Page 78: of Offshore Engineer Magazine (Oct/Nov 2014)

Read this page in Pdf, Flash or Html5 edition of Oct/Nov 2014 Offshore Engineer Magazine

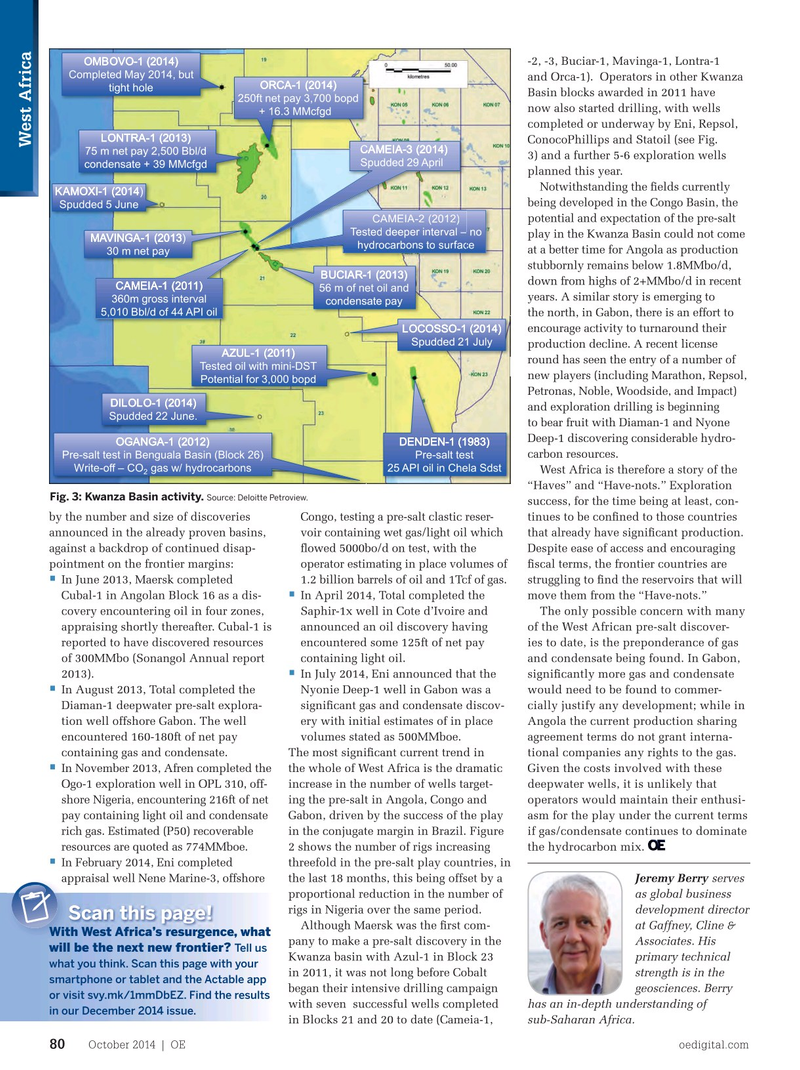

-2, -3, Buciar-1, Mavinga-1, Lontra-1

OMBOVO-1 (2014)

Completed May 2014, but and Orca-1). Operators in other Kwanza

ORCA-1 (2014) tight hole

Basin blocks awarded in 2011 have 250ft net pay 3,700 bopd now also started drilling, with wells + 16.3 MMcfgd completed or underway by Eni, Repsol,

LONTRA-1 (2013)

ConocoPhillips and Statoil (see Fig.

West Africa

CA CAMEIA-3 (2014) 75 m net pay 2,500 Bbl/d 3) and a further 5-6 exploration wells

Spudded 29 April condensate + 39 MMcfgd planned this year.

