Page 28: of Maritime Logistics Professional Magazine (Q3 2015)

Read this page in Pdf, Flash or Html5 edition of Q3 2015 Maritime Logistics Professional Magazine

PORT TECHNOLOGY

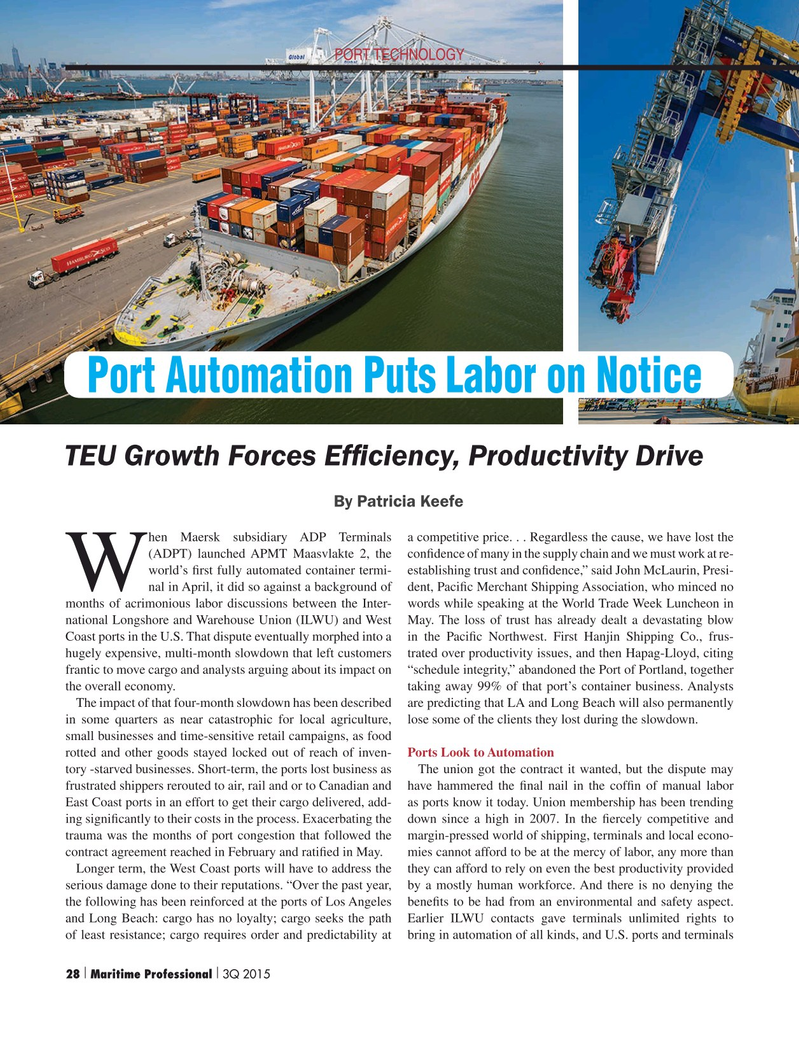

Port Automation Puts Labor on Notice

TEU Growth Forces Ef? ciency, Productivity Drive

By Patricia Keefe hen Maersk subsidiary ADP Terminals a competitive price. . . Regardless the cause, we have lost the (ADPT) launched APMT Maasvlakte 2, the con? dence of many in the supply chain and we must work at re- world’s ? rst fully automated container termi- establishing trust and con? dence,” said John McLaurin, Presi-

Wnal in April, it did so against a background of dent, Paci? c Merchant Shipping Association, who minced no months of acrimonious labor discussions between the Inter- words while speaking at the World Trade Week Luncheon in national Longshore and Warehouse Union (ILWU) and West May. The loss of trust has already dealt a devastating blow

Coast ports in the U.S. That dispute eventually morphed into a in the Paci? c Northwest. First Hanjin Shipping Co., frus- hugely expensive, multi-month slowdown that left customers trated over productivity issues, and then Hapag-Lloyd, citing frantic to move cargo and analysts arguing about its impact on “schedule integrity,” abandoned the Port of Portland, together the overall economy. taking away 99% of that port’s container business. Analysts

The impact of that four-month slowdown has been described are predicting that LA and Long Beach will also permanently in some quarters as near catastrophic for local agriculture, lose some of the clients they lost during the slowdown. small businesses and time-sensitive retail campaigns, as food rotted and other goods stayed locked out of reach of inven- Ports Look to Automation tory -starved businesses. Short-term, the ports lost business as The union got the contract it wanted, but the dispute may frustrated shippers rerouted to air, rail and or to Canadian and have hammered the ? nal nail in the cof? n of manual labor

East Coast ports in an effort to get their cargo delivered, add- as ports know it today. Union membership has been trending ing signi? cantly to their costs in the process. Exacerbating the down since a high in 2007. In the ? ercely competitive and trauma was the months of port congestion that followed the margin-pressed world of shipping, terminals and local econo- contract agreement reached in February and rati? ed in May. mies cannot afford to be at the mercy of labor, any more than

Longer term, the West Coast ports will have to address the they can afford to rely on even the best productivity provided serious damage done to their reputations. “Over the past year, by a mostly human workforce. And there is no denying the the following has been reinforced at the ports of Los Angeles bene? ts to be had from an environmental and safety aspect. and Long Beach: cargo has no loyalty; cargo seeks the path Earlier ILWU contacts gave terminals unlimited rights to of least resistance; cargo requires order and predictability at bring in automation of all kinds, and U.S. ports and terminals 28 Maritime Professional 3Q 2015| | 18-33 Q3 MP2015.indd 28 9/18/2015 9:46:33 AM

27

27

29

29