Page 26: of Maritime Reporter Magazine (June 2019)

80th Anniversary World Yearbook

Read this page in Pdf, Flash or Html5 edition of June 2019 Maritime Reporter Magazine

2019

THE U.S. WORK

A ‘work in progress,’ the North American brown water, shallow draft sectors have experienced a tumultuous year of evolution, changing market conditions, a rapidly shifting regulatory environment and new opportunities. Anything but boring; and within the pages of Maritime Reporter’ & Engineering News’ Annual Yearbook, Joseph Keefe, editor of sister-publication MarineNews, takes a deep dive into the issues driving the domestic waterfront.

for clean air improvements in large port cities. Value.com, if this downturn has taught us anything, big

WORKBOAT EMISSIONS

The new report, entitled “Impact of Updated Service companies survive.

More than one year ago, Volkswagon learned the ul- timate (and painful) meaning of the iconic U.S. adage Life Estimates on Harbor Craft and Switcher Locomo- Fast forward to November, however, and global con- of “Don’t do the crime if you can’t do the time – or tive Emission Forecasts and Cost-Effectiveness,” found sulting ? rm AlixPartners, in a report entitled, “Too at least pay the staggering ? ne.” And pay it forward, the average Category 2 workboat remains in service for many ships, too few rigs: why recovery is still a dis- 50 years, instead of the 23-year lifespan estimated by tant dream for the OSV sector,” warned that companies

Volkswagen did. The auto manufacturer got caught us- the EPA in the 2008 Heavy Duty Locomotive and Ma- counting on a quick return to stability in the OSV sector ing software to trick emissions control software during testing on hundreds of thousands of vehicles in order rine Rule. A longer service life reduces the ? eet’s turn- were in for a rude awakening. The September report over rate to cleaner, lower-emitting engines, therefore went on to say that OSV companies continue to face to get a passing grade, after which the cars operated in increasing future-year emission estimates. pressure due to a radically changed oil industry and violation of the Clean Air Act.

Commercial marine and locomotive source catego- must take quick and decisive action in order to survive

As part of a series of three settlements with the U.S. ries should be a primary focus of future emission reduc- in what should be considered the ‘new normal.’

Environmental Protection Agency (EPA) totaling close tion efforts for retro? t/repower programs based on cost The AlixPartners report insists that the global OSV to $14.7 billion, Volkswagen was required to fund two mitigation trusts to the tune of $2.925 billion, which effectiveness. In other words: this is a great opportunity market is oversupplied by about 1,150 vessels. About is now being used to clean up diesel emissions in the for operators to get green cheaply, and a terri? c way to 900 vessels are 15 years or older which will have dif-

United States. The money is slated for projects with keep our shipyards humming along. ? culty ? nding work and could be retired. But there are real factors preventing a reduction in the overall supply “eligible mitigation actions,” such as upgrading tug-

OFFSHORE ENERGY WORKBOATS of vessels. The sector is fragmented, with the largest boat or ferry engines, to reduce the excess emissions

By autumn of 2018, a glimmer of hope in the offshore operators controlling 30% of the ? eet and the remain- that were produced by the illegal cars. Engines change energy markets – especially in the Gulf of Mexico – ing 70% controlled by 400 smaller operators with ? eets outs can only be repowered to EPA levels Tier 3 or Tier had oil support operators looking to a better tomorrow. of six or fewer vessels. Small operators have little in- 4. Other eligible options include the increasingly popu-

It had been a long time since anyone could say that. centive to retire any of their own ? eets and are loathe to lar hybrid or all-electric option.

As it happens, the top 10 recipients of trust funds Multiple bankruptcies dogged offshore service ? rms as take action that would bene? t the larger companies or are also the states with the largest marine sectors. The low oil prices dampened the economics of deepwater the sector overall.

drilling. The emergence of slimmer, hopefully more Moreover, a high proportion of these vessels are out bene? ciaries have 10 years to request their funding and implement approved mitigation actions. Applications pro? table offshore companies and some interesting de- of class and worth less than what it would cost to get must include projected NOx reductions and impact on velopments on the merger side foretell – if nothing else them back to operating condition. So why aren’t own- – excitement in the months to come. ers sending them to the scrap yard? This is often to do air and community health. Project priority will be based

All that said; the hottest news in the last twelve months with age. At the same time, the scrapping option is not on the emissions reduction or offset per dollar spent, as well as factors such as health bene? ts and impact on probably was the merger of Tidewater and GulfMark, as economically attractive for offshore supply vessels eclipsed only perhaps by Harvey Gulf’s (attempted) as it would be for tankers or bulk carriers. The low steel wild areas. Suf? ce it to say that, when it comes to ? - party crashing at the 11th hour. New Tidewater is the content of offshore supply vessels leaves them with a nancing engine upgrades and replacements using other largest OSV owner on the planet by sheer number of scrap value of less than 1 to $2 million, with transport people’s money – this is as good as it will ever get.

