Page 45: of Maritime Reporter Magazine (June 2019)

80th Anniversary World Yearbook

Read this page in Pdf, Flash or Html5 edition of June 2019 Maritime Reporter Magazine

world yearbook system includes the underlying owners, vessel opera- ates around 700 vessels at any one time”. Oldendorff tors (sometimes called “freight merchants”) and major Carriers estimated that its controlled ? eet (owned and charterers. On the tanker side, brokers Poten compiles chartered) stood at 57 million tons deadweight (mdwt) a ranking of the largest crude oil charterers. Typically, in early 2018. Though hefty sounding, this ? gure repre- the large cargo interests may control ? eets of vessels sents 6% of the overall bulk ? eet, pegged at 935 million taken in under timecharters; oil “majors” will operate dwt by VesselsValue.

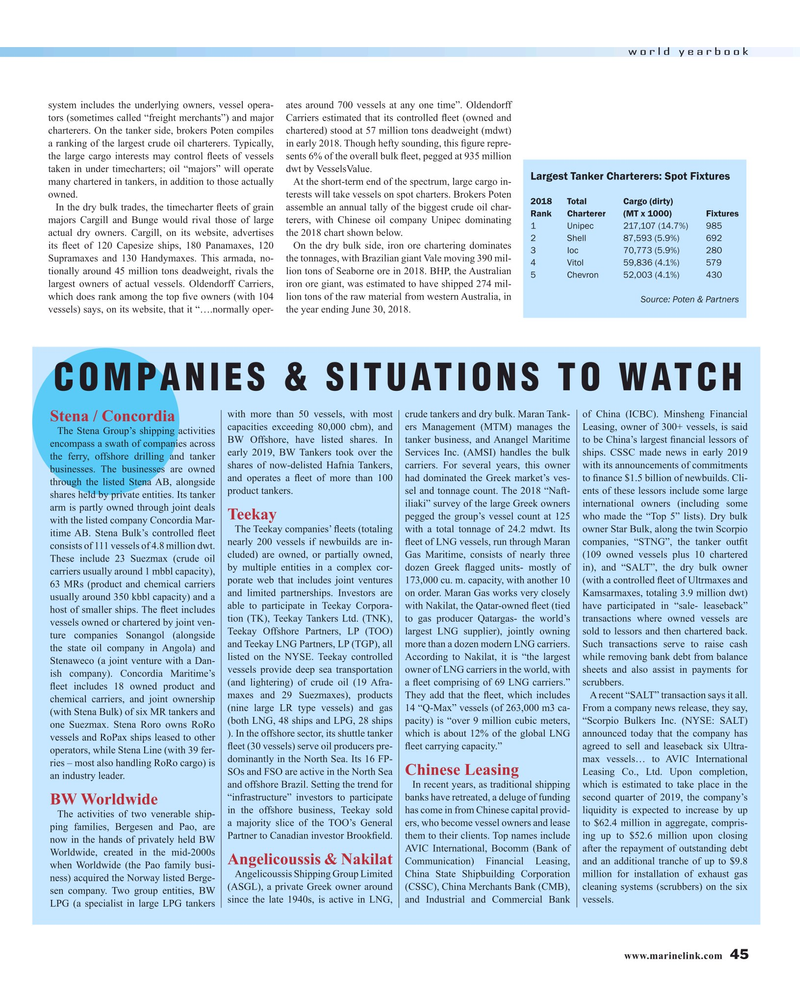

Largest Tanker Charterers: Spot Fixtures many chartered in tankers, in addition to those actually At the short-term end of the spectrum, large cargo in- owned. terests will take vessels on spot charters. Brokers Poten 2018 Total Cargo (dirty)

In the dry bulk trades, the timecharter ? eets of grain assemble an annual tally of the biggest crude oil char-

Rank Charterer (MT x 1000) Fixtures majors Cargill and Bunge would rival those of large terers, with Chinese oil company Unipec dominating 1 Unipec 217,107 (14.7%) 985 actual dry owners. Cargill, on its website, advertises the 2018 chart shown below.

2 Shell 87,593 (5.9%) 692 its ? eet of 120 Capesize ships, 180 Panamaxes, 120 On the dry bulk side, iron ore chartering dominates 3 Ioc 70,773 (5.9%) 280

Supramaxes and 130 Handymaxes. This armada, no- the tonnages, with Brazilian giant Vale moving 390 mil- 4 Vitol 59,836 (4.1%) 579 tionally around 45 million tons deadweight, rivals the lion tons of Seaborne ore in 2018. BHP, the Australian 5 Chevron 52,003 (4.1%) 430 largest owners of actual vessels. Oldendorff Carriers, iron ore giant, was estimated to have shipped 274 mil- which does rank among the top ? ve owners (with 104 lion tons of the raw material from western Australia, in

Source: Poten & Partners vessels) says, on its website, that it “….normally oper- the year ending June 30, 2018.

