Page 21: of Offshore Engineer Magazine (Apr/May 2014)

Read this page in Pdf, Flash or Html5 edition of Apr/May 2014 Offshore Engineer Magazine

South America

Analysis and other companies are going a pipeline to Myanmar. This being, the Strait of Malacca that under the sea,” Metelitsa and Caribbean out and investing, not so much may have some impact in and the South China Sea will concludes. “This is a trade

Sub-Saharan Africa to keep market share in these the medium term, but these continue to be a critical trade route area frst and foremost...

Middle East and other areas, but really to have the are still marginal sources of route. We are going to see that

North Africa

North America technical knowhow, the techni- production and marginal gas “The oil and gas on top of increasing both in terms of oil

Former Soviet cal expertise, to come back and and oil amounts. For the time the sea is more important than and in terms of LNG.”

Union and Arctic build up their own market share,

Asia and Paci?c particularly in the South China

South China Sea

Sea region. So we are seeing

Oil

Europe the most technically advanced

Natural gas production being done by China, South Asia especially with deepwater natu- 0% 10% 20% 30% ral gas drilling in the eastern part

Fig. 3: Share of estimated world undiscovered conventional oil of the South China Sea.”

Image: EIA.

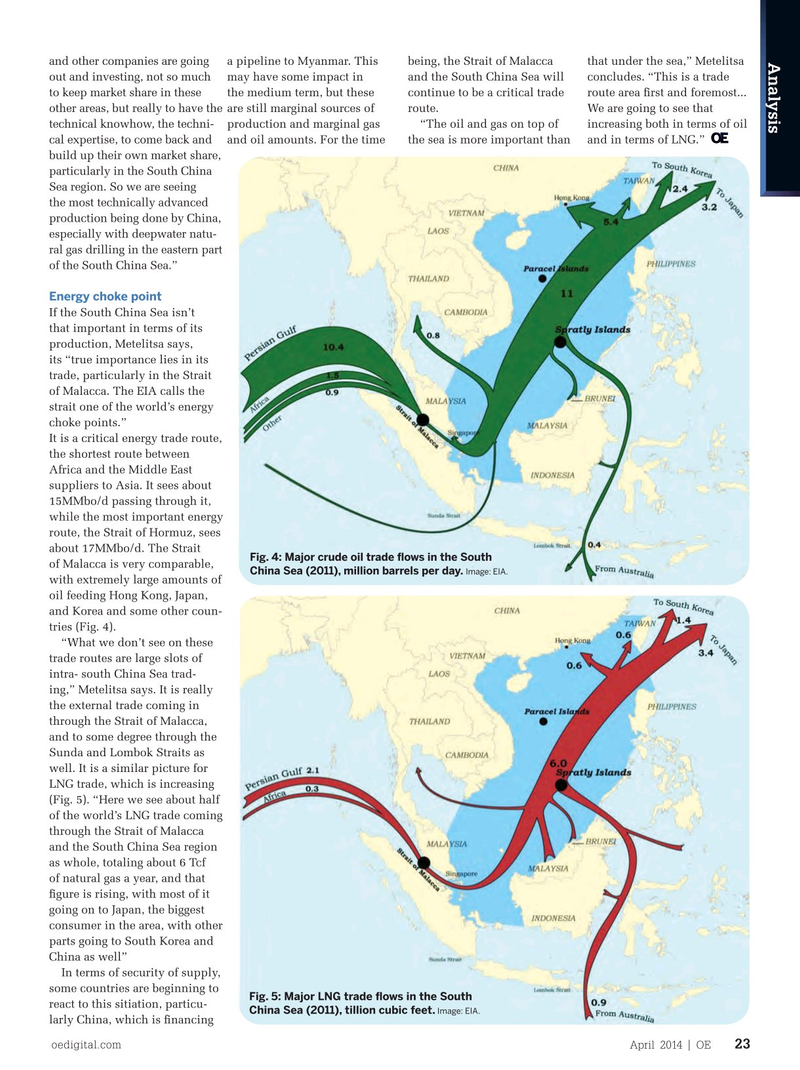

and gas resources (2012). and typhoons. The produc- Energy choke point ers are, however, are getting If the South China Sea isn’t better at dealing with some of that important in terms of its these issues. Production was production, Metelitsa says, only down for a few weeks its “true importance lies in its after the devastating typhoon trade, particularly in the Strait

Haiyan in the Philippines last of Malacca. The EIA calls the

November. Storms that have strait one of the world’s energy hit the Gulf of Thailand have choke points.” only knocked out production It is a critical energy trade route, for weeks at a time. the shortest route between

Cooperation, rather than Africa and the Middle East competition, helped. The suppliers to Asia. It sees about majority of production takes 15MMbo/d passing through it, place in the Gulf of Thailand while the most important energy area, the Malaysia area, and, route, the Strait of Hormuz, sees to a somewhat lesser degree, about 17MMbo/d. The Strait

Fig. 4: Major crude oil trade fows in the South in the Pearl River Basin, in of Malacca is very comparable,

China Sea (2011), million barrels per day. Image: EIA.

China. The countries that with extremely large amounts of have actually looked past oil feeding Hong Kong, Japan, their territorial disputes, or and Korea and some other coun- settled them, have had the tries (Fig. 4).

most production success. “What we don’t see on these

Brunei and Malaysia settled trade routes are large slots of their territorial disputes in intra- south China Sea trad- 2009, and entered production ing,” Metelitsa says. It is really sharing agreements. Despite the external trade coming in not having settled their dis- through the Strait of Malacca, pute, Thailand and Malaysia and to some degree through the have agreed to work together Sunda and Lombok Straits as in a joint development area. well. It is a similar picture for

There are a variety of differ-

LNG trade, which is increasing ent ways that companies and (Fig. 5). “Here we see about half countries approach drilling of the world’s LNG trade coming in the area. These range from through the Strait of Malacca service agreements in the and the South China Sea region

Philippines–where foreign as whole, totaling about 6 Tcf companies come in and take of natural gas a year, and that on the risk of drilling them- fgure is rising, with most of it selves– to investing in offshore going on to Japan, the biggest assets globally, to build up consumer in the area, with other technical expertise, which parts going to South Korea and

China has been doing.

China as well” “We call this the ‘sea turtle’ In terms of security of supply, strategy,” says Metelitsa, some countries are beginning to

Fig. 5: Major LNG trade fows in the South where China National Offshore react to this sitiation, particu-

China Sea (2011), tillion cubic feet.

Image: EIA.

Oil Corporation (CNOOC) larly China, which is fnancing oedigital.com April 2014 | OE 23 000_OE0414_Analysis_meg.indd 23 3/23/14 9:27 AM

20

20

22

22