US Barging Industry Navigating Black Swan Events

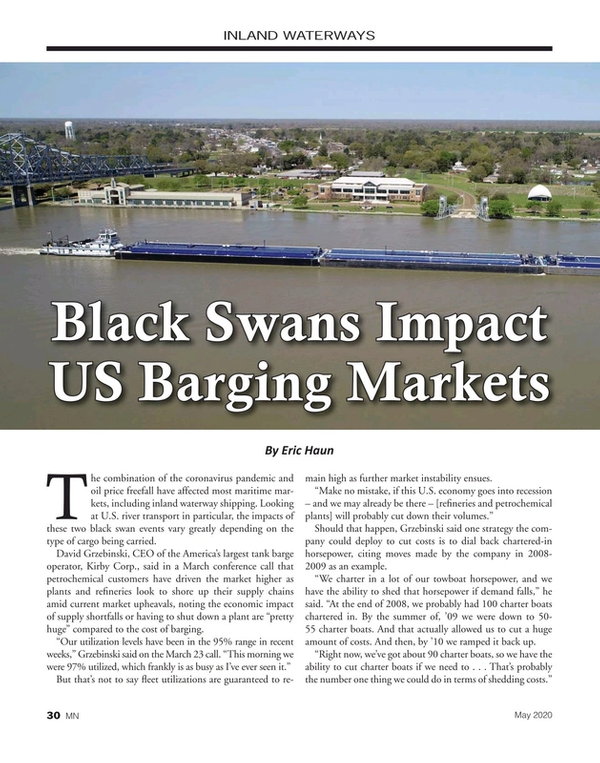

The combination of the coronavirus pandemic and oil price freefall have affected most maritime markets, including inland waterway shipping. Looking at U.S. river transport in particular, the impacts of these two black swan events vary greatly depending on the type of cargo being carried.

David Grzebinski, CEO of the America’s largest tank barge operator, Kirby Corp., said in a March conference call that petrochemical customers have driven the market higher as plants and refineries look to shore up their supply chains amid current market upheavals, noting the economic impact of supply shortfalls or having to shut down a plant are “pretty huge” compared to the cost of barging.

“Our utilization levels have been in the 95% range in recent weeks,” Grzebinski said on the March 23 call. “This morning we were 97% utilized, which frankly is as busy as I've ever seen it.”

But that’s not to say fleet utilizations are guaranteed to remain high as further market instability ensues.

“Make no mistake, if this U.S. economy goes into recession – and we may already be there – [refineries and petrochemical plants] will probably cut down their volumes.”

Should that happen, Grzebinski said one strategy the company could deploy to cut costs is to dial back chartered-in horsepower, citing moves made by the company in 2008-2009 as an example.

“We charter in a lot of our towboat horsepower, and we have the ability to shed that horsepower if demand falls,” he said. “At the end of 2008, we probably had 100 charter boats chartered in. By the summer of, ’09 we were down to 50-55 charter boats. And that actually allowed us to cut a huge amount of costs. And then, by ’10 we ramped it back up.

“Right now, we've got about 90 charter boats, so we have the ability to cut charter boats if we need to . . . That’s probably the number one thing we could do in terms of shedding costs.”

“Although it's very tough to predict the full impact of the coronavirus in a recession, we think our marine transportation businesses are well positioned to weather this potential depressed market conditions. We anticipate that our volumes could decline, but we believe as in past cycles that our marine customer contracts in our variable cost structure will help to minimize the impact on the company.” Grzebinski said.

© hildeanna / Abobe Stock

© hildeanna / Abobe Stock

The story is entirely different for dry cargo barging, which was a challenged market even before the recent oil price crash and before the novel coronavirus was discovered in December 2019.

The US’ second-largest dry cargo barge owner, American Commercial Lines (ACL), filed for Chapter 11 bankruptcy protection in February, citing in court documents a “confluence of environmental, macroeconomic and industry-specific factors” that have created a “perfect storm” negatively affecting its business.

“Like many others in our industry, over the last four years ACL has been affected by challenging market conditions, the weather and the closure of key areas of the river system for extended periods of time,” said ACL President and CEO, Mark Knoy, in a statement on February 4.

Among factors listed was unusually high levels of rainfall and flooding that have severely hindered inland waterway shipping, resulting in increased operating costs and reduced revenues. “For the quarter ended September 30, 2019, ACL estimates that it lost approximately $18 million in revenue as a result of the high water conditions and periodic river closures. ACL’s operating costs increased by an estimated $86 million during the nine months ended September 30, 2019 as a result of this flooding,” the company said.

ACL also pointed to a barge capacity glut brought on by declines in domestic coal shipments as well as decreased demand for soybeans and other goods as a result of the U.S.-China trade war – two issues that, like challenging weather conditions, are expected to continue into the future.

© Christopher Boswell / Abobe Stock

© Christopher Boswell / Abobe Stock

According to BIMCO, U.S. exports of dry bulk goods to China have fallen by 18.9 million metric tons, 9.1 million of which can be attributed to lost soy bean exports.

