Page 24: of Offshore Engineer Magazine (Apr/May 2014)

Read this page in Pdf, Flash or Html5 edition of Apr/May 2014 Offshore Engineer Magazine

the Wood government body, to increase

Review, exploration and recovery

Rig stats echoed the around existing assets, as review ? nd- well as helping to commer-

Worldwide ings. It said cialize known but “parked”

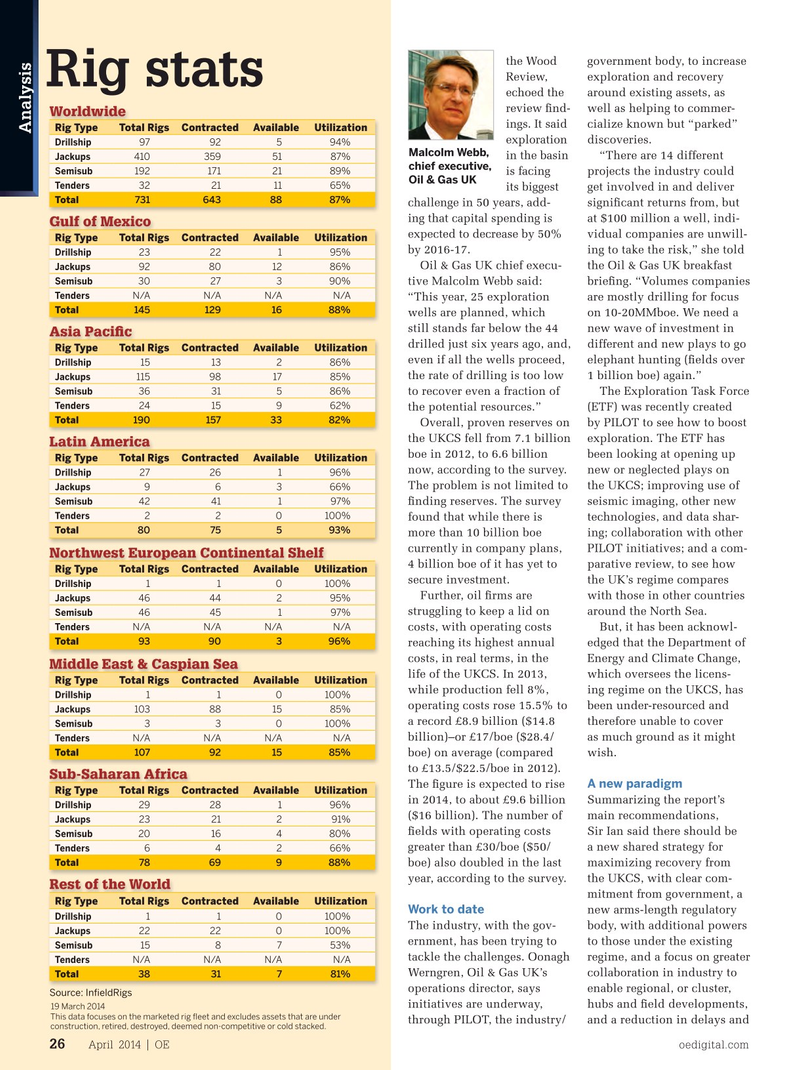

Rig Type Total Rigs Contracted Available Utilization

Analysis exploration discoveries.

Drillship 97 92 5 94%

Malcolm Webb, in the basin “There are 14 different 410 359 51 87%Jackups chief executive,

Semisub 192 171 21 89% is facing projects the industry could

Oil & Gas UK 32 21 11 65%Tenders its biggest get involved in and deliver 731 643 88 87%Total challenge in 50 years, add- signi? cant returns from, but ing that capital spending is at $100 million a well, indi-

Gulf of Mexico expected to decrease by 50% vidual companies are unwill-

Rig Type Total Rigs Contracted Available Utilization by 2016-17. ing to take the risk,” she told 23 22 1 95%Drillship

Oil & Gas UK chief execu- the Oil & Gas UK breakfast 92 80 1286%

Jackups 30 27 390%

Semisub tive Malcolm Webb said: brie? ng. “Volumes companies

N/A N/AN/A N/A

Tenders “This year, 25 exploration are mostly drilling for focus 145 129 16 88%

Total wells are planned, which on 10-20MMboe. We need a still stands far below the 44 new wave of investment in

Asia Paci? c drilled just six years ago, and, different and new plays to go

Rig Type Total Rigs Contracted Available Utilization even if all the wells proceed, elephant hunting (? elds over