COMPANIES & SITUATIONS TO WATCH with more than 50 vessels, with most crude tankers and dry bulk. Maran Tank- of China (ICBC). Minsheng Financial

Stena / Concordia

The Stena Group’s shipping activities capacities exceeding 80,000 cbm), and ers Management (MTM) manages the Leasing, owner of 300+ vessels, is said encompass a swath of companies across BW Offshore, have listed shares. In tanker business, and Anangel Maritime to be China’s largest ? nancial lessors of the ferry, offshore drilling and tanker early 2019, BW Tankers took over the Services Inc. (AMSI) handles the bulk ships. CSSC made news in early 2019 businesses. The businesses are owned shares of now-delisted Hafnia Tankers, carriers. For several years, this owner with its announcements of commitments through the listed Stena AB, alongside and operates a ? eet of more than 100 had dominated the Greek market’s ves- to ? nance $1.5 billion of newbuilds. Cli- product tankers. sel and tonnage count. The 2018 “Naft- ents of these lessors include some large shares held by private entities. Its tanker iliaki” survey of the large Greek owners international owners (including some arm is partly owned through joint deals pegged the group’s vessel count at 125 who made the “Top 5” lists). Dry bulk

Teekay with the listed company Concordia Mar-

The Teekay companies’ ? eets (totaling with a total tonnage of 24.2 mdwt. Its owner Star Bulk, along the twin Scorpio itime AB. Stena Bulk’s controlled ? eet nearly 200 vessels if newbuilds are in- ? eet of LNG vessels, run through Maran companies, “STNG”, the tanker out? t consists of 111 vessels of 4.8 million dwt.

These include 23 Suezmax (crude oil cluded) are owned, or partially owned, Gas Maritime, consists of nearly three (109 owned vessels plus 10 chartered by multiple entities in a complex cor- dozen Greek ? agged units- mostly of in), and “SALT”, the dry bulk owner carriers usually around 1 mbbl capacity), 63 MRs (product and chemical carriers porate web that includes joint ventures 173,000 cu. m. capacity, with another 10 (with a controlled ? eet of Ultrmaxes and usually around 350 kbbl capacity) and a and limited partnerships. Investors are on order. Maran Gas works very closely Kamsarmaxes, totaling 3.9 million dwt) able to participate in Teekay Corpora- with Nakilat, the Qatar-owned ? eet (tied have participated in “sale- leaseback” host of smaller ships. The ? eet includes tion (TK), Teekay Tankers Ltd. (TNK), to gas producer Qatargas- the world’s transactions where owned vessels are vessels owned or chartered by joint ven- ture companies Sonangol (alongside Teekay Offshore Partners, LP (TOO) largest LNG supplier), jointly owning sold to lessors and then chartered back. the state oil company in Angola) and and Teekay LNG Partners, LP (TGP), all more than a dozen modern LNG carriers. Such transactions serve to raise cash listed on the NYSE. Teekay controlled According to Nakilat, it is “the largest while removing bank debt from balance

Stenaweco (a joint venture with a Dan- ish company). Concordia Maritime’s vessels provide deep sea transportation owner of LNG carriers in the world, with sheets and also assist in payments for ? eet includes 18 owned product and (and lightering) of crude oil (19 Afra- a ? eet comprising of 69 LNG carriers.” scrubbers.

chemical carriers, and joint ownership maxes and 29 Suezmaxes), products They add that the ? eet, which includes A recent “SALT” transaction says it all. (nine large LR type vessels) and gas 14 “Q-Max” vessels (of 263,000 m3 ca- From a company news release, they say, (with Stena Bulk) of six MR tankers and one Suezmax. Stena Roro owns RoRo (both LNG, 48 ships and LPG, 28 ships pacity) is “over 9 million cubic meters, “Scorpio Bulkers Inc. (NYSE: SALT) vessels and RoPax ships leased to other ). In the offshore sector, its shuttle tanker which is about 12% of the global LNG announced today that the company has ? eet (30 vessels) serve oil producers pre- ? eet carrying capacity.” agreed to sell and leaseback six Ultra- operators, while Stena Line (with 39 fer- dominantly in the North Sea. Its 16 FP- max vessels… to AVIC International ries – most also handling RoRo cargo) is

Chinese Leasing

SOs and FSO are active in the North Sea Leasing Co., Ltd. Upon completion, an industry leader. and offshore Brazil. Setting the trend for In recent years, as traditional shipping which is estimated to take place in the “infrastructure” investors to participate banks have retreated, a deluge of funding second quarter of 2019, the company’s

BW Worldwide in the offshore business, Teekay sold has come in from Chinese capital provid- liquidity is expected to increase by up

The activities of two venerable ship- ping families, Bergesen and Pao, are a majority slice of the TOO’s General ers, who become vessel owners and lease to $62.4 million in aggregate, compris- now in the hands of privately held BW Partner to Canadian investor Brook? eld. them to their clients. Top names include ing up to $52.6 million upon closing

AVIC International, Bocomm (Bank of after the repayment of outstanding debt

Worldwide, created in the mid-2000s

Angelicoussis & Nakilat Communication) Financial Leasing, and an additional tranche of up to $9.8 when Worldwide (the Pao family busi-

Angelicoussis Shipping Group Limited China State Shipbuilding Corporation million for installation of exhaust gas ness) acquired the Norway listed Berge- sen company. Two group entities, BW (ASGL), a private Greek owner around (CSSC), China Merchants Bank (CMB), cleaning systems (scrubbers) on the six

LPG (a specialist in large LPG tankers since the late 1940s, is active in LNG, and Industrial and Commercial Bank vessels. www.marinelink.com 45

MR #6 (42-49).indd 45 6/3/2019 3:31:07 PM

44

44

46

46