Page 30: of Offshore Engineer Magazine (Jan/Feb 2024)

Read this page in Pdf, Flash or Html5 edition of Jan/Feb 2024 Offshore Engineer Magazine

COVER FEATURE FLOATING PRODUCTION

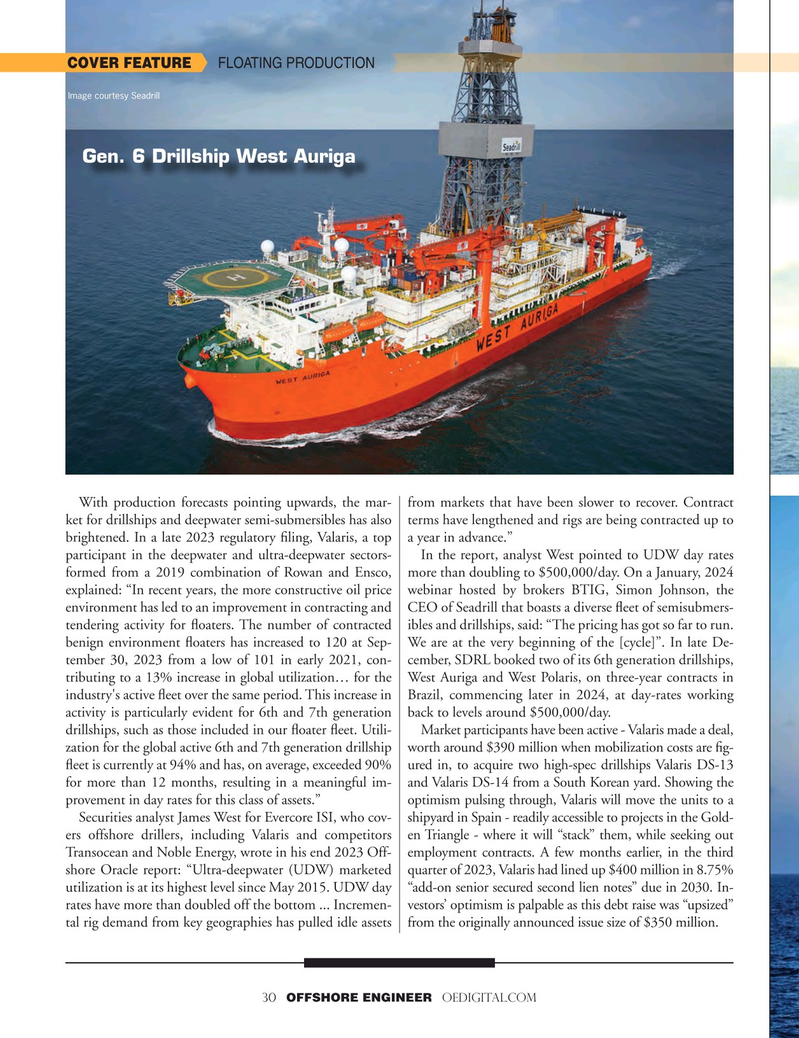

Image courtesy Seadrill

Gen. 6 Drillship West Auriga

With production forecasts pointing upwards, the mar- from markets that have been slower to recover. Contract ket for drillships and deepwater semi-submersibles has also terms have lengthened and rigs are being contracted up to brightened. In a late 2023 regulatory fling, Valaris, a top a year in advance.” participant in the deepwater and ultra-deepwater sectors- In the report, analyst West pointed to UDW day rates formed from a 2019 combination of Rowan and Ensco, more than doubling to $500,000/day. On a January, 2024 explained: “In recent years, the more constructive oil price webinar hosted by brokers BTIG, Simon Johnson, the environment has led to an improvement in contracting and CEO of Seadrill that boasts a diverse feet of semisubmers- tendering activity for foaters. The number of contracted ibles and drillships, said: “The pricing has got so far to run. benign environment foaters has increased to 120 at Sep- We are at the very beginning of the [cycle]”. In late De- tember 30, 2023 from a low of 101 in early 2021, con- cember, SDRL booked two of its 6th generation drillships, tributing to a 13% increase in global utilization… for the West Auriga and West Polaris, on three-year contracts in industry's active feet over the same period. This increase in Brazil, commencing later in 2024, at day-rates working activity is particularly evident for 6th and 7th generation back to levels around $500,000/day.

drillships, such as those included in our foater feet. Utili- Market participants have been active - Valaris made a deal, zation for the global active 6th and 7th generation drillship worth around $390 million when mobilization costs are fg- feet is currently at 94% and has, on average, exceeded 90% ured in, to acquire two high-spec drillships Valaris DS-13 for more than 12 months, resulting in a meaningful im- and Valaris DS-14 from a South Korean yard. Showing the provement in day rates for this class of assets.” optimism pulsing through, Valaris will move the units to a

Securities analyst James West for Evercore ISI, who cov- shipyard in Spain - readily accessible to projects in the Gold- ers offshore drillers, including Valaris and competitors en Triangle - where it will “stack” them, while seeking out

Transocean and Noble Energy, wrote in his end 2023 Off- employment contracts. A few months earlier, in the third shore Oracle report: “Ultra-deepwater (UDW) marketed quarter of 2023, Valaris had lined up $400 million in 8.75% utilization is at its highest level since May 2015. UDW day “add-on senior secured second lien notes” due in 2030. In- rates have more than doubled off the bottom ... Incremen- vestors’ optimism is palpable as this debt raise was “upsized” tal rig demand from key geographies has pulled idle assets from the originally announced issue size of $350 million. 30 OFFSHORE ENGINEER OEDIGITAL.COM

29

29

31

31