Page 24: of Offshore Engineer Magazine (Jan/Feb 2021)

Floating Production Outlook

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2021 Offshore Engineer Magazine

FEATURE FPSOs 2016. Contracts for four FPSOs were placed in 2020 – three variety of contractors in SE Asia, Northern Europe and Brazil. for Brazil, one for Senegal.

Planned FPSO Projects

All told, 64 of the 79 FPSO contracts (81%) over the past ten years entailed construction or conversion of ?rst time FP- As of mid-January 2021, there were 110 projects in the

SOs. These FPSOs have not previously operated as production planning stage that could require an FPSO as a production units. Another 15 contracts (19%) involved redeployment of system. Around 38% of FPSO projects in the planning stage an existing FPSO to a new ?eld. Typically the redeployment are located in Brazil, some of which require multiple FPSOs. contract involves major modi?cation of the process plant and Africa is in second place, with 24% of planned FPSO proj- mooring system, plus general upgrade to the entire unit. ects. Nigeria and Angola account for two-thirds of the Af- rican projects. Other major locations are SE Asia, Northern

FPSOs Now Being Built

Europe, Guyana/Suriname and Australia.

Twenty FPSOs are currently on order. Six are in the ?nal Details for all FPSO projects in the planning queue are pro- stage of completion, with delivery scheduled over the next 12 vided in the WER online database, information that is kept months. Seven are scheduled for completion in 2022. Sev- up to date on a daily basis.

en more are in the early stage of construction with delivery

Projected Orders for FPSOs planned in 2023/24.

Eight (40%) of the FPSOs on order are being built for use A bottom-up methodology was used to forecast the num- offshore Brazil. The others are destined for Guyana (2), In- ber of FPSO orders. We examined each FPSO project in the dia (2), Mauritania/Senegal (2), UK/Norway (2), Israel (1), planning queue to determine its probability to proceed to an and Mexico (1). Two more orders are speculative FPSO hulls investment decision by end-2025. The forecast takes into ac- likely to be used on projects in Brazil or Guyana. count future oil prices, capex budgets, deepwater competitive-

China is the dominant location for FPSO construction and ness and other underlying business drivers in each of three conversion. Seventeen of the 20 FPSOs on order are partially market scenarios – as well as each project’s status, barriers to or fully contracted to Chinese yards. Singapore has retained proceeding, size and quality of reserves, operator ?nancial the second position, with at least partial involvement in 2 of strength and capex allocation strategy and other factors.

the 20 orders. Korean yards – which had been a powerful force Depending on the future business scenario we expect orders in this market sector – have only one FPSO contract in prog- for 23 to 48 FPSOs over the next ?ve years. Our most likely ress. Topsides plant fabrication and integration is spread over a forecast is 37 FPSO orders. This ?gure is 28% higher than the

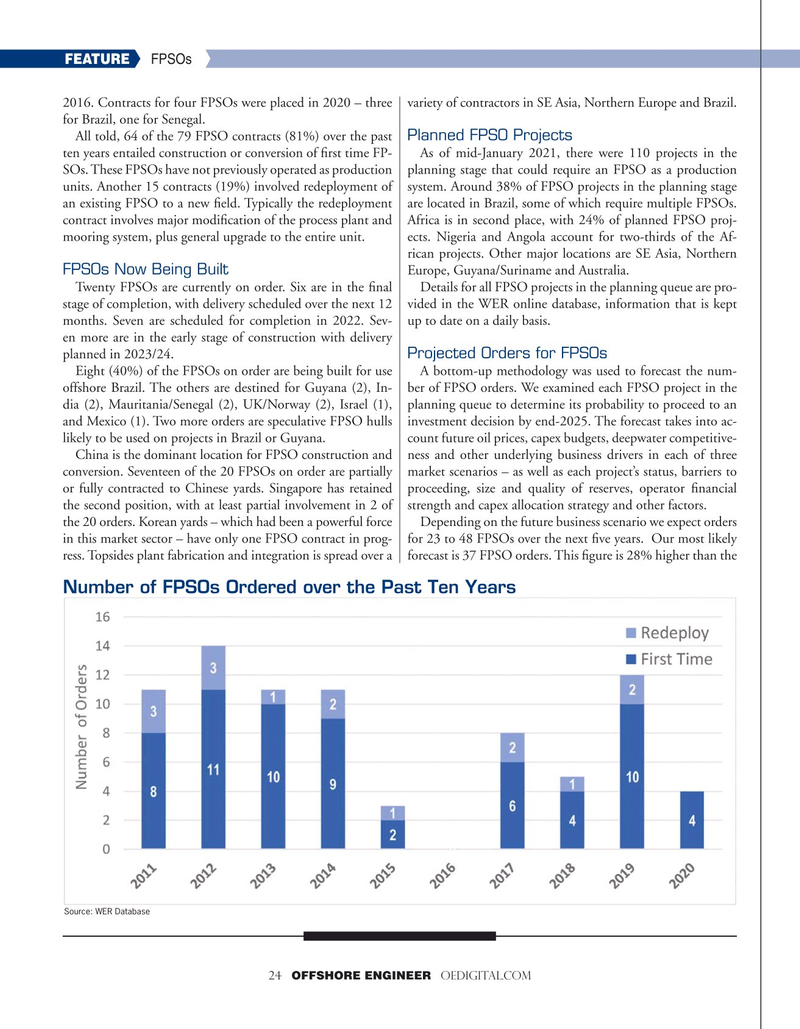

Number of FPSOs Ordered over the Past Ten Years

Source: WER Database 24 OFFSHORE ENGINEER OEDIGITAL.COM

23

23

25

25