Page 28: of Maritime Reporter Magazine (June 2019)

80th Anniversary World Yearbook

Read this page in Pdf, Flash or Html5 edition of June 2019 Maritime Reporter Magazine

2019 sunshine in their bottom lines. They may get their wish. mented the market for towboats is. By comparison, the to drive up production costs by 2%-3% annually. This

In fact, as much as 41 percent – a whopping 17,596 Harbor/Escort market is dominated by two companies, in turn will have a negative effect on tug producers net vessels – of the domestic commercial ? eet is now older Diversi? ed Marine and Washburn & Doughty, who operating margins, which typically are less than 5%. than 21 years, some of it (13,353; 31%) 25 years or together accounted for more than 50% of production, Tariffs also will increase the cost of imported products older (or in other words, far older than what the rest of both in terms of units and value. such as deck gear. the world deems ready for the breakers). More signi? - In terms of volume, tugboats production is forecast to cantly, 61% of all U.S. ? ag self-propelled vessels are grow almost 3% annually to 2023 and towboats more USCG DOMESTIC FLAG STATE REPORT older than 25 years. Our ? eets need to be renewed and than 6%. Towboat production will grow faster because The U.S. Coast Guard’s 2018 Domestic Annual Re- they need to be renewed now. Virtually 99% of those 2018 production was far below its historical average. port contains statistics regarding inspections and en- vessels can be considered workboats. The major demand drivers for tugboats and towboats forcement of regulations on U.S. ? agged vessels. For

Alarmingly, the ? eet of large U.S.-? ag vessels en- over the next ? ve years will include black oil and re- the ? rst time, the Coast Guard presented information gaged in international trade has declined from approxi- ? ned petroleum products, petrochemicals and agricul- re? ecting the entire U.S. Flag ? eet, including barges, mately 199 vessels at the end of 1990 to 82 vessels at tural chemicals. cargo vessels, passenger vessels, vessels operating on the end of 2017. In February 2018, the number of U.S.- For example, since 2010, 333 chemical industry the Outer Continental Shelf, research and school ships, ? ag vessels dropped again, to 81 vessels. The heart projects cumulatively valued at more than $200 bil- ? shing vessels, and the newest members of the inspect- of the U.S. merchant ? eet, therefore, is its workboat, lion have been announced, with 53% of the investment ed ? eet, towing vessels. With the addition of towing brown water sector. That won’t change any time soon. completed or under construction and 41% in the plan- vessels, which started getting inspected under 46 CFR ning phase. Subchapter M in July of 2018, the size of the U.S. in-

TUGBOAT & TOWBOAT MANUFACTURING

Further, 71% of chemical investment from shale gas spected ? eet grew by approximately 6,500 vessels to a

A recent report from Amadee+Company provides a is bulk petrochemicals and plastic resins. Of that, 52% total ? eet size of nearly 20,000 vessels, an increase of unique, ? rst-time market and competitive analysis of of total investment (around $105 billion) is petrochemi- 50%. Unclear in all of that is why, if the U.S. commer- the size, segmentation, competition, trends and outlook cals and 19% of total investment (around $37.5 billion) cial ? eet numbers as many as 42,500 vessels, why ALL in the manufacture and supply of tugboats and towboats is plastic resins. U.S. petrochemical investment has of these hulls aren’t being inspected.

in the United States. Products analyzed include harbor/ largely focused on agricultural chemicals, methanol, In comparison to last year, which was the ? rst year escort, ocean, ATB, inland and multipurpose tugboats ethylene and ethylene derivatives, especially polyeth- the Coast Guard published their annual report, the num- and towboats. The report, “tugboat and towboat Manu- ylene. ber of vessel inspections increased by 1,624 and the av- facturing in the United States from 2017-2023,” pro- Nearly 20 facilities, or crackers, are being built or ex- erage number of de? ciencies identi? ed per inspection vides a detailed look at a segment of one of the oldest panded in the U.S. to convert natural gas liquids (NGL) increased from 1.17 to 1.26, rising nearly 8%. That may industries in the United States: shipbuilding. such as ethane and propane into ethylene. Ethylene is have something to do with the introduction of all those

According to the report, currently there are approxi- the most used petrochemical globally currently and the previously uninspected subM hulls. Or, not. 2019 will mately 125 shipyards operating in the United States, main ingredient in polyethylene plastic. Nine of these show a clearer trend.

spread across 26 states, which are classi? ed as active crackers are expected to come online in the U.S. by It is important to note that since this report covers the shipbuilders, and capable of building tugboats and tow- 2020, representing 10.7 million metric tons/year of new 2018 calendar year and the compliance date for imple- boats. Of these, only 39 manufacturers manufacture ethylene capacity. As much as 9.2 million metric tons mentation of towing vessels was July 20, 2018, only tugboats and towboats, and of these, only eight made of that will be online by the end of 2019 in the U.S. ? ve months of data for inspected towing vessels is in- tugboats exclusively, in the most recent year analyzed. Gulf alone. cluded in this report. Hence, the numbers may actually

The report identi? es Eastern Shipbuilding Group, Di- Many of the natural resources used as inputs for these be far worse on an annualized basis, looking ahead. versi? ed Marine and Conrad Shipyard/Conrad Orange plants, as well as the petrochemicals and re? nery prod- Interestingly enough, passenger vessels accounted for as the biggest players in terms of shipment value. ucts produced, will be shipped by water for domestic 72.3% of those de? ciencies. However, based on ves-

