Page 17: of Maritime Logistics Professional Magazine (Q3 2014)

Power & Fuel Management

Read this page in Pdf, Flash or Html5 edition of Q3 2014 Maritime Logistics Professional Magazine

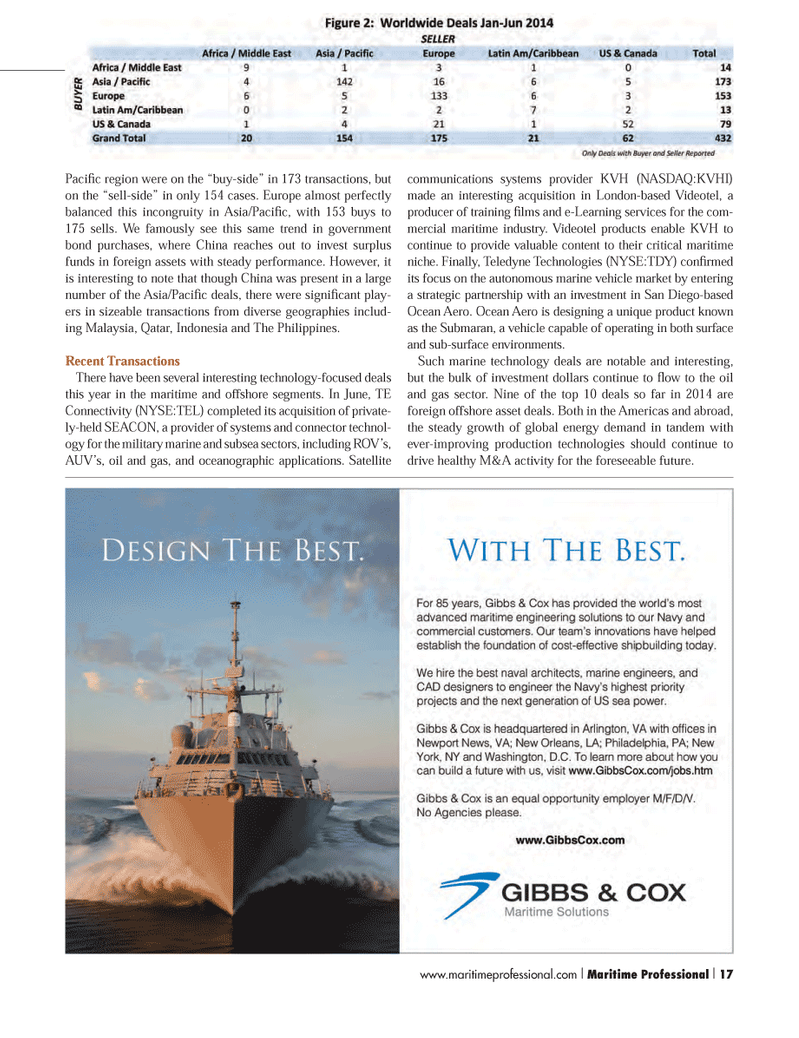

PaciÞ c region were on the Òbuy-sideÓ in 173 transactions, but on the Òsell-sideÓ in only 154 cases. Europe almost perfectly balanced this incongruity in Asia/PaciÞ c, with 153 buys to 175 sells. We famously see this same trend in government bond purchases, where China reaches out to invest surplus funds in foreign assets with steady performance. However, it is interesting to note that though China was present in a large number of the Asia/PaciÞ c deals, there were signiÞ cant play-ers in sizeable transactions from diverse geographies includ- ing Malaysia, Qatar, Indonesia and The Philippines. Recent Transactions There have been several interesting technology-focused deals this year in the maritime and offshore segments. In June, TE Connectivity (NYSE:TEL) completed its acquisition of private- ly-held SEACON, a provider of systems and connector technol- ogy for the military marine and subsea sectors, including ROVÕs, AUVÕs, oil and gas, and oceanographic applications. Satellite communications systems provider KVH (NASDAQ:KVHI) made an interesting acquisition in London-based Videotel, a producer of training Þ lms and e-Learning services for the com- mercial maritime industry. Videotel products enable KVH to continue to provide valuable content to their critical maritime niche. Finally, Teledyne Technologies (NYSE:TDY) conÞ rmed its focus on the autonomous marine vehicle market by entering a strategic partnership with an investment in San Diego-based Ocean Aero. Ocean Aero is designing a unique product known as the Submaran, a vehicle capable of operating in both surface and sub-surface environments. Such marine technology deals are notable and interesting, but the bulk of investment dollars continue to ß ow to the oil and gas sector. Nine of the top 10 deals so far in 2014 are foreign offshore asset deals. Both in the Americas and abroad, the steady growth of global energy demand in tandem with ever-improving production technologies should continue to drive healthy M&A activity for the foreseeable future. www.maritimeprofessional.com I Maritime Professional I 171-17 Q3 MP2014.indd 171-17 Q3 MP2014.indd 178/13/2014 4:03:52 PM8/13/2014 4:03:52 PM

16

16

18

18