Page 25: of Maritime Reporter Magazine (February 2022)

Government Shipbuilding

Read this page in Pdf, Flash or Html5 edition of February 2022 Maritime Reporter Magazine

U.S. OFFSHORE WIND hat a difference a year makes. This time offshore wind project development in the U.S. within this last year there was still some uncertainty decade, forecasts the number, CAPEX, OPEX and timing of around the federal offshore wind permit- projects, and provides a roadmap to understanding and ac- ting process, the timing of offshore wind cessing these market opportunities.

Wprojects and certainty for the supply chain.

At the beginning of 2022 the situation is more positive. The So, what has changed?

? nal investment decision has been made for a major offshore The excitement surrounding U.S. wind is founded on two wind project which has also reached ? nancial close, 12 OCS power supply and demand drivers. On the supply side, federal projects are under ? nal federal permitting review, 17.5 GW of leases containing over 20 GW of project capacity have been project capacity has secured offtake commitments, 16.5 GW awarded – the last in early 2019. And more federal leasing of new federal offshore leasing activity in the northeast, South is underway. On the demand side eight Northeast and Mid-

Atlantic and California is underway, turbine component, foun- Atlantic states have established offshore wind procurement dation, and cable factories are being built in the U.S., awards targets and/or procured offshore wind capacity from develop- for at least six Jones Act compliant wind farm support vessels ers operating federal offshore wind leases. Two Paci? c coast were announced in the last quarter of 2021 and offshore wind states are also working through the process to establish off- port development is accelerating. shore wind goals.

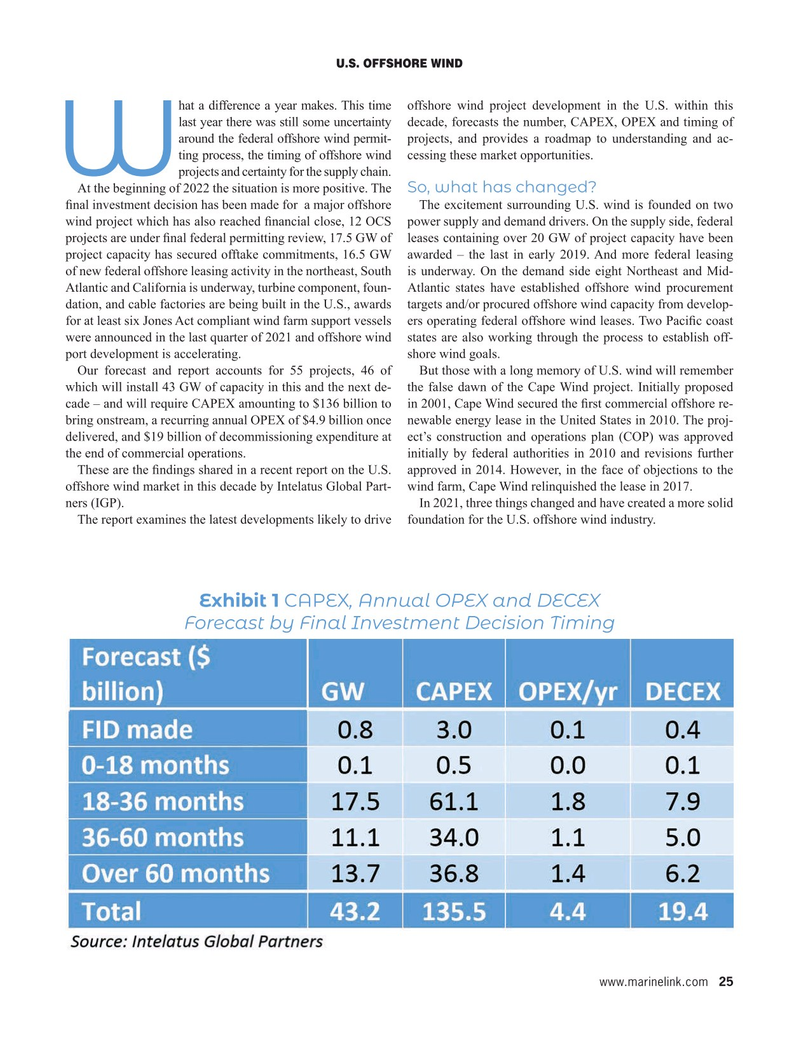

Our forecast and report accounts for 55 projects, 46 of But those with a long memory of U.S. wind will remember which will install 43 GW of capacity in this and the next de- the false dawn of the Cape Wind project. Initially proposed cade – and will require CAPEX amounting to $136 billion to in 2001, Cape Wind secured the ? rst commercial offshore re- bring onstream, a recurring annual OPEX of $4.9 billion once newable energy lease in the United States in 2010. The proj- delivered, and $19 billion of decommissioning expenditure at ect’s construction and operations plan (COP) was approved the end of commercial operations. initially by federal authorities in 2010 and revisions further

These are the ? ndings shared in a recent report on the U.S. approved in 2014. However, in the face of objections to the offshore wind market in this decade by Intelatus Global Part- wind farm, Cape Wind relinquished the lease in 2017.

ners (IGP). In 2021, three things changed and have created a more solid

The report examines the latest developments likely to drive foundation for the U.S. offshore wind industry.

Exhibit 1 CAPEX, Annual OPEX and DECEX

Forecast by Final Investment Decision Timing www.marinelink.com 25

MR #2 (18-33).indd 25 2/4/2022 9:27:42 AM

24

24

26

26