Page 45: of Maritime Reporter Magazine (July 2020)

Maritime Power Edition

Read this page in Pdf, Flash or Html5 edition of July 2020 Maritime Reporter Magazine

offsHore wind that hold some 80% of the world’s wind capacity potential. well for the global supply chain. WER expects offshore wind

Representing another boost for overall capacity potential, these projects will require between $1 trillion and $1.5 trillion of ca- areas are typically further from shore where the wind generally pex over the next two decades. Much is still on the table for blows stronger, resulting in higher turbine capacity factors. the gamut of suppliers and marine services firms, as 80% of

Today’s most proven floating wind turbines are Equinor’s offshore wind projects detailed in the report and database are

Hywind, employed on the 88MW Tampen project, and Prin- still in early stages of planning and development. ciple Power’s WindFloat, being used on the 50MW Kincar- With a pipeline of activity so large, there’s plenty of work to dine project, but WER’s report looks at more than 50 floating be had by existing players and new entrants alike. We’ve al- wind concepts in various stages that are being studied across ready seen a number of traditional offshore oil and gas play- the globe. Just as is occurring for traditional fixed-base tur- ers—from operators such as Shell, Total, Equinor and Repsol, bine projects, the increasing size of floating projects and the all the way down the supply chain—transfer their skillset into industrialization of the hull construction process is helping cer- the offshore wind market over the years. For these firms and tain concepts reduce project LCOE. For example, as Equinor others, including traditional offshore oil and gas players such as matures the technology, it aims to bring the LCOE of Hywind yards for jacket and HVDC substation fabrication, as well as for projects to €40 -60/MWh by 2030. construction and assembly of floating foundations, opportuni-

A pipeline of more than 50 GW of floating capacity requiring ties abound as projects get larger, deeper and further from shore. $93 billion to $148 billion of capex investment has been identi- Offshore wind farms need servicing, creating even more fied by WER. As is the case in the bottom-fixed segment, the work for a wide range of support providers—from boatbuild-

U.K. presently has the largest floating pipeline at more than 25 ers to turbine technicians. In Europe, for example, onshore op-

GW, followed by Norway (more than 5 GW) and Japan, the U.S., eration support bases are having associated positive impacts

South Korea, Ireland, France and Taiwan, each with multi-GW (long-term direct jobs, and bolstered local supply chains) in pipelines. WER’s report highlights the development of a much port regions that had been historically active but have struggled large pipeline after the middle of this decade, with potential more recently due depressed oil and gas and shipping markets. zones discussed in the U.S., Japan, Norway, U.K. and France. Using the current UK $94,000/MW/year operational expendi- ture (opex) cost, the current pipeline of projects could require

BiG POteNtiaL MeaNS BiG OPPORtuNitieS up to $46.6 billion of annual opex spend within the next de-

Forecasted near- and long-term increased activity bodes very cade, says WER.

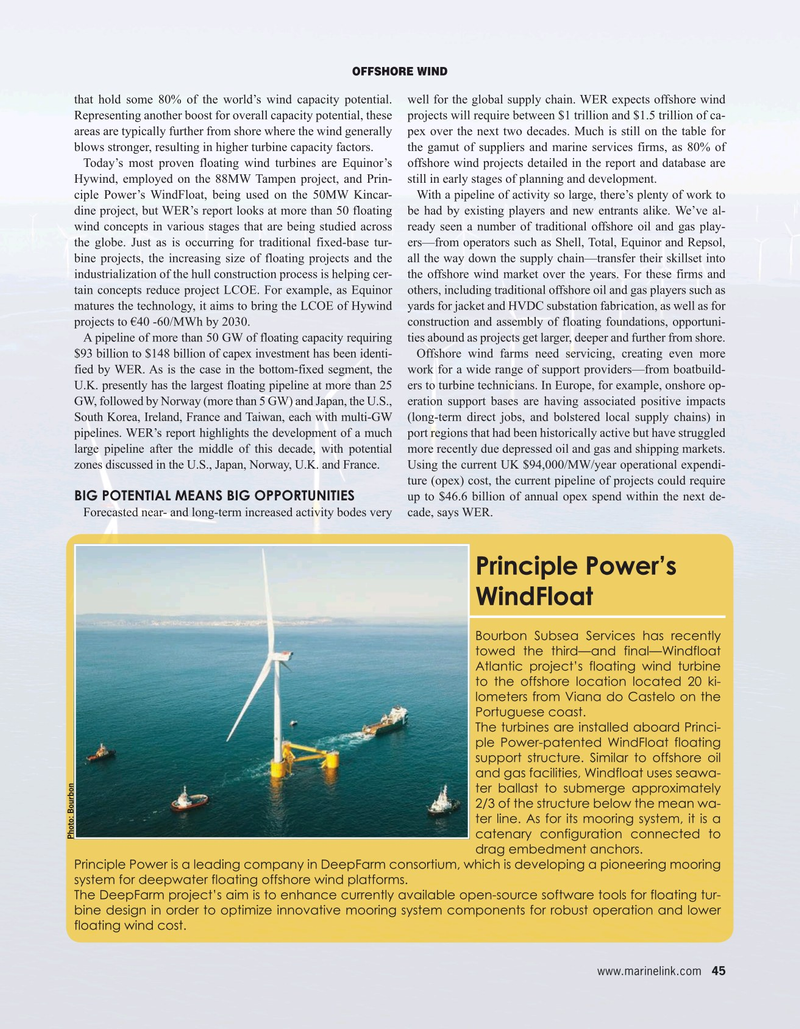

Principle Power’s

WindFloat

Bourbon Subsea Services has recently towed the third—and final—Windfloat

Atlantic project’s floating wind turbine to the offshore location located 20 ki- lometers from Viana do Castelo on the

Portuguese coast.

The turbines are installed aboard Princi- ple Power-patented WindFloat floating support structure. Similar to offshore oil and gas facilities, Windfloat uses seawa- ter ballast to submerge approximately 2/3 of the structure below the mean wa- ter line. As for its mooring system, it is a catenary configuration connected to

Photo: Bourbon drag embedment anchors.

Principle Power is a leading company in DeepFarm consortium, which is developing a pioneering mooring system for deepwater floating offshore wind platforms.

The DeepFarm project’s aim is to enhance currently available open-source software tools for floating tur- bine design in order to optimize innovative mooring system components for robust operation and lower floating wind cost.

www.marinelink.com 45

44

44

46

46