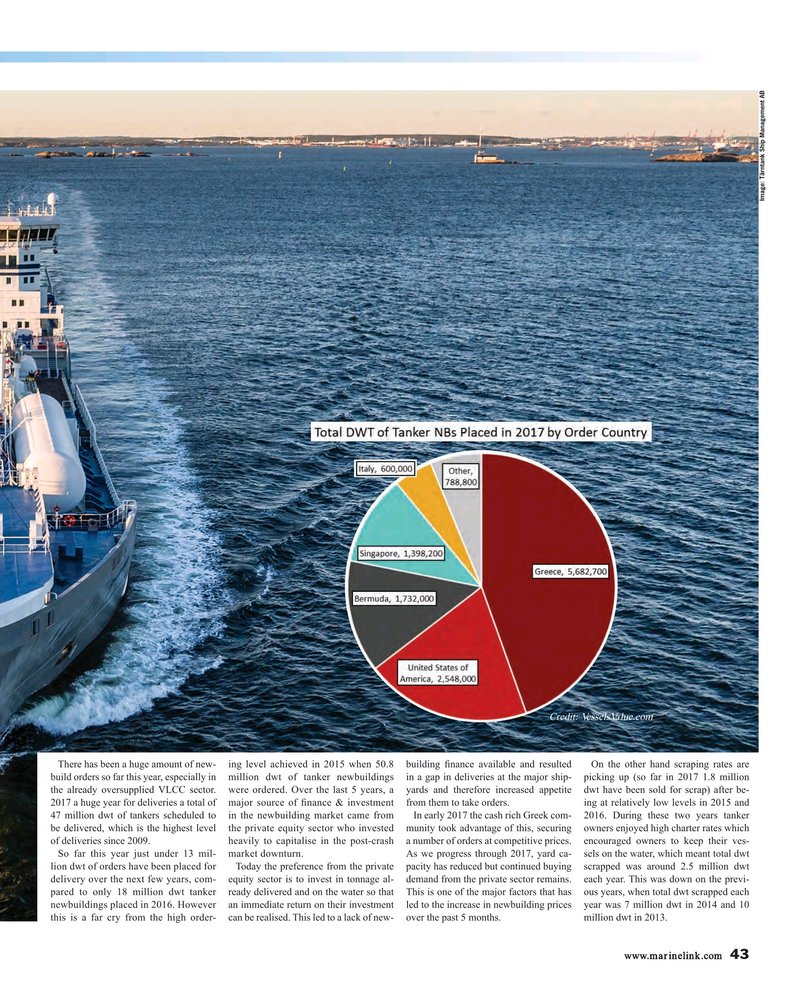

Credit: VesselsValue.com

There has been a huge amount of new- ing level achieved in 2015 when 50.8 building ? nance available and resulted On the other hand scraping rates are build orders so far this year, especially in million dwt of tanker newbuildings in a gap in deliveries at the major ship- picking up (so far in 2017 1.8 million the already oversupplied VLCC sector. were ordered. Over the last 5 years, a yards and therefore increased appetite dwt have been sold for scrap) after be- 2017 a huge year for deliveries a total of major source of ? nance & investment from them to take orders. ing at relatively low levels in 2015 and 47 million dwt of tankers scheduled to in the newbuilding market came from In early 2017 the cash rich Greek com- 2016. During these two years tanker be delivered, which is the highest level the private equity sector who invested munity took advantage of this, securing owners enjoyed high charter rates which of deliveries since 2009. heavily to capitalise in the post-crash a number of orders at competitive prices. encouraged owners to keep their ves-

So far this year just under 13 mil- market downturn. As we progress through 2017, yard ca- sels on the water, which meant total dwt lion dwt of orders have been placed for Today the preference from the private pacity has reduced but continued buying scrapped was around 2.5 million dwt delivery over the next few years, com- equity sector is to invest in tonnage al- demand from the private sector remains. each year. This was down on the previ- pared to only 18 million dwt tanker ready delivered and on the water so that This is one of the major factors that has ous years, when total dwt scrapped each newbuildings placed in 2016. However an immediate return on their investment led to the increase in newbuilding prices year was 7 million dwt in 2014 and 10 this is a far cry from the high order- can be realised. This led to a lack of new- over the past 5 months. million dwt in 2013.

www.marinelink.com 43

MR #6 (42-49).indd 43 MR #6 (42-49).indd 43 6/7/2017 12:15:50 PM6/7/2017 12:15:50 PM

42

42

44

44