Notwithstanding the ? elds currently

KAMOXI-1 (2014) being developed in the Congo Basin, the

Spudded 5 June potential and expectation of the pre-salt

CAMEIA-2 (2012)CAMEIA-2 (2012)

T sted deeper interv rv r al – Te Te Tested deeper interval – no play in the Kwanza Basin could not come

MAVINGA-1 (2013) hydrocarbons to surfacehydrocarbons to surf rf r ace at a better time for Angola as production 30 m net pay stubbornly remains below 1.8MMbo/d,

BUCIAR-1 (2013) down from highs of 2+MMbo/d in recent

CAMEIA-1 (2011) 56 m of net oil and years. A similar story is emerging to 360m gross interval condensate pay 5,010 Bbl/d of 44 API oil the north, in Gabon, there is an effort to encourage activity to turnaround their

LOCOSSO-1 (2014)

Spudded 21 July production decline. A recent license

AZUL-1 (2011) round has seen the entry of a number of

Tested oil with mini-DST new players (including Marathon, Repsol,

Potential for 3,000 bopd

Petronas, Noble, Woodside, and Impact)

DILOLO-1 (2014) and exploration drilling is beginning

Spudded 22 June.

to bear fruit with Diaman-1 and Nyone

Deep-1 discovering considerable hydro-

OGANGA-1 (2012) DENDEN-1 (1983) carbon resources.

Pre-salt test in BengualaBasin (Block 26) Pre-salt test

Write-off –CO gas w/ hydrocarbons 25 API oil in Chela Sdst

West Africa is therefore a story of the 2 “Haves” and “Have-nots.” Exploration

Fig. 3: Kwanza Basin activity. Source: Deloitte Petroview.

success, for the time being at least, con- by the number and size of discoveries Congo, testing a pre-salt clastic reser- tinues to be con? ned to those countries announced in the already proven basins, voir containing wet gas/light oil which that already have signi? cant production. against a backdrop of continued disap- ? owed 5000bo/d on test, with the Despite ease of access and encouraging pointment on the frontier margins: operator estimating in place volumes of ? scal terms, the frontier countries are •

In June 2013, Maersk completed 1.2 billion barrels of oil and 1Tcf of gas. struggling to ? nd the reservoirs that will •

Cubal-1 in Angolan Block 16 as a dis- In April 2014, Total completed the move them from the “Have-nots.” covery encountering oil in four zones, Saphir-1x well in Cote d’Ivoire and The only possible concern with many appraising shortly thereafter. Cubal-1 is announced an oil discovery having of the West African pre-salt discover- reported to have discovered resources encountered some 125ft of net pay ies to date, is the preponderance of gas of 300MMbo (Sonangol Annual report containing light oil. and condensate being found. In Gabon, • 2013). In July 2014, Eni announced that the signi? cantly more gas and condensate

In August 2013, Total completed the Nyonie Deep-1 well in Gabon was a would need to be found to commer- •

Diaman-1 deepwater pre-salt explora- signi? cant gas and condensate discov- cially justify any development; while in tion well offshore Gabon. The well ery with initial estimates of in place Angola the current production sharing encountered 160-180ft of net pay volumes stated as 500MMboe. agreement terms do not grant interna- containing gas and condensate. The most signi? cant current trend in tional companies any rights to the gas. • In November 2013, Afren completed the the whole of West Africa is the dramatic Given the costs involved with these

Ogo-1 exploration well in OPL 310, off- increase in the number of wells target- deepwater wells, it is unlikely that shore Nigeria, encountering 216ft of net ing the pre-salt in Angola, Congo and operators would maintain their enthusi- pay containing light oil and condensate Gabon, driven by the success of the play asm for the play under the current terms rich gas. Estimated (P50) recoverable in the conjugate margin in Brazil. Figure if gas/condensate continues to dominate resources are quoted as 774MMboe. 2 shows the number of rigs increasing the hydrocarbon mix. • In February 2014, Eni completed threefold in the pre-salt play countries, in appraisal well Nene Marine-3, offshore appraisal well Nene Marine-3, offshore the last 18 months, this being offset by a Jeremy Berry serves proportional reduction in the number of as global business rigs in Nigeria over the same period. development director

Scan this page!

Although Maersk was the ? rst com- at Gaffney, Cline &

With West Africa’s resurgence, what pany to make a pre-salt discovery in the Associates. His Tell us will be the next new frontier?

Kwanza basin with Azul-1 in Block 23 primary technical what you think. Scan this page with your in 2011, it was not long before Cobalt strength is in the smartphone or tablet and the Actable app began their intensive drilling campaign geosciences. Berry or visit svy.mk/1mmDbEZ. Find the results with seven successful wells completed has an in-depth understanding of in our December 2014 issue.

in Blocks 21 and 20 to date (Cameia-1, sub-Saharan Africa.

October 2014 | OE oedigital.com 80 076_OE1014_Geofocus1_gaffney.indd 80 9/23/14 5:26 PM

77

77

79

79