Page 38: of Maritime Logistics Professional Magazine (Q3 2013)

Training & Security

Read this page in Pdf, Flash or Html5 edition of Q3 2013 Maritime Logistics Professional Magazine

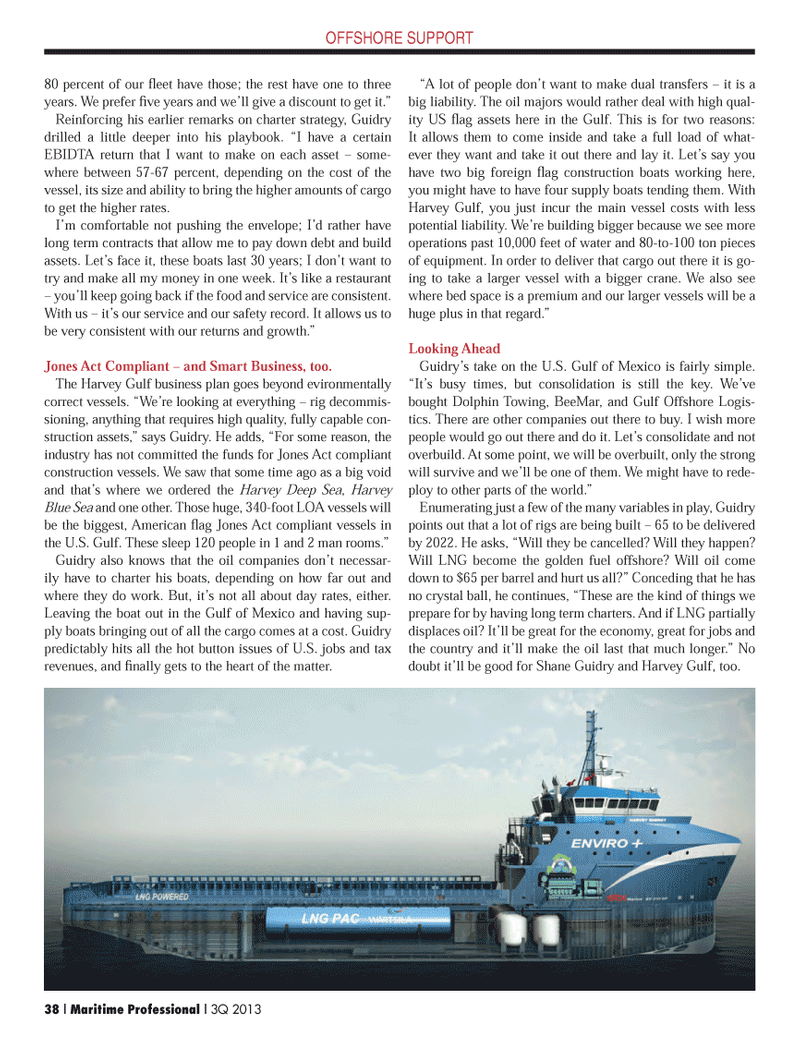

OFFSHORE SUPPORT 80 percent of our ß eet have those; the rest have one to three years. We prefer Þ ve years and weÕll give a discount to get it.Ó Reinforcing his earlier remarks on charter strategy, Guidry drilled a little deeper into his playbook. ÒI have a certain EBIDTA return that I want to make on each asset Ð some- where between 57-67 percent, depending on the cost of the vessel, its size and ability to bring the higher amounts of cargo to get the higher rates. IÕm comfortable not pushing the envelope; IÕd rather have long term contracts that allow me to pay down debt and build assets. LetÕs face it, these boats last 30 years; I donÕt want to try and make all my money in one week. ItÕs like a restaurant Ð youÕll keep going back if the food and service are consistent. With us Ð itÕs our service and our safety record. It allows us to be very consistent with our returns and growth.Ó Jones Act Compliant ? and Smart Business, too. The Harvey Gulf business plan goes beyond evironmentally correct vessels. ÒWeÕre looking at everything Ð rig decommis- sioning, anything that requires high quality, fully capable con- struction assets,Ó says Guidry. He adds, ÒFor some reason, the industry has not committed the funds for Jones Act compliant construction vessels. We saw that some time ago as a big void and thatÕs where we ordered the Harvey Deep Sea , Harvey Blue Sea and one other. Those huge, 340-foot LOA vessels will be the biggest, American ß ag Jones Act compliant vessels in the U.S. Gulf. These sleep 120 people in 1 and 2 man rooms.Ó Guidry also knows that the oil companies donÕt necessar- ily have to charter his boats, depending on how far out and where they do work. But, itÕs not all about day rates, either. Leaving the boat out in the Gulf of Mexico and having sup- ply boats bringing out of all the cargo comes at a cost. Guidry predictably hits all the hot button issues of U.S. jobs and tax revenues, and Þ nally gets to the heart of the matter. ÒA lot of people donÕt want to make dual transfers Ð it is a big liability. The oil majors would rather deal with high qual- ity US ß ag assets here in the Gulf. This is for two reasons: It allows them to come inside and take a full load of what- ever they want and take it out there and lay it. LetÕs say you have two big foreign ß ag construction boats working here, you might have to have four supply boats tending them. With Harvey Gulf, you just incur the main vessel costs with less potential liability. WeÕre building bigger because we see more operations past 10,000 feet of water and 80-to-100 ton pieces of equipment. In order to deliver that cargo out there it is go- ing to take a larger vessel with a bigger crane. We also see where bed space is a premium and our larger vessels will be a huge plus in that regard.Ó Looking AheadGuidryÕs take on the U.S. Gulf of Mexico is fairly simple. ÒItÕs busy times, but consolidation is still the key. WeÕve bought Dolphin Towing, BeeMar, and Gulf Offshore Logis- tics. There are other companies out there to buy. I wish more people would go out there and do it. LetÕs consolidate and not overbuild. At some point, we will be overbuilt, only the strong will survive and weÕll be one of them. We might have to rede- ploy to other parts of the world.Ó Enumerating just a few of the many variables in play, Guidry points out that a lot of rigs are being built Ð 65 to be delivered by 2022. He asks, ÒWill they be cancelled? Will they happen? Will LNG become the golden fuel offshore? Will oil come down to $65 per barrel and hurt us all?Ó Conceding that he has no crystal ball, he continues, ÒThese are the kind of things we prepare for by having long term charters. And if LNG partially displaces oil? ItÕll be great for the economy, great for jobs and the country and itÕll make the oil last that much longer.Ó No doubt itÕll be good for Shane Guidry and Harvey Gulf, too. 38 | Maritime Professional | 3Q 2013MP #3 34-49.indd 38MP #3 34-49.indd 389/10/2013 10:19:04 AM9/10/2013 10:19:04 AM

37

37

39

39