Unfortunately, not everyone has gotten on board OSVs owned, but Edison Chouest Offshore remains in costs also weighing on that dif? cult decision. And, OSV the clean and green train. It turns out that commercial the pole position by ? eet value. According to Vessels- demand is lower than it was ? ve years ago. Indeed, Ves- selValue’s Charlie Hockless summed up the situation in workboat engines are staying in service more than two late November, “These leaner times have forced drill- times longer than predicted by the U.S. Environmental

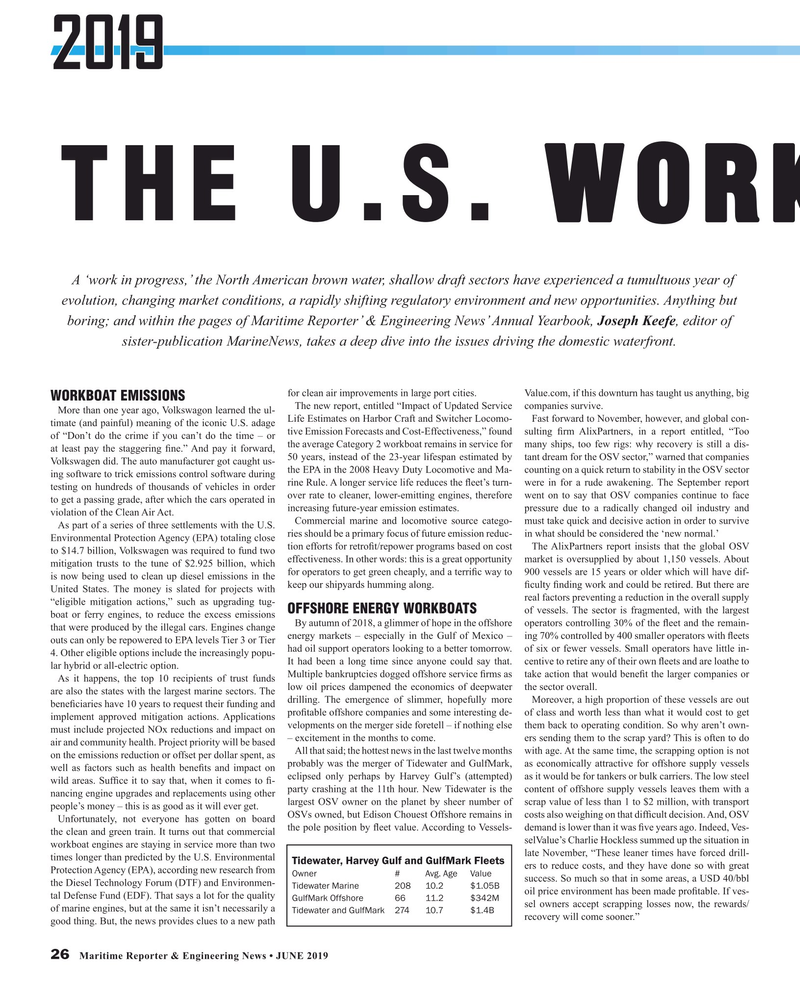

Tidewater, Harvey Gulf and GulfMark Fleets ers to reduce costs, and they have done so with great

Protection Agency (EPA), according new research from

Owner # Avg. Age Value success. So much so that in some areas, a USD 40/bbl the Diesel Technology Forum (DTF) and Environmen-

Tidewater Marine 208 10.2 $1.05B oil price environment has been made pro? table. If ves- tal Defense Fund (EDF). That says a lot for the quality

GulfMark Offshore 66 11.2 $342M sel owners accept scrapping losses now, the rewards/ of marine engines, but at the same it isn’t necessarily a

Tidewater and GulfMark 274 10.7 $1.4B recovery will come sooner.” good thing. But, the news provides clues to a new path 26 Maritime Reporter & Engineering News • JUNE 2019

MR #6 (26-33).indd 26 6/3/2019 9:50:15 AM

25

25

27

27