Page 23: of Offshore Engineer Magazine (Mar/Apr 2017)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2017 Offshore Engineer Magazine

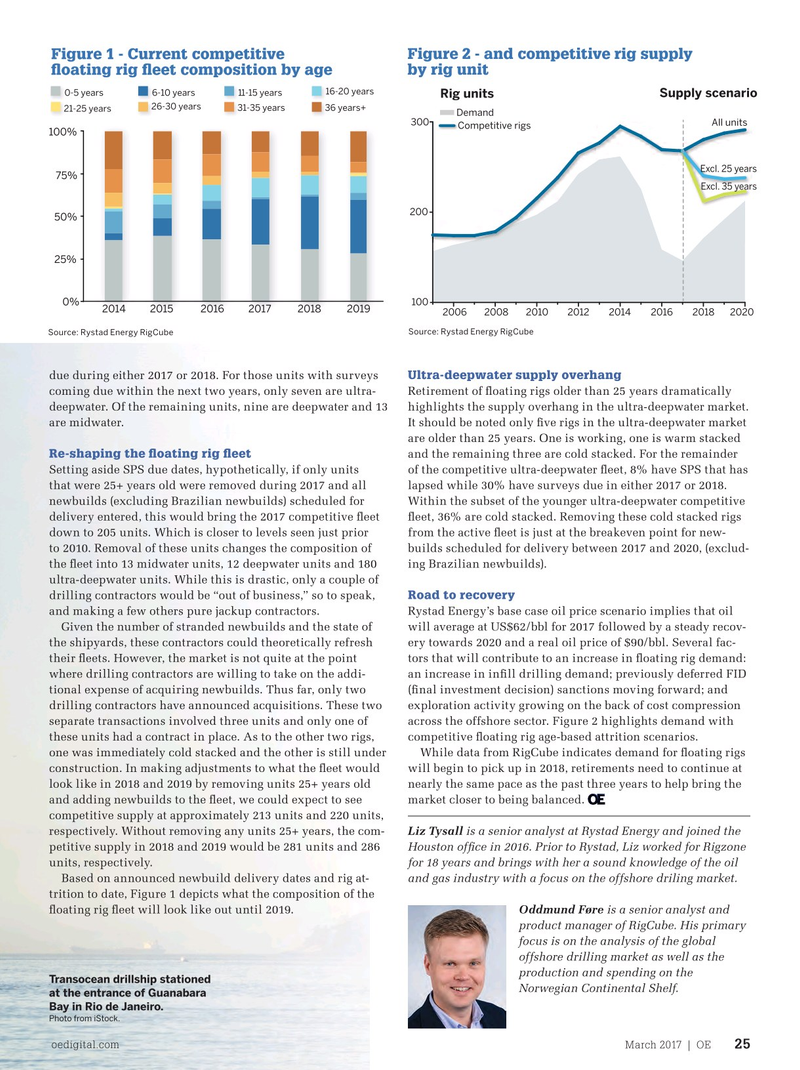

Figure 1 - Current competitive Figure 2 - and competitive rig supply ? oating rig ? eet composition by age by rig unit 16-20 years 0-5 years 6-10 years 11-15 years

Rig units Supply scenario 26-30 years 21-25 years 31-35 years 36 years+

Demand 300 All units

Competitive rigs 100%

Excl. 25 years 75%

Excl. 35 years 200 50%

Ultra-deepwater 25% 100 0% 201420152016201720182019 2006 2008 2010 2012 2014 2016 2018 2020 facing supply

Source: Rystad Energy RigCube Source: Rystad Energy RigCube due during either 2017 or 2018. For those units with surveys Ultra-deepwater supply overhang coming due within the next two years, only seven are ultra- Retirement of ? oating rigs older than 25 years dramatically deepwater. Of the remaining units, nine are deepwater and 13 highlights the supply overhang in the ultra-deepwater market. steepest recovery are midwater. It should be noted only ? ve rigs in the ultra-deepwater market are older than 25 years. One is working, one is warm stacked

Re-shaping the ? oating rig ? eet and the remaining three are cold stacked. For the remainder lthough drilling contractors are scrapping ? oating Setting aside SPS due dates, hypothetically, if only units of the competitive ultra-deepwater ? eet, 8% have SPS that has rigs at a relatively decent pace, removing only older that were 25+ years old were removed during 2017 and all lapsed while 30% have surveys due in either 2017 or 2018.

