Page 62: of Maritime Logistics Professional Magazine (Q3 2016)

Shipbuilding, Repair & Maintenance

Read this page in Pdf, Flash or Html5 edition of Q3 2016 Maritime Logistics Professional Magazine

STATISTICS

DOMESTIC SHIPYARDS – UNDER THE

RADAR – SHINE IN EXPORT MARKETS

The U.S. Department of Transportation’s Maritime Admin- building in context of discussions surrounding the Jones Act istration (Marad) issued its report entitled The Economic Im- and its implications for local, state and the national economy. portance of the U.S. Shipbuilding and Repairing Industry in A growing number of attacks have been seen on the almost

November of 2015. As we prepared for this edition of Mar- 100-year old law which speci? es that U.S. ? ag tonnage en-

Pro, we asked them for speci? c details on domestic export gaged in cabotage trades must, among other things, be built activity. They delivered. in the United States and crewed by American mariners. In

According to Marad, there are currently 124 shipyards in perhaps the most vocal of these spats, the Commonwealth of the United States, spread across 26 states, which are classi? ed Puerto Rico recently pinned its hopes for economic recovery as active shipbuilders. Not surprisingly, the Federal govern- by demanding that the Jones Act be suspended for its ocean ment is an important source of demand for U.S. shipbuilders. shipping trades. This didn’t happen, of course, but the impli-

While just one percent of the vessels delivered in 2014 (11 cation that U.S. boatbuilding costs make it uncompetitive on of 1,067) were delivered to U.S. government agencies, it is the world stage was a much-repeated, familiar theme in these also true that 10 of the 12 large deep-draft vessels delivered arguments. Upon closer inspection, however, the numbers were delivered to the U.S. government: ? ve to the U.S. Navy, would suggest otherwise.

four to the U.S. Coast Guard, and one to the National Science Research and compilation by the U.S. Maritime Administra-

Foundation. Today, that latter metric is changing (somewhat) tion (Marad) for the purposes of this edition actually showed as U.S. yards enjoy a resurgence of sorts in terms of Jones a robust export trade for U.S. yards, and one which holds sig-

Act newbuilding. This short term a phenomenon has its limi- ni? cant promise, as well. To be sure, the export volume and tations because older hulls in a rapidly diminishing domestic traf? c occurs in speci? c niche sectors. These do not include ? eet are not being replaced in a one-for-one fashion, and there the production deep sea, blue water deep draft tonnage, some- is only so much demand for coastwise traf? c, especially in thing which the Asian yards in particular excel at, especially the tanker trades. Eventually U.S. yards will need to look for when executing series-build newbuild programs. On this side other sources of work. Some have already found it – overseas. of the pond, the U.S. component has done surprisingly well,

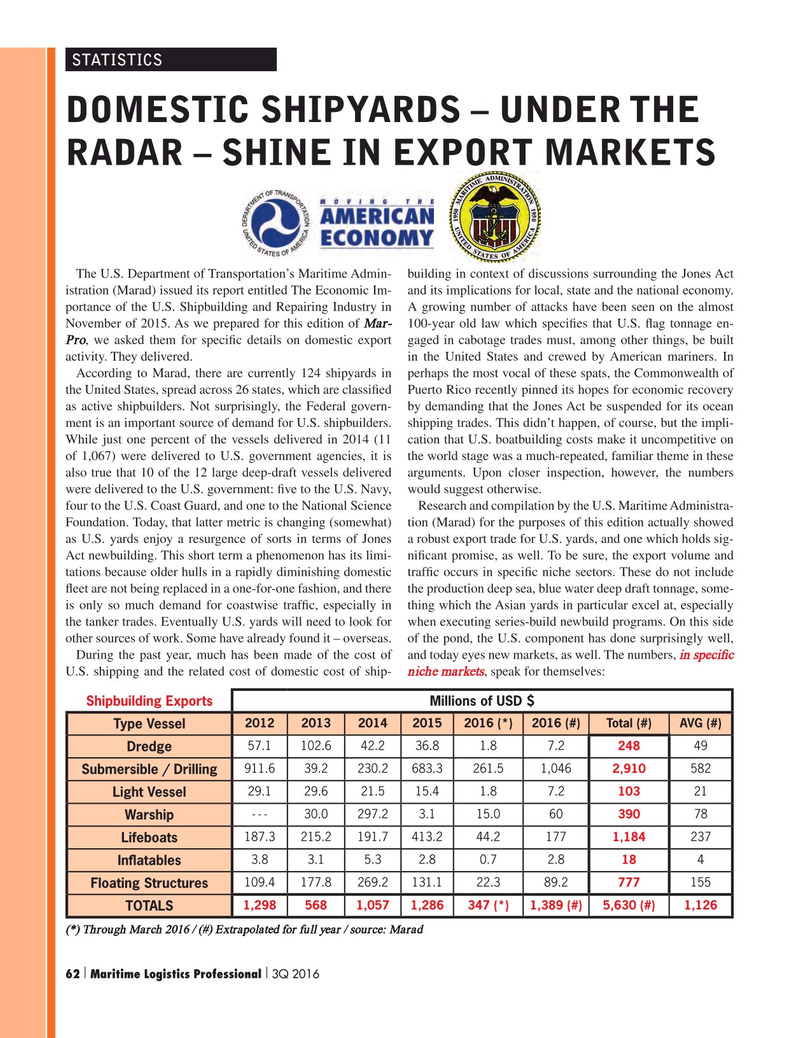

During the past year, much has been made of the cost of and today eyes new markets, as well. The numbers, in speci? c

U.S. shipping and the related cost of domestic cost of ship- niche markets, speak for themselves:

Shipbuilding Exports Millions of USD $ 20122013201420152016 (*)2016 (#)Total (#)AVG (#)

Type Vessel 57.1102.642.236.81.87.2 248 49

Dredge 911.639.2230.2683.3261.51,046 2,910 582

Submersible / Drilling 29.129.621.515.41.87.2 103 21

Light Vessel - - -30.0297.23.115.060 390 78

Warship 187.3215.2191.7413.244.2177 1,184 237

Lifeboats 3.83.15.32.80.72.8 18 4

In? atables 109.4177.8269.2131.122.389.2 777 155

Floating Structures 1,2985681,0571,286347 (*)1,389 (#)5,630 (#)1,126

TOTALS (*) Through March 2016 / (#) Extrapolated for full year / source: Marad | | 62 Maritime Logistics Professional 3Q 2016 50-63 Q3 MP2016.indd 62 8/17/2016 10:29:56 AM

61

61

63

63