Page 38: of Maritime Reporter Magazine (June 2019)

80th Anniversary World Yearbook

Read this page in Pdf, Flash or Html5 edition of June 2019 Maritime Reporter Magazine

2019

BY ROBERT DAY, HEAD OF OFFSHORE, VESSELS VALUE

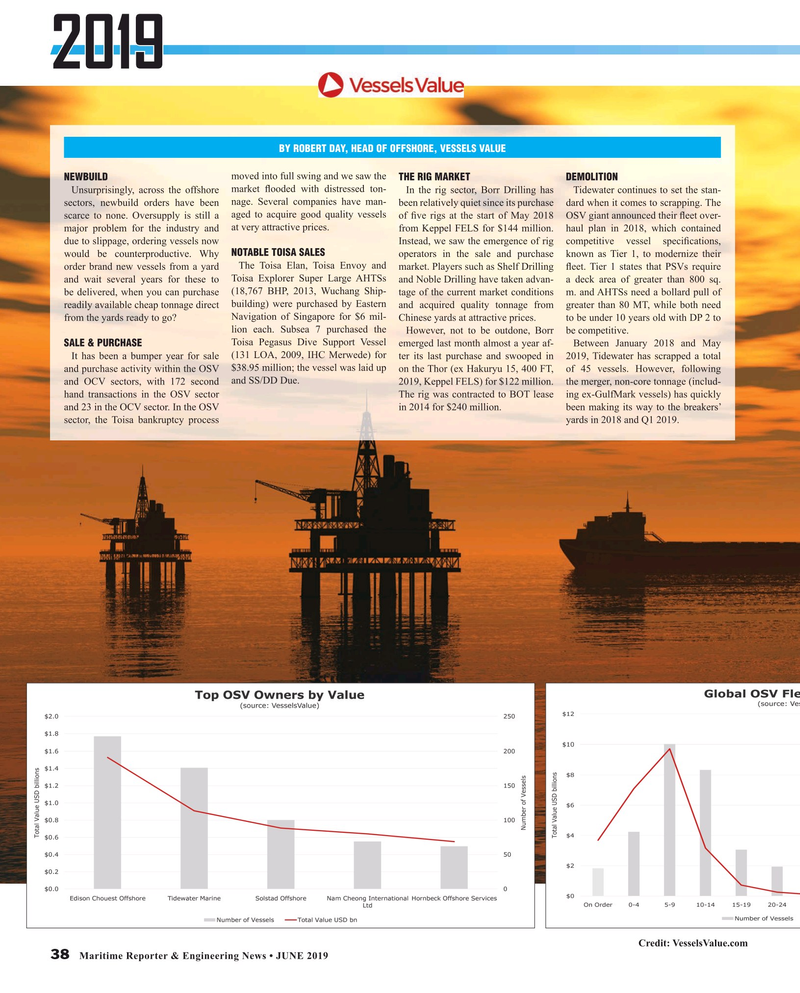

NEWBUILD moved into full swing and we saw the THE RIG MARKET DEMOLITION

Unsurprisingly, across the offshore market ? ooded with distressed ton-

In the rig sector, Borr Drilling has Tidewater continues to set the stan- sectors, newbuild orders have been nage. Several companies have man- been relatively quiet since its purchase dard when it comes to scrapping. The scarce to none. Oversupply is still a aged to acquire good quality vessels of ? ve rigs at the start of May 2018 OSV giant announced their ? eet over- major problem for the industry and at very attractive prices.

from Keppel FELS for $144 million. haul plan in 2018, which contained due to slippage, ordering vessels now Instead, we saw the emergence of rig competitive vessel speci? cations, would be counterproductive. Why NOTABLE TOISA SALES operators in the sale and purchase known as Tier 1, to modernize their order brand new vessels from a yard The Toisa Elan, Toisa Envoy and market. Players such as Shelf Drilling ? eet. Tier 1 states that PSVs require and wait several years for these to Toisa Explorer Super Large AHTSs and Noble Drilling have taken advan- a deck area of greater than 800 sq. be delivered, when you can purchase (18,767 BHP, 2013, Wuchang Ship- tage of the current market conditions m. and AHTSs need a bollard pull of readily available cheap tonnage direct building) were purchased by Eastern and acquired quality tonnage from greater than 80 MT, while both need

Navigation of Singapore for $6 mil- from the yards ready to go? Chinese yards at attractive prices. to be under 10 years old with DP 2 to lion each. Subsea 7 purchased the

However, not to be outdone, Borr be competitive.

SALE & PURCHASE Toisa Pegasus Dive Support Vessel emerged last month almost a year af- Between January 2018 and May

It has been a bumper year for sale (131 LOA, 2009, IHC Merwede) for ter its last purchase and swooped in 2019, Tidewater has scrapped a total and purchase activity within the OSV $38.95 million; the vessel was laid up on the Thor (ex Hakuryu 15, 400 FT, of 45 vessels. However, following and OCV sectors, with 172 second and SS/DD Due.

2019, Keppel FELS) for $122 million. the merger, non-core tonnage (includ- hand transactions in the OSV sector The rig was contracted to BOT lease ing ex-GulfMark vessels) has quickly and 23 in the OCV sector. In the OSV in 2014 for $240 million. been making its way to the breakers’ sector, the Toisa bankruptcy process yards in 2018 and Q1 2019.

Credit: VesselsValue.com 38 Maritime Reporter & Engineering News • JUNE 2019

MR #6 (34-41).indd 38 6/3/2019 12:18:09 PM

37

37

39

39