Page 15: of Maritime Reporter Magazine (June 2025)

Read this page in Pdf, Flash or Html5 edition of June 2025 Maritime Reporter Magazine

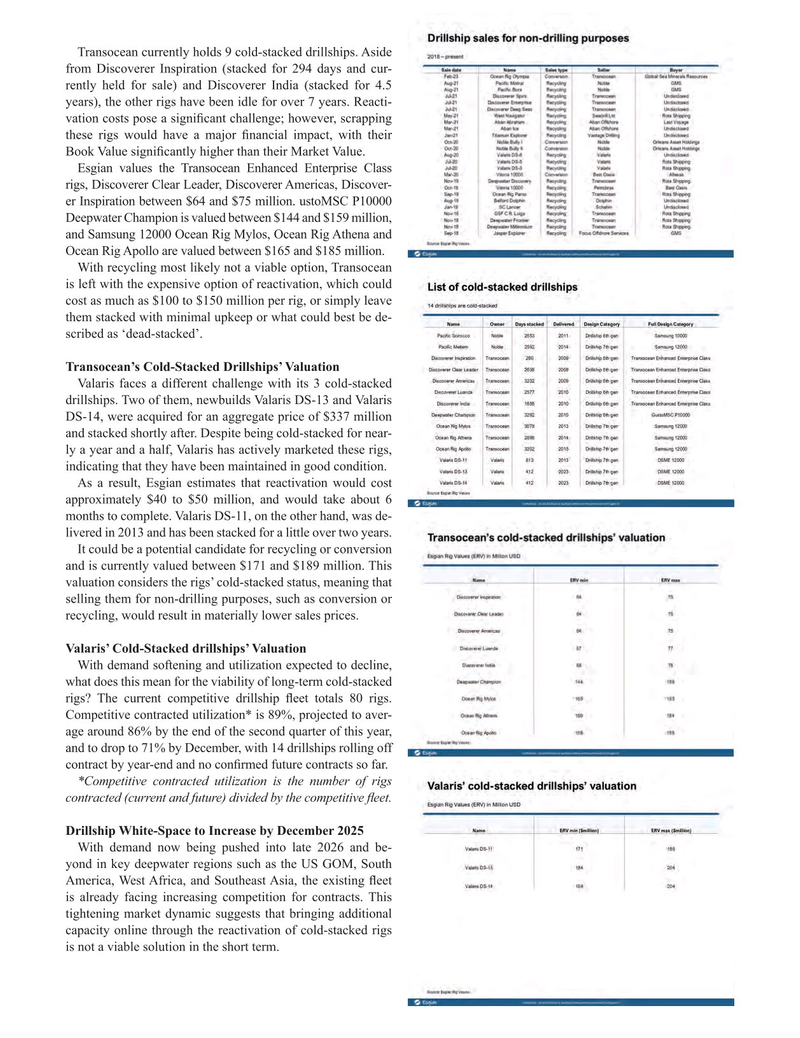

Transocean currently holds 9 cold-stacked drillships. Aside from Discoverer Inspiration (stacked for 294 days and cur- rently held for sale) and Discoverer India (stacked for 4.5 years), the other rigs have been idle for over 7 years. Reacti- vation costs pose a signi? cant challenge; however, scrapping these rigs would have a major ? nancial impact, with their

Book Value signi? cantly higher than their Market Value.

Esgian values the Transocean Enhanced Enterprise Class rigs, Discoverer Clear Leader, Discoverer Americas, Discover- er Inspiration between $64 and $75 million. ustoMSC P10000

Deepwater Champion is valued between $144 and $159 million, and Samsung 12000 Ocean Rig Mylos, Ocean Rig Athena and

Ocean Rig Apollo are valued between $165 and $185 million.

With recycling most likely not a viable option, Transocean is left with the expensive option of reactivation, which could cost as much as $100 to $150 million per rig, or simply leave them stacked with minimal upkeep or what could best be de- scribed as ‘dead-stacked’.

Transocean’s Cold-Stacked Drillships’ Valuation

Valaris faces a different challenge with its 3 cold-stacked drillships. Two of them, newbuilds Valaris DS-13 and Valaris

DS-14, were acquired for an aggregate price of $337 million and stacked shortly after. Despite being cold-stacked for near- ly a year and a half, Valaris has actively marketed these rigs, indicating that they have been maintained in good condition.

As a result, Esgian estimates that reactivation would cost approximately $40 to $50 million, and would take about 6 months to complete. Valaris DS-11, on the other hand, was de- livered in 2013 and has been stacked for a little over two years.

It could be a potential candidate for recycling or conversion and is currently valued between $171 and $189 million. This valuation considers the rigs’ cold-stacked status, meaning that selling them for non-drilling purposes, such as conversion or recycling, would result in materially lower sales prices.

Valaris’ Cold-Stacked drillships’ Valuation

With demand softening and utilization expected to decline, what does this mean for the viability of long-term cold-stacked rigs? The current competitive drillship ? eet totals 80 rigs.

Competitive contracted utilization* is 89%, projected to aver- age around 86% by the end of the second quarter of this year, and to drop to 71% by December, with 14 drillships rolling off contract by year-end and no con? rmed future contracts so far.

*Competitive contracted utilization is the number of rigs contracted (current and future) divided by the competitive ? eet.

Drillship White-Space to Increase by December 2025

With demand now being pushed into late 2026 and be- yond in key deepwater regions such as the US GOM, South

America, West Africa, and Southeast Asia, the existing ? eet is already facing increasing competition for contracts. This tightening market dynamic suggests that bringing additional capacity online through the reactivation of cold-stacked rigs is not a viable solution in the short term.

MR #6 (1-17).indd 15 MR #6 (1-17).indd 15 5/31/2025 10:20:27 PM5/31/2025 10:20:27 PM

14

14

16

16