Page 48: of Offshore Engineer Magazine (Mar/Apr 2020)

Offshore Wind Outlook

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2020 Offshore Engineer Magazine

THE FINAL WORD OFFSHORE WIND to provide a new energy source of millions of onshore con- Even with the delay, East Coast states are moving ahead sumers. The Vineyard Wind delay could create bottlenecks with their plans for offshore wind. Six states announced more at the East Coasts ports that are tasked with building the off- than 16 gigawatts of new offshore wind targets in 2019 alone. shore wind industry. While companies are spending millions In total, more than 25 gigawatts of offshore wind projects are of dollars upgrading and expanding existing East Coast port targeted by Atlantic states. facilities, there is no one single port that can handle every type Furthermore, states are not just theorizing about wind, they of project needed to build an entire offshore wind industry. are actively awarding wind contacts. In the past year, New

Wind developers, and their vendors, will utilize a network of York awarded 1.7 gigawatts of offshore wind contracts to two

East Coast ports to meet their various needs. The complexity projects; New Jersey gave the green light for a 1.1-gigawatt of orchestrating such a logistical network, means that if there project; Connecticut signed a 804-megawatt deal; and off- is a “stacking effect” at one port, there could be ripples of de- shore Virginia, construction began on the ?rst wind farm in lays at virtually every other East Coast port. federal waters.

The Bureau of Ocean Energy Management (BOEM), the States are pushing offshore wind forward, to the bene?t of federal regulator with authority over offshore wind leasing, millions of Americans. Close to $70 billion in capital expen- understands these risks. BOEM delaying Vineyard Wind, ditures by 2030 will be needed, and more than 160,000 di- shows, almost counterintuitively, how invested the govern- rect, indirect or induced jobs could be created by 2050. The ment is in the success of offshore wind. Getting it right is most recent offshore wind lease auction generated $405 mil- more important than getting it ?rst. This means ?nalizing lion in Federal revenues. Clearly, there is more hinging on the an environmental analysis that can be used to support and success of Vineyard Wind and other permits than ever before. streamline approvals for vast offshore wind projects that are The Trump administration is checking every box to make being planned throughout the Atlantic. sure that offshore wind is a success story, and the U.S. De-

Cape Wind is a warning of what can happen to a new in- partment of the Interior is making sure history does not re- dustry. Vineyard Wind was not always supposed to be the ?rst peat itself. Realigning the interpretation of the Migratory Bird offshore American wind project. Cape Wind owned that dis- Treaty Act (MBTA) to meet its statutory intent and reforming tinction. The $2.6 billion project with 130 turbines would the National Environmental Policy Act (NEPA) allow com- eventually power 200,000 along Cape Cod. But onerous reg- mon-sense to prevail and limit the ability of litigation to derail ulations and short-sighted litigation can end the hopes of any massively important projects that bene?t energy consumers ascendant industry as fast as any market miscalculation. In while protecting the environment. 2017, Cape Wind had to pull the plug on its project of Cape But without a ?rm regulatory foundation to build upon, all

Cod after years of, as the New York Times described it, “end- the bene?ts of offshore wind will vanish overnight. The ?nal less litigation.” Round after round of lawsuits drove up costs stroke – getting past the Vineyard Wind permitting hurdles and established delays and prevented Massachusetts residents by getting it right – will open the door to an offshore wind from being able to access a new energy source. industry that will be here for a long, long time.

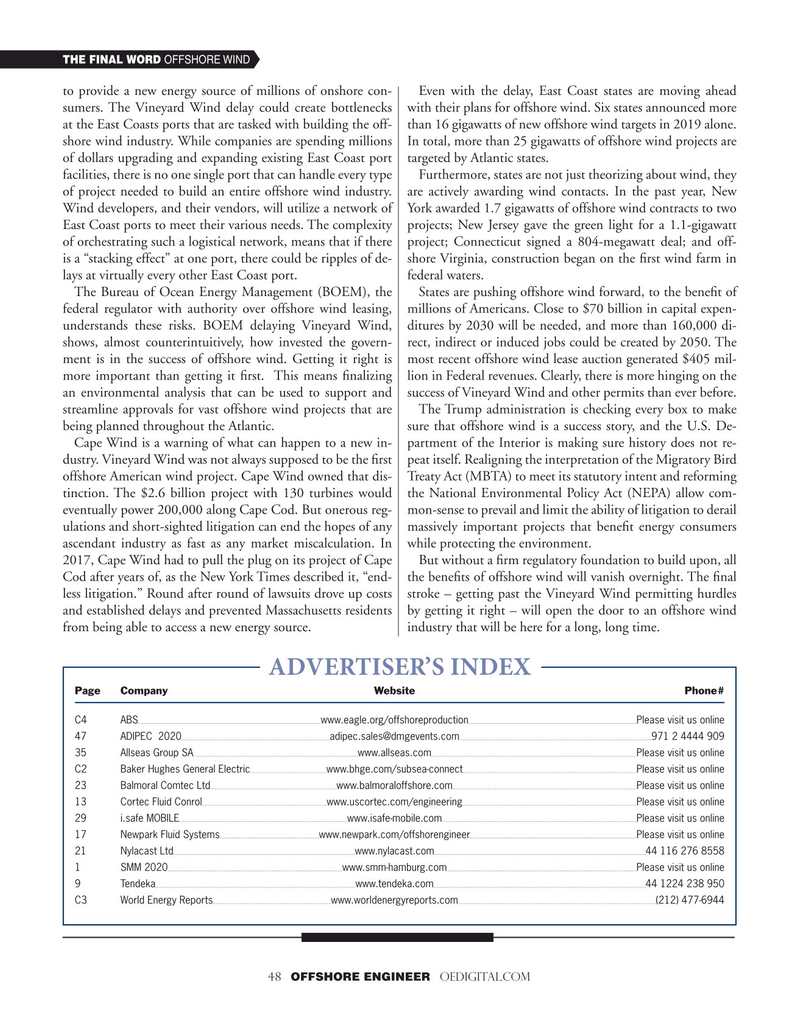

ADVERTISER’S INDEX

Page Company Website Phone#

C4 ABS www.eagle.org/offshoreproduction Please visit us online 47 ADIPEC 2020 [email protected] 971 2 4444 909 35 Allseas Group SA www.allseas.com Please visit us online

C2 Baker Hughes General Electric www.bhge.com/subsea-connect Please visit us online 23 Balmoral Comtec Ltd www.balmoraloffshore.com Please visit us online 13 Cortec Fluid Conrol www.uscortec.com/engineering Please visit us online 29 i.safe MOBILE www.isafe-mobile.com Please visit us online 17 Newpark Fluid Systems www.newpark.com/offshorengineer Please visit us online 21 Nylacast Ltd www.nylacast.com 44 116 276 8558 1 SMM 2020 www.smm-hamburg.com Please visit us online 9 Tendeka www.tendeka.com 44 1224 238 950

C3 World Energy Reports www.worldenergyreports.com (212) 477-6944 48 OFFSHORE ENGINEER OEDIGITAL.COM

47

47

3rd Cover

3rd Cover