Page 15: of Offshore Engineer Magazine (Sep/Oct 2021)

Digital Transformation

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2021 Offshore Engineer Magazine

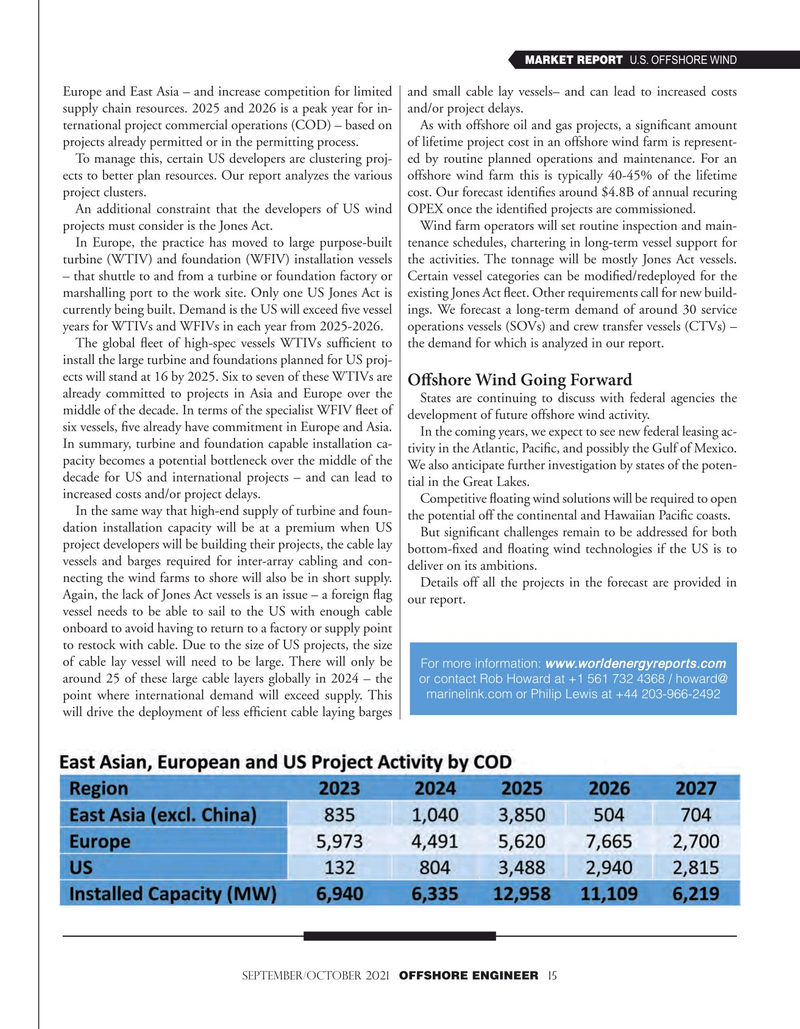

MARKET REPORT U.S. OFFSHORE WIND

Europe and East Asia – and increase competition for limited and small cable lay vessels– and can lead to increased costs supply chain resources. 2025 and 2026 is a peak year for in- and/or project delays.

ternational project commercial operations (COD) – based on As with offshore oil and gas projects, a signifcant amount projects already permitted or in the permitting process. of lifetime project cost in an offshore wind farm is represent-

To manage this, certain US developers are clustering proj- ed by routine planned operations and maintenance. For an ects to better plan resources. Our report analyzes the various offshore wind farm this is typically 40-45% of the lifetime project clusters. cost. Our forecast identifes around $4.8B of annual recuring

An additional constraint that the developers of US wind OPEX once the identifed projects are commissioned.

projects must consider is the Jones Act. Wind farm operators will set routine inspection and main-

In Europe, the practice has moved to large purpose-built tenance schedules, chartering in long-term vessel support for turbine (WTIV) and foundation (WFIV) installation vessels the activities. The tonnage will be mostly Jones Act vessels. – that shuttle to and from a turbine or foundation factory or Certain vessel categories can be modifed/redeployed for the marshalling port to the work site. Only one US Jones Act is existing Jones Act feet. Other requirements call for new build- currently being built. Demand is the US will exceed fve vessel ings. We forecast a long-term demand of around 30 service years for WTIVs and WFIVs in each year from 2025-2026. operations vessels (SOVs) and crew transfer vessels (CTVs) –

The global feet of high-spec vessels WTIVs suffcient to the demand for which is analyzed in our report.

install the large turbine and foundations planned for US proj- ects will stand at 16 by 2025. Six to seven of these WTIVs are

Ofshore Wind Going Forward already committed to projects in Asia and Europe over the

States are continuing to discuss with federal agencies the middle of the decade. In terms of the specialist WFIV feet of development of future offshore wind activity. six vessels, fve already have commitment in Europe and Asia.

In the coming years, we expect to see new federal leasing ac-

In summary, turbine and foundation capable installation ca- tivity in the Atlantic, Pacifc, and possibly the Gulf of Mexico. pacity becomes a potential bottleneck over the middle of the We also anticipate further investigation by states of the poten- decade for US and international projects – and can lead to tial in the Great Lakes.

increased costs and/or project delays.

Competitive foating wind solutions will be required to open

In the same way that high-end supply of turbine and foun- the potential off the continental and Hawaiian Pacifc coasts. dation installation capacity will be at a premium when US

But signifcant challenges remain to be addressed for both project developers will be building their projects, the cable lay bottom-fxed and foating wind technologies if the US is to vessels and barges required for inter-array cabling and con- deliver on its ambitions.

necting the wind farms to shore will also be in short supply.

Details off all the projects in the forecast are provided in

Again, the lack of Jones Act vessels is an issue – a foreign fag our report.

vessel needs to be able to sail to the US with enough cable onboard to avoid having to return to a factory or supply point to restock with cable. Due to the size of US projects, the size of cable lay vessel will need to be large. There will only be

For more information: www.worldenergyreports.com around 25 of these large cable layers globally in 2024 – the or contact Rob Howard at +1 561 732 4368 / howard@ marinelink.com or Philip Lewis at +44 203-966-2492 point where international demand will exceed supply. This will drive the deployment of less effcient cable laying barges september/october 2021 OFFSHORE ENGINEER 15

14

14

16

16