Drillship 15 13 286% the rate of drilling is too low 1 billion boe) again.” 115 98 17 85%

Jackups

Semisub 36 31 586% to recover even a fraction of The Exploration Task Force 24 15 9 62%

Tenders the potential resources.” (ETF) was recently created 190 157 3382%

Total

Overall, proven reserves on by PILOT to see how to boost the UKCS fell from 7.1 billion exploration. The ETF has

Latin America boe in 2012, to 6.6 billion been looking at opening up

Rig Type Total Rigs Contracted Available Utilization now, according to the survey. new or neglected plays on

Drillship 27 26 196%

The problem is not limited to the UKCS; improving use of

Jackups 9 6 366% The basin in 2014, according to Oil & Gas UK, based on its 2014 Activity Survey. 42 41 1 97%

Semisub ? nding reserves. The survey seismic imaging, other new 2 2 0100%

Tenders found that while there is technologies, and data shar- complexity. He emphasized 80 75 5 93%

Total more than 10 billion boe ing; collaboration with other that the new regulator’s role currently in company plans, PILOT initiatives; and a com- would focus on stewardship,

Northwest European Continental Shelf 4 billion boe of it has yet to parative review, to see how rather than regulation.

Rig Type Total Rigs Contracted Available Utilization secure investment. the UK’s regime compares The review outlines six

Drillship 1 1 0100%

Further, oil ? rms are with those in other countries sector strategies, covering:

Jackups 46 44 2 95% struggling to keep a lid on around the North Sea. exploration, asset steward- 46 45 1 97%

Semisub

Tenders

N/A N/AN/A N/A costs, with operating costs But, it has been acknowl- ship, regional development,

Total 93 90 396% reaching its highest annual edged that the Department of infrastructure, technology, costs, in real terms, in the Energy and Climate Change, and decommissioning.

Middle East & Caspian Sea life of the UKCS. In 2013, which oversees the licens-

Rig Type Total Rigs Contracted Available Utilization

Exploration while production fell 8%, ing regime on the UKCS, has

Drillship 1 1 0100% operating costs rose 15.5% to been under-resourced and The largest section, and the 103 88 15 85%

Jackups a record £8.9 billion ($14.8 therefore unable to cover biggest challenge, among 3 3 0100%

Semisub billion)–or £17/boe ($28.4/ as much ground as it might these was how to increase

N/A N/AN/A N/A

Tenders 107 92 15 85%

Total boe) on average (compared wish. exploration rates.

According to the review, to £13.5/$22.5/boe in 2012).

Sub-Saharan Africa

A new paradigm more than 360 exploration

The ? gure is expected to rise

Rig Type Total Rigs Contracted Available Utilization wells have been drilled on the in 2014, to about £9.6 billion Summarizing the report’s

Drillship 29 28 196%

UKCS since 2000, leading to ($16 billion). The number of main recommendations, 23 21 2 91%

Jackups the discovery of 4.2 billion ? elds with operating costs Sir Ian said there should be 20 16 480%

Semisub boe. However, post-2008, greater than £30/boe ($50/ a new shared strategy for 6 4 266%

Tenders 78 69 988%

Total exploration activity has fallen boe) also doubled in the last maximizing recovery from sharply, reaching a low of 14 year, according to the survey. the UKCS, with clear com-

Rest of the World mitment from government, a wells in 2011. Last year was

Rig Type Total Rigs Contracted Available Utilization

Work to date new arms-length regulatory not much better, with just 15

Drillship 1 1 0100%

The industry, with the gov- body, with additional powers exploration wells reported.

Jackups 22 22 0100% ernment, has been trying to to those under the existing According to the review, to 15 8 7 53%

Semisub tackle the challenges. Oonagh regime, and a focus on greater boost exploration rates, access

Tenders

N/A N/AN/A N/A

Werngren, Oil & Gas UK’s collaboration in industry to to geological information and

Total 38 31 7 81% operations director, says enable regional, or cluster, the corresponding ability to

Source: In? eldRigs initiatives are underway, hubs and ? eld developments, evaluate new plays needs to 19 March 2014

This data focuses on the marketed rig ? eet and excludes assets that are under through PILOT, the industry/ and a reduction in delays and be addressed. It suggests that construction, retired, destroyed, deemed non-competitive or cold stacked.

April 2014 | OE oedigital.com 26 000_OE0414_Analysis-Wood.indd 26 3/23/14 9:16 AM

23

23

25

25