Page 13: of Maritime Logistics Professional Magazine (Q3 2014)

Power & Fuel Management

Read this page in Pdf, Flash or Html5 edition of Q3 2014 Maritime Logistics Professional Magazine

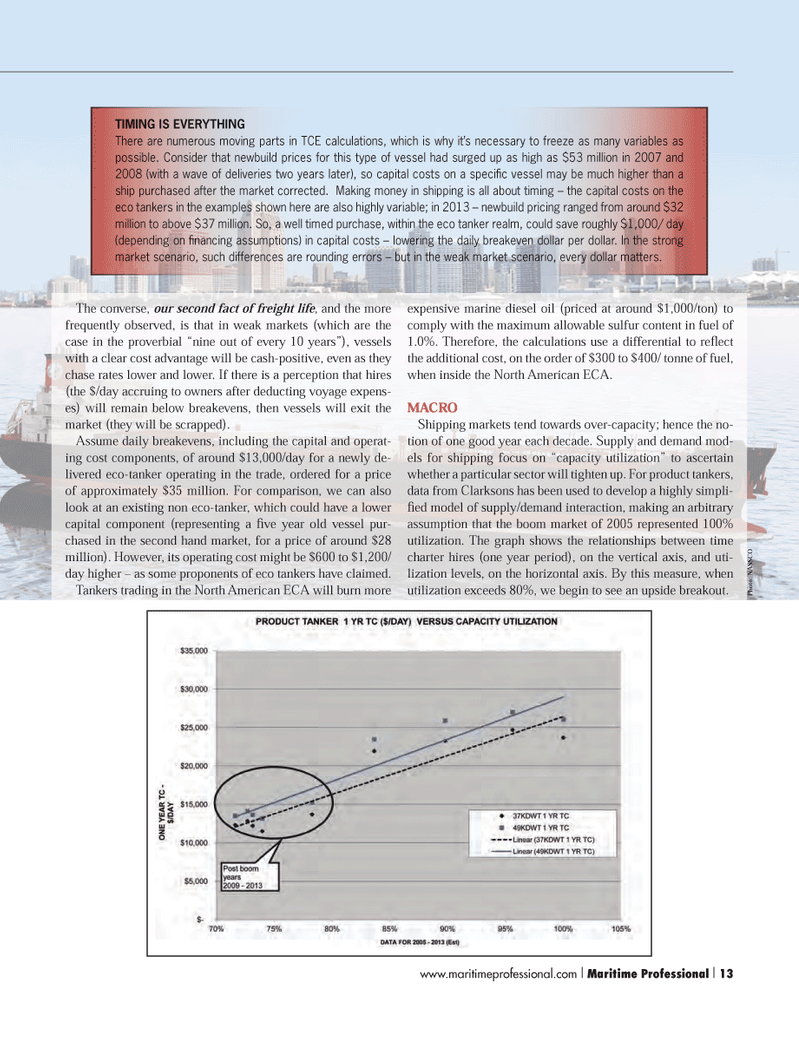

TIMING IS EVERYTHING There are numerous moving parts in TCE calculations, which is why it?s necessary to freeze as many variables as possible. Consider that newbuild prices for this type of vessel had surged up as high as $53 million in 2007 and 2008 (with a wave of deliveries two years later), so capital costs on a speci c vessel may be much higher than a ship purchased after the market corrected. Making money in shipping is all about timing ? the capital costs on the eco tankers in the examples shown here are also highly variable; in 2013 ? newbuild pricing ranged from around $32 million to above $37 million. So, a well timed purchase, within the eco tanker realm, could save roughly $1,000/ day (depending on nancing assumptions) in capital costs ? lowering the daily breakeven dollar per dollar. In the strong market scenario, such differences are rounding errors ? but in the weak market scenario, every dollar matters. The converse, our second fact of freight life , and the more frequently observed, is that in weak markets (which are the case in the proverbial ?nine out of every 10 years?), vessels with a clear cost advantage will be cash-positive, even as they chase rates lower and lower. If there is a perception that hires (the $/day accruing to owners after deducting voyage expens- es) will remain below breakevens, then vessels will exit the market (they will be scrapped). Assume daily breakevens, including the capital and operat- ing cost components, of around $13,000/day for a newly de- livered eco-tanker operating in the trade, ordered for a price of approximately $35 million. For comparison, we can also look at an existing non eco-tanker, which could have a lower capital component (representing a ve year old vessel pur- chased in the second hand market, for a price of around $28 million). However, its operating cost might be $600 to $1,200/ day higher ? as some proponents of eco tankers have claimed. Tankers trading in the North American ECA will burn more expensive marine diesel oil (priced at around $1,000/ton) to comply with the maximum allowable sulfur content in fuel of 1.0%. Therefore, the calculations use a differential to re ect the additional cost, on the order of $300 to $400/ tonne of fuel, when inside the North American ECA. MACRO Shipping markets tend towards over-capacity; hence the no- tion of one good year each decade. Supply and demand mod-els for shipping focus on ?capacity utilization? to ascertain whether a particular sector will tighten up. For product tankers, data from Clarksons has been used to develop a highly simpli- ed model of supply/demand interaction, making an arbitrary assumption that the boom market of 2005 represented 100% utilization. The graph shows the relationships between time charter hires (one year period), on the vertical axis, and uti- lization levels, on the horizontal axis. By this measure, when utilization exceeds 80%, we begin to see an upside breakout. Photo: NASSCO www.maritimeprofessional.com I Maritime Professional I 131-17 Q3 MP2014.indd 131-17 Q3 MP2014.indd 138/13/2014 4:03:09 PM8/13/2014 4:03:09 PM

12

12

14

14