A rigs will not correct the looming supply over-hang in newbuilds (excluding Brazilian newbuilds) scheduled for Within the subset of the younger ultra-deepwater competitive the ultra-deepwater market. Cold stacking in the ultra-deepwa- delivery entered, this would bring the 2017 competitive ? eet ? eet, 36% are cold stacked. Removing these cold stacked rigs ter market will close the gap, but will not resolve the problem down to 205 units. Which is closer to levels seen just prior from the active ? eet is just at the breakeven point for new- long-term. to 2010. Removal of these units changes the composition of builds scheduled for delivery between 2017 and 2020, (exclud- the ? eet into 13 midwater units, 12 deepwater units and 180 ing Brazilian newbuilds).

Utilization statistics ultra-deepwater units. While this is drastic, only a couple of

As we head into 2017, utilization of the competitive ? oat- drilling contractors would be “out of business,” so to speak,

Road to recovery ing rig ? eet stands at 47%. This compares to early 2014 and making a few others pure jackup contractors. Rystad Energy’s base case oil price scenario implies that oil when utilization was at 85%. As oil prices started declin- Given the number of stranded newbuilds and the state of will average at US$62/bbl for 2017 followed by a steady recov- ing in 2014, drilling contractors were reading the writing the shipyards, these contractors could theoretically refresh ery towards 2020 and a real oil price of $90/bbl. Several fac- on the wall and rig attrition began in earnest. By the end their ? eets. However, the market is not quite at the point tors that will contribute to an increase in ? oating rig demand: of 2014, 19 ? oating rigs exited the ? eet, followed by 27 where drilling contractors are willing to take on the addi- an increase in in? ll drilling demand; previously deferred FID during 2015 and 24 during 2016. Since 2014, taking into tional expense of acquiring newbuilds. Thus far, only two (? nal investment decision) sanctions moving forward; and consideration rig attrition and new entrants, the annual- drilling contractors have announced acquisitions. These two exploration activity growing on the back of cost compression ized rate of decline for the competitive ? oating rig ? eet separate transactions involved three units and only one of across the offshore sector. Figure 2 highlights demand with has been approximately -6%/yr. Rig attrition announce- these units had a contract in place. As to the other two rigs, competitive ? oating rig age-based attrition scenarios. ments slowed slightly towards the end of 2016. Based on one was immediately cold stacked and the other is still under While data from RigCube indicates demand for ? oating rigs research by Rystad Energy, we expect construction. In making adjustments to what the ? eet would will begin to pick up in 2018, retirements need to continue at retirements of between 8-10 ? oating rigs look like in 2018 and 2019 by removing units 25+ years old nearly the same pace as the past three years to help bring the during 1H 2017. and adding newbuilds to the ? eet, we could expect to see market closer to being balanced.

Taking a closer look at some statis- competitive supply at approximately 213 units and 220 units, tics, 39% of the idle ? oating rigs have respectively. Without removing any units 25+ years, the com- Liz Tysall is a senior analyst at Rystad Energy and joined the delivery dates prior to the year 2000. petitive supply in 2018 and 2019 would be 281 units and 286 Houston of? ce in 2016. Prior to Rystad, Liz worked for Rigzone

The SPS (special periodic survey) on units, respectively. for 18 years and brings with her a sound knowledge of the oil 20% of these units has lapsed and an- Based on announced newbuild delivery dates and rig at- and gas industry with a focus on the offshore driling market.

other 54% have surveys that will come trition to date, Figure 1 depicts what the composition of the ? oating rig ? eet will look like out until 2019. Oddmund Føre is a senior analyst and product manager of RigCube. His primary focus is on the analysis of the global offshore drilling market as well as the production and spending on the

Transocean drillship stationed

Norwegian Continental Shelf. at the entrance of Guanabara

Bay in Rio de Janeiro.

Photo from iStock.

oedigital.com March 2017 | OE 25 024_OE0217_Feat1_Rystad.indd 25 2/21/17 5:50 PM

22

22

24

24