Page 9: of Offshore Engineer Magazine (Jan/Feb 2024)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2024 Offshore Engineer Magazine

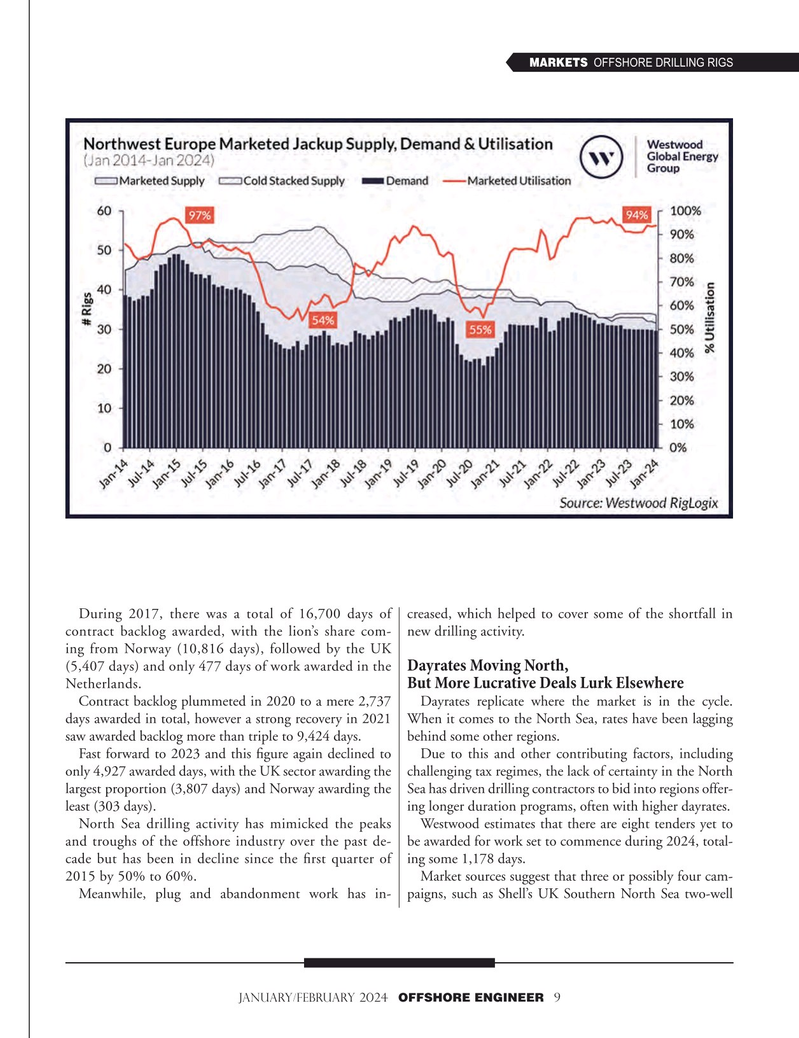

MARKETS OFFSHORE DRILLING RIGS

During 2017, there was a total of 16,700 days of creased, which helped to cover some of the shortfall in contract backlog awarded, with the lion’s share com- new drilling activity. ing fr om N orway (10,816 days), followed by the UK (5,407 days) and only 477 days of work awarded in the

Dayrates Moving North,

Netherlands.

But More Lucrative Deals Lurk Elsewhere

Contract backlog plummeted in 2020 to a mere 2,737 Dayrates replicate where the market is in the cycle. days awar ded in total, however a strong recovery in 2021 When it comes to the North Sea, rates have been lagging saw awarded backlog more than triple to 9,424 days. behind some other regions.

Fast forward to 2023 and this fgure again declined to Due to this and other contributing factors, including only 4,927 awarded days, with the UK sector awarding the challenging tax regimes, the lack of certainty in the North largest pr oportion (3,807 days) and Norway awarding the Sea has driven drilling contractors to bid into regions offer- least (303 days). ing longer duration programs, often with higher dayrates.

North Sea drilling activity has mimicked the peaks Westwood estimates that there are eight tenders yet to and troughs of the offshore industry over the past de- be awarded for work set to commence during 2024, total- cade but has been in decline since the frst quarter of ing some 1,178 days. 2015 by 50% to 60%. Market sources suggest that three or possibly four cam-

Meanwhile, plug and abandonment work has in- paigns, such as Shell’s UK Southern North Sea two-well january/february 2024 OFFSHORE ENGINEER 9

8

8

10

10