BIMCO’s chief shipping analyst Peter Sand said, “'Phase One' of the trade agreement [signed by the U.S. and China in January] may reverse some of the lost volumes in exports to China but it will not necessarily provide a large boost to U.S. exports. . . It also comes in the midst of the coronavirus outbreak which is affecting both demand for the goods in China and their production in the U.S., hampering higher exports.”

For dry cargo barging in general, the combination of depressed oil prices and COVID-19 will only make matters worse, softening demand for coal as well as soybeans and other agricultural goods.

Keep it moving

In any market conditions, and even during a pandemic, vital goods still need to be moved on the U.S. inland waterways, and operators across the country are taking steps to ensure commerce flows continue.

Peter Stephaich, Chairman and CEO of dry and liquid river transportation provider Campbell Transportation CO., said, the company has worked with customers to prepare for the impact of COVID-19 and to ensure essential goods are delivered safely. “Our vessels continue to operate, our shipyards continue to provide critical services, and our tankermen continue to transfer products. These are functions that are necessary to provide essential goods to the public.”

“Our focus remains on the health and safety of our personnel and the public and therefore our response has been very proactive,” Stephaich said, noting that good preparation and training practices have made inland marine transportation industry better suited than most to deal with emergency response.

In March, Campbell implemented an incident command team that has coordinated with health officials and authorities to ensure best practices to maintain the health and safety of company personnel throughout the undefined outbreak period, Stephaich said.

“Some of the changes we have made are social distancing requirements at all facilities, enhanced restricted access to vessels and facilities, work from home requirement for office personnel, and COVID-19 screening protocol prior to crew change of the vessels or shift change at facilities,” Stephaich said. “These new processes have changed the way we work, but I’m happy to report we have managed through them effectively and have no reported cases of COVID-19 at any of our facilities or vessels.”

(Image: U.S. Centers for Disease Control and Prevention)The American Waterways Operators (AWO) has made available on its website a number of tools and resources to help operators navigate the coronavirus pandemic. In a recent webinar presented by the organization, CTEH’s Dr. Christopher Kuhlman, a board-certified toxicologist and industrial hygienist covered a wide range of maritime-specific COVID-19 emergency response issues, including the proper use of personal protective equipment (PPE) as well as best practices for screening crew members and disinfecting vessel areas. (Image: U.S. Centers for Disease Control and Prevention)The American Waterways Operators (AWO) has made available on its website a number of tools and resources to help operators navigate the coronavirus pandemic. In a recent webinar presented by the organization, CTEH’s Dr. Christopher Kuhlman, a board-certified toxicologist and industrial hygienist covered a wide range of maritime-specific COVID-19 emergency response issues, including the proper use of personal protective equipment (PPE) as well as best practices for screening crew members and disinfecting vessel areas.Keeping vessels coronavirus free is a safety concern first and foremost, but there are also financial factors to be considered. If a crewmember were to contract the coronavirus, costs for sidelining the vessel mid-journey, quarantining the crew, cleaning the vessel and mobilizing another crew could run $40,000 to $50,000 per day, Canal Barge CEO, Merritt Lane, told Reuters, adding that the outage of one vessel could run into the hundreds of thousands of dollars. |

(Photo: Campbell Transportation Company)

(Photo: Campbell Transportation Company)

While transport operations have continued on U.S. rivers through COVID-19, profound short- and long-term impacts are to be expected. “The inland marine transportation industry is not immune to the effects of COVID-19 on operations and demand for our services,” Stephaich said.

COVID-19’s immediate impacts are glaring, and short-term effects are beginning to come into focus. “It’s apparent that we will realize a new normal. Our way of operating has been changed due to the threat of this pandemic,” Stephaich said. “I envision enhanced screening and testing protocols will remain for an extended period of time. I also believe we have learned how to better utilize technology in our regular operations.”

Looking further down the line, Stephaich said the outlook becomes hazy: “The long-term effects on our business are still undetermined. . . There is too much uncertainty at this point to provide definitive guidance on the long-term impact from COVID-19 on our markets.”

“Certain industries we serve will likely be in a prolonged downturn due to the economic slowdown we are experiencing,” he said. “Energy markets are being impacted due to reduced demand and an oversupply from the Russia and Saudi market disruptions.”

“We still believe there is an essential need for low-cost transportation of bulk products in the future,” Stephaich added. “That provides us with certainty that our high-quality equipment and personnel will still be in demand.”

Read US Barging Industry Navigating Black Swan Events in Pdf, Flash or Html5 edition of May 2020 Marine News

Other stories from May 2020 issue

Content

- INSIGHTS: Mary Ann Bucci, Executive Director, Port of Pittsburgh Commission page: 12

- COVID-19 Economic Recovery Should Include Infrastructure Investment page: 20

- The Unsung Benefits of the Inland Waterways page: 22

- US Barging Industry Navigating Black Swan Events page: 30

- Port of Indiana-Mt. Vernon Makes ‘Next Generation’ Terminal Upgrades page: 38