U.S. tugboat and towboat production has ranged be- consumption and exports. Without towboats and tug- sel population, Cargo vessels received a higher ratio tween 105 and 122 units annually, worth $600-$900 boats these products could not be moved. of de? ciencies per vessel, with an average of 4.17. To million. Although small compared to U.S. government A negative for the industry is tariffs. Steel represent be fair, the passenger vessel sector is one of the most shipbuilding, tugboat and towboat production is abso- approximately 25% of a typical tug’s production costs. highly regulated and closely watched – as perhaps it lutely necessary for U.S. waterborne transportation, The Trump Administration’s imposition of a 25% tariff should be, given the millions of lives at stake – in the which is estimated at $16.9 billion in 2019, is of strate- on imported steel and aluminum in 2018 is expected U.S. ? ag ? eet.

gic importance, and is protected by the Jones Act.

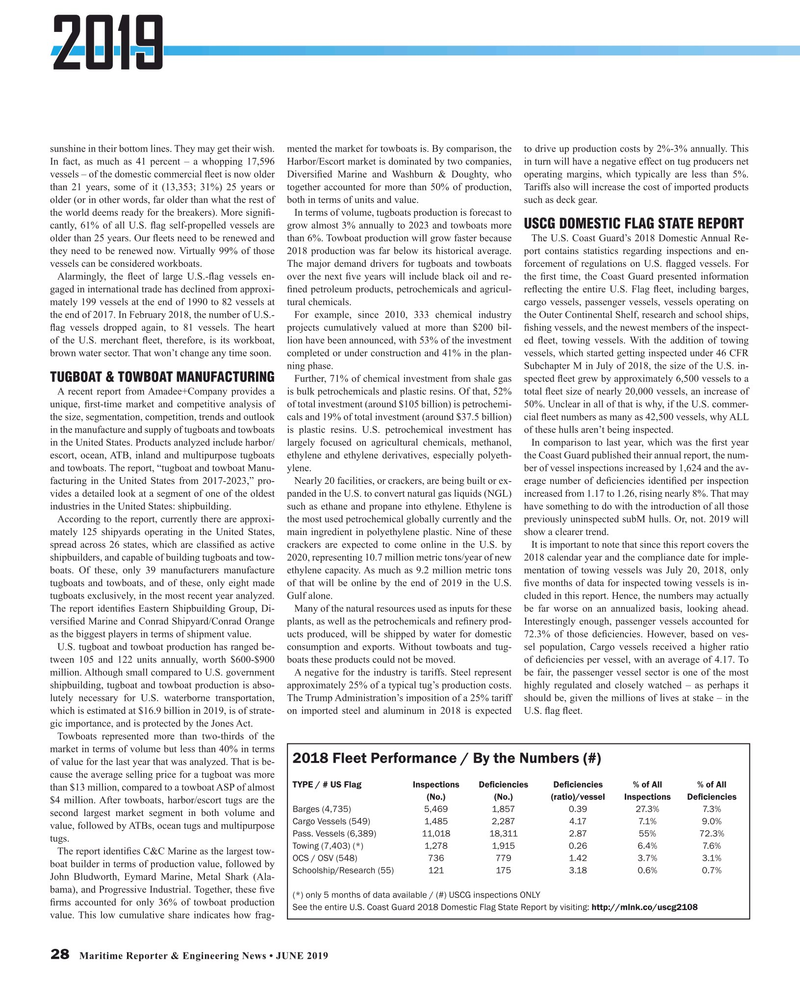

Towboats represented more than two-thirds of the market in terms of volume but less than 40% in terms 2018 Fleet Performance / By the Numbers (#) of value for the last year that was analyzed. That is be- cause the average selling price for a tugboat was more

TYPE / # US Flag Inspections De? ciencies De? ciencies % of All % of All than $13 million, compared to a towboat ASP of almost (No.) (No.) (ratio)/vessel Inspections De? ciencies $4 million. After towboats, harbor/escort tugs are the

Barges (4,735) 5,469 1,857 0.39 27.3% 7.3% second largest market segment in both volume and

Cargo Vessels (549) 1,485 2,287 4.17 7.1% 9.0% value, followed by ATBs, ocean tugs and multipurpose

Pass. Vessels (6,389) 11,018 18,311 2.87 55% 72.3% tugs.

Towing (7,403) (*) 1,278 1,915 0.26 6.4% 7.6%

The report identi? es C&C Marine as the largest tow-

OCS / OSV (548) 736 779 1.42 3.7% 3.1% boat builder in terms of production value, followed by

Schoolship/Research (55) 121 175 3.18 0.6% 0.7%

John Bludworth, Eymard Marine, Metal Shark (Ala- bama), and Progressive Industrial. Together, these ? ve (*) only 5 months of data available / (#) USCG inspections ONLY ? rms accounted for only 36% of towboat production

See the entire U.S. Coast Guard 2018 Domestic Flag State Report by visiting: http://mlnk.co/uscg2108 value. This low cumulative share indicates how frag- 28 Maritime Reporter & Engineering News • JUNE 2019

MR #6 (26-33).indd 28 6/3/2019 9:51:08 AM

27

27

29

29