Page 12: of Maritime Logistics Professional Magazine (Q3 2014)

Power & Fuel Management

Read this page in Pdf, Flash or Html5 edition of Q3 2014 Maritime Logistics Professional Magazine

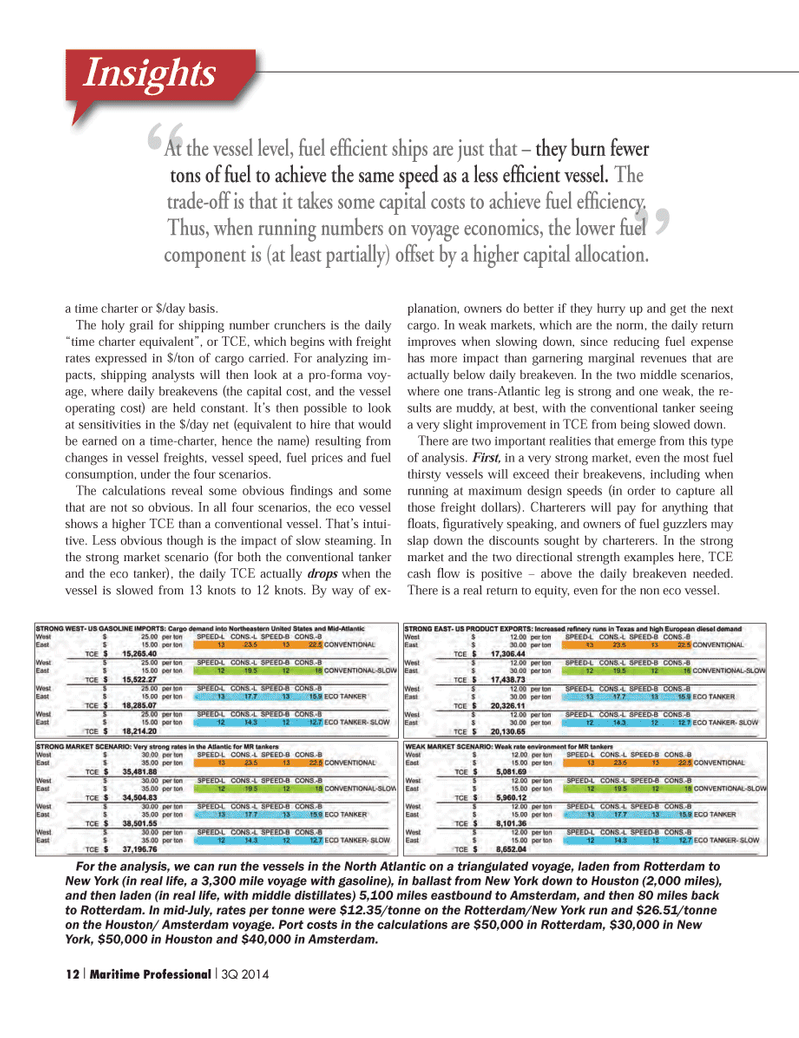

a time charter or $/day basis. The holy grail for shipping number crunchers is the daily ?time charter equivalent?, or TCE, which begins with freight rates expressed in $/ton of cargo carried. For analyzing im- pacts, shipping analysts will then look at a pro-forma voy- age, where daily breakevens (the capital cost, and the vessel operating cost) are held constant. It?s then possible to look at sensitivities in the $/day net (equivalent to hire that would be earned on a time-charter, hence the name) resulting from changes in vessel freights, vessel speed, fuel prices and fuel consumption, under the four scenarios.The calculations reveal some obvious ndings and some that are not so obvious. In all four scenarios, the eco vessel shows a higher TCE than a conventional vessel. That?s intui- tive. Less obvious though is the impact of slow steaming. In the strong market scenario (for both the conventional tanker and the eco tanker), the daily TCE actually drops when the vessel is slowed from 13 knots to 12 knots. By way of ex- planation, owners do better if they hurry up and get the next cargo. In weak markets, which are the norm, the daily return improves when slowing down, since reducing fuel expense has more impact than garnering marginal revenues that are actually below daily breakeven. In the two middle scenarios, where one trans-Atlantic leg is strong and one weak, the re- sults are muddy, at best, with the conventional tanker seeing a very slight improvement in TCE from being slowed down. There are two important realities that emerge from this type of analysis. First, in a very strong market, even the most fuel thirsty vessels will exceed their breakevens, including when running at maximum design speeds (in order to capture all those freight dollars). Charterers will pay for anything that oats, guratively speaking, and owners of fuel guzzlers may slap down the discounts sought by charterers. In the strong market and the two directional strength examples here, TCE cash ow is positive ? above the daily breakeven needed. There is a real return to equity, even for the non eco vessel. Insights??At the vessel level, fuel efÞ cient ships are just that Ð they burn fewer tons of fuel to achieve the same speed as a less efÞ cient vessel. The trade-off is that it takes some capital costs to achieve fuel efÞ ciency. Thus, when running numbers on voyage economics, the lower fuel component is (at least partially) offset by a higher capital allocation. For the analysis, we can run the vessels in the North Atlantic on a triangulated voyage, laden from Rotterdam to New York (in real life, a 3,300 mile voyage with gasoline), in ballast from New York down to Houston (2,000 miles), and then laden (in real life, with middle distillates) 5,100 miles eastbound to Amsterdam, and then 80 miles back to Rotterdam. In mid-July, rates per tonne were $12.35/tonne on the Rotterdam/New York run and $26.51/tonne on the Houston/ Amsterdam voyage. Port costs in the calculations are $50,000 in Rotterdam, $30,000 in New York, $50,000 in Houston and $40,000 in Amsterdam. 12 I Maritime Professional I 3Q 20141-17 Q3 MP2014.indd 121-17 Q3 MP2014.indd 128/13/2014 4:02:40 PM8/13/2014 4:02:40 PM

11